Travelers 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

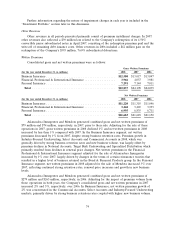

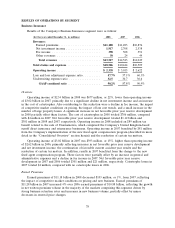

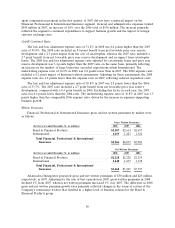

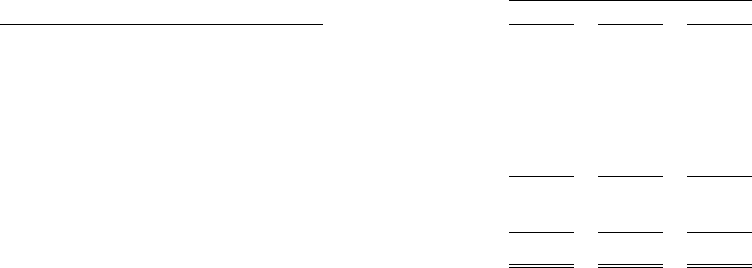

Net Written Premiums

(for the year ended December 31, in millions) 2008 2007 2006

Select Accounts ............................. $ 2,756 $ 2,711 $ 2,663

Commercial Accounts ........................ 2,524 2,518 2,376

National Accounts ........................... 996 1,056 1,135

Industry-Focused Underwriting .................. 2,396 2,301 2,196

Target Risk Underwriting ...................... 1,593 1,665 1,629

Specialized Distribution ....................... 939 1,015 1,022

Total Business Insurance Core ................ 11,204 11,266 11,021

Business Insurance Other ...................... 16 52 25

Total Business Insurance .................... $11,220 $11,318 $11,046

In Business Insurance Core, gross and net written premiums in 2008 decreased by 3% and 1%

from 2007, respectively. The difference in rates of decline between gross and net written premiums in

2008 was concentrated in National Accounts, where a significant portion of gross written premiums is

ceded to other insurers and residual market pools. As a result, the decline in gross written premiums

did not have a proportional impact on net written premiums. Net written premium growth in the

Industry-Focused Underwriting, Select Accounts and Commercial Accounts groups generally reflected

higher business retention levels and new business volume in several business units within these groups.

This was more than offset by premium declines in Specialized Distribution, Target Risk Underwriting

and National Accounts.

In 2007, Business Insurance Core gross written premiums declined $49 million, or less than 1%,

from the comparable 2006 total, whereas net written premiums increased $245 million, or 2%,

compared with 2006. The difference in growth rates between gross and net written premiums in 2007

was also concentrated in National Accounts due to the same factor described above. All markets in

Business Insurance Core operations, except National Accounts and Specialized Distribution, recorded

net written premium growth in 2007, driven by higher new business volume throughout the majority of

markets coupled with continued strong business retention rates, offset in some markets by minor

decreases in renewal price changes. Net written premium growth in 2007 also benefited from a

reduction in ceded premiums related to catastrophe reinsurance coverage.

Select Accounts. Net written premiums of $2.76 billion in 2008 increased 2% over 2007. Business

retention rates in 2008 remained strong and were slightly higher than in 2007. Renewal price changes

remained positive but declined from 2007. In the aggregate, new business volume in 2008 was virtually

level with 2007. The Company experienced a favorable impact on its new business volume from its

enhanced quote-to-issue agency platform and multivariate pricing program for smaller businesses served

by Select Accounts. However, new business volume for larger accounts in 2008 declined from 2007

primarily due to competitive market conditions.

Net written premiums of $2.71 billion in 2007 grew 2% over 2006. New business volume increased

over 2006, due in part to the introduction of the Company’s enhanced quote-to-issue agency platform

and multivariate pricing program in 37 states. Enhanced marketing efforts and additional products sold

to existing customers also contributed to new business growth in 2007. Business retention rates

remained strong in 2007. Renewal price changes in this market remained positive in 2007 but were

lower than in 2006, as price increases for coastal coverages were partially offset by declines in renewal

price changes for non-coastal coverages, which continue to be impacted by competitive market

conditions.

Commercial Accounts. Net written premiums of $2.52 billion in 2008 were virtually level with the

2007 total. Business retention rates in 2008 remained strong and were higher than in 2007. Renewal

82