Travelers 2008 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

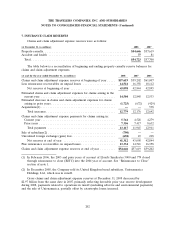

7. INSURANCE CLAIM RESERVES (Continued)

The number of policyholders tendering asbestos claims for the first time was consistent with the

number tendering claims in 2007. Defense and indemnity costs in these categories remain at similar

levels to what the Company has experienced in recent years due to the level of trial activity involving

impaired individuals.

On January 29, 2009, the Company and PPG Industries, Inc (‘‘PPG’’), along with approximately 30

other insurers of PPG, agreed in principle on a modified settlement agreement to settle asbestos-

related coverage litigation under insurance policies issued to PPG. The tentative settlement agreement

has been incorporated into the Modified Third Amended Plan of Reorganization (‘‘Amended Plan’’)

proposed as part of the Pittsburgh Corning Corp. (‘‘PCC’’, which is 50% owned by PPG) bankruptcy

proceeding. Pursuant to the proposed Amended Plan, which was filed on January 30, 2009, PCC, along

with enumerated other companies (including PPG as well as the Company as a participating insurer),

are to receive protections afforded by Section 524(g) of the Bankruptcy Code from certain asbestos-

related bodily injury claims. The Company had entered into a prior agreement in principle with PPG in

2002 which was contingent upon final court approval of the Second Amended Plan of Reorganization

for PCC, but in December 2006, the United States Bankruptcy Court declined to confirm that Plan of

Reorganization. As a result of the December 2006 ruling, the Company removed the reserves

associated with the prior agreement from the structured settlement category of the asbestos reserve and

made a corresponding increase in the unallocated asbestos IBNR reserve. Under the current agreement

in principle, the Company has the option to make a series of payments over the next 20 years totaling

approximately $620 million to the Trust to be created under the Amended Plan, or it may elect to

make a one-time discounted payment, which, as of June 30, 2009, would total approximately

$430 million (approximately $400 million after reinsurance). The current agreement in principle with

PPG is subject to numerous contingencies, including final court approval of the Amended Plan, and the

Company has no obligation to make the settlement payment until all contingencies are satisfied. The

Company’s obligations under this agreement in principle continue to be included in the unallocated

asbestos IBNR reserve.

The Company’s quarterly asbestos reserve review includes an analysis of exposure and claim

payment patterns by policyholder category, as well as recent settlements, policyholder bankruptcies,

judicial rulings and legislative actions. Developing payment trends among policyholders in the Home

Office, Field Office and Assumed and International categories are also analyzed. In addition, the

Company reviews its historical gross and net loss and expense paid experience, year-by-year, to assess

any emerging trends, fluctuations, or characteristics suggested by the aggregate paid activity. For certain

policyholders an estimate of the gross ultimate exposure for indemnity and related claim adjustment

expense is determined, and for those policyholders the Company calculates, by each policy year, a

ceded reinsurance projection based on any applicable facultative and treaty reinsurance, past ceded

experience and reinsurance collections. Conventional actuarial methods are not utilized to establish

asbestos reserves nor have the Company’s evaluations resulted in any way of determining a meaningful

average asbestos defense or indemnity payment.

Net asbestos losses and expenses paid in 2008 were $658 million, compared with $317 million in

2007. The increase in net paid losses was the result of the ACandS payment in the third quarter of

2008. Excluding the ACandS settlement, payments in 2008 were $293 million. Approximately 59% and

20% of total net paid losses in 2008 and 2007, respectively, related to policyholders with whom the

Company had entered into settlement agreements limiting the Company’s liability.

207