Travelers 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

certain personal physical injury claims, of which workers’ compensation claims comprise a significant

portion. In cases where the Company did not receive a release from the claimant, the structured

settlement is included in reinsurance recoverables as the Company retains the contingent liability to the

claimant. In the event that the life insurance company fails to make the required annuity payments, the

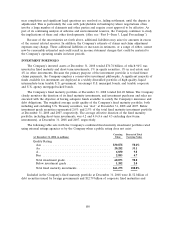

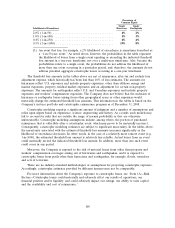

Company would be required to make such payments. The following table presents the Company’s top

five groups by structured settlements at December 31, 2008 (in millions). Also included is the A.M.

Best rating of the Company’s predominant insurer from each insurer group at February 19, 2009:

Structured

Group Settlements A.M. Best Rating of Group’s Predominant Insurer

Old Mutual ......................... $1,075 A third highest of 16 ratings

MetLife ........................... 554 A+ second highest of 16 ratings

Genworth .......................... 485 A+ second highest of 16 ratings

Symetra ........................... 296 A third highest of 16 ratings

ING Group ......................... 242 A+ second highest of 16 ratings

Many reinsurance companies and life insurance companies have been negatively impacted by

deteriorating economic conditions, including unprecedented financial market disruption. A number of

such companies have been subjected to downgrades and/or negative outlook changes by various ratings

agencies, including those with which the Company conducts business. The Company considers these

factors in assessing the adequacy of its allowance for uncollectible amounts.

OUTLOOK

The Company’s objective is to enhance its position as a consistently profitable market leader and a

cost-effective provider of property and casualty insurance in the United States and in selected

international markets. A variety of factors continue to affect the property and casualty insurance

market and the Company’s core business outlook for 2009, including general economic conditions,

competitive conditions in the markets served by the Company’s business segments, loss cost trends,

interest rate trends and the investment environment.

General Economic Conditions. The United States and other countries around the world have been

experiencing deteriorating economic conditions, including unprecedented financial market disruption. If

this trend in economic conditions continues or deteriorates further in 2009, it could adversely affect the

Company’s results in future periods. During an economic downturn, demand for the Company’s

products may decrease, and credit risk associated with agents, customers, reinsurers and the Company’s

investment portfolio may be adversely impacted. In addition, in an inflationary environment, loss costs

may increase. Such costs may also increase in an economic downturn, due to an increase in fraudulent

reporting of claims, reduced maintenance of insured property or increased frequency of small claims.

Moreover, although the Company does not anticipate needing additional capital in the near term due

to the Company’s strong current financial position, financial market disruption may make it difficult for

the insurance industry generally, and the Company in particular, to raise additional capital, when

needed, on acceptable terms or at all. As discussed below, losses on the Company’s investment

portfolio may adversely impact the Company’s shareholders’ equity and statutory surplus. As further

discussed below, the interest rate environment and general economic conditions could further impact

the net investment income the Company is able to earn on both its fixed maturity investments and

other invested assets.

Competition. The Company expects property casualty insurance market conditions to continue to

be very competitive in 2009, particularly for new business. If the current disruption in the insurance

marketplace continues into 2009, there may be increased opportunity for new business, but competition

for that new business may also be significant. For example, competitors that are experiencing financial

difficulties may offer products at prices and on terms that are not consistent with the Company’s

110