Travelers 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(S&P). Rating agencies typically issue two types of ratings: claims-paying (or financial strength) ratings

which assess an insurer’s ability to meet its financial obligations to policyholders and debt ratings which

assess a company’s prospects for repaying its debts and assist lenders in setting interest rates and terms

for a company’s short- and long-term borrowing needs. Agency ratings are not a recommendation to

buy, sell or hold any security, and they may be revised or withdrawn at any time by the rating agency.

Each agency’s rating should be evaluated independently of any other agency’s rating. The system and

the number of rating categories can vary widely from rating agency to rating agency. Customers usually

focus on claims-paying ratings, while creditors focus on debt ratings. Investors use both to evaluate a

company’s overall financial strength. The ratings issued on the Company or its subsidiaries by any of

these agencies are announced publicly and are available on the Company’s website and from the

agencies.

The Company’s insurance operations could be negatively impacted by a downgrade in one or more

of the Company’s claims-paying or debt ratings. If this were to occur, the Company could experience a

reduced demand for certain products in certain markets. Additionally, the Company’s ability to access

the capital markets could be impacted by a downgrade in one or more of the Company’s debt ratings.

If this were to occur, the Company could incur higher borrowing costs.

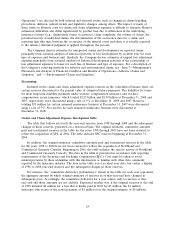

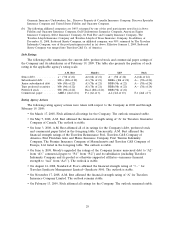

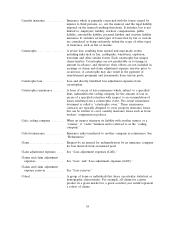

Claims—Paying Ratings

The following table summarizes the current claims-paying (or financial strength) ratings of the

Travelers Reinsurance Pool, Travelers C&S Co. of America, Travelers Personal single state companies,

Travelers C&S Co. of Europe, Ltd., Travelers Guarantee Company of Canada and Travelers Insurance

Company Limited as of February 19, 2009. The table also presents S&P’s Lloyd’s Syndicate Assessment

rating for Travelers Syndicate Management—Syndicate 5000. The table presents the position of each

rating in the applicable agency’s rating scale.

A.M. Best Moody’s S&P Fitch

Travelers Reinsurance Pool(a)(b) ...... A+ (2nd of 16) Aa2 (3rd of 21) AA (4th of 21) AA (3rd of 24)

Travelers C&S Co. of America ....... A+ (2nd of 16) Aa2 (3rd of 21) AA (4th of 21) AA (3rd of 24)

First Floridian Auto and Home Ins. Co. A (4th of 16) — — AA (3rd of 24)

First Trenton Indemnity Company ..... A (3rd of 16) — — AA (3rd of 24)

The Premier Insurance Company of

Massachusetts ................. A (3rd of 16) — — —

Travelers C&S Co. of Europe, Ltd. .... A+ (2nd of 16) Aa2 (3rd of 21) AA (4th of 21) —

Travelers Guarantee Company of Canada . A (3rd of 16) — — —

Travelers Insurance Company Limited . . A (3rd of 16) — — —

Travelers Syndicate Management

Limited—Syndicate 5000 .......... — — 3 (9 of 15) —

(a) The Travelers Reinsurance Pool consists of: The Travelers Indemnity Company, The Charter Oak Fire

Insurance Company, The Phoenix Insurance Company, The Travelers Indemnity Company of Connecticut,

The Travelers Indemnity Company of America, Travelers Property Casualty Company of America, Travelers

Commercial Casualty Company, TravCo Insurance Company, The Travelers Home and Marine Insurance

Company, Travelers Casualty and Surety Company, Northland Insurance Company, Northfield Insurance

Company, Northland Casualty Company, American Equity Specialty Insurance Company, The Standard Fire

Insurance Company, The Automobile Insurance Company of Hartford, Connecticut, Travelers Casualty

Insurance Company of America, Farmington Casualty Company, Travelers Commercial Insurance Company,

Travelers Casualty Company of Connecticut, Travelers Property Casualty Insurance Company, Travelers

Personal Security Insurance Company, Travelers Personal Insurance Company, Travelers Excess and Surplus

Lines Company, St. Paul Fire and Marine Insurance Company, St. Paul Surplus Lines Insurance Company,

Athena Assurance Company, St. Paul Protective Insurance Company, St. Paul Medical Liability Insurance

Company, St. Paul Guardian Insurance Company, St. Paul Mercury Insurance Company, Fidelity and

28