Travelers 2008 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

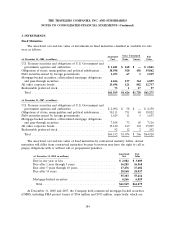

3. INVESTMENTS (Continued)

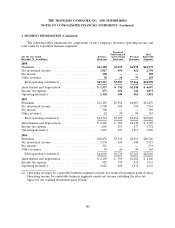

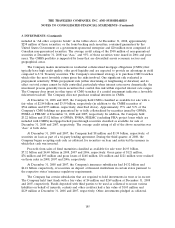

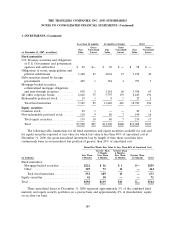

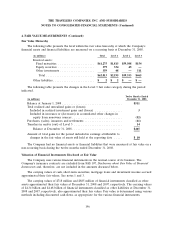

Less than 12 months 12 months or longer Total

Gross Gross Gross

Fair Unrealized Fair Unrealized Fair Unrealized

(at December 31, 2007, in millions) Value Losses Value Losses Value Losses

Fixed maturities

U.S. Treasury securities and obligations

of U.S. Government and government

agencies and authorities .......... $ 29 $— $ 69 $ — $ 98 $ —

Obligations of states, municipalities and

political subdivisions ............. 3,428 23 2,044 17 5,472 40

Debt securities issued by foreign

governments ................... 409 1 384 4 793 5

Mortgage-backed securities,

collateralized mortgage obligations

and pass-through securities ........ 838 5 3,118 60 3,956 65

All other corporate bonds ........... 2,646 55 5,797 139 8,443 194

Redeemable preferred stock ......... 19 1 8 1 27 2

Total fixed maturities ............ 7,369 85 11,420 221 18,789 306

Equity securities

Common stock ................... 29 1 — — 29 1

Non-redeemable preferred stock ...... 110 9 80 7 190 16

Total equity securities ............ 139 10 80 7 219 17

Total ........................ $7,508 $95 $11,500 $228 $19,008 $323

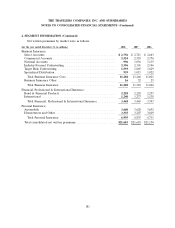

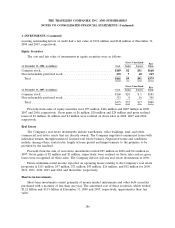

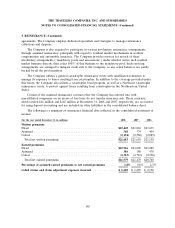

The following table summarizes for all fixed maturities and equity securities available for sale and

for equity securities reported at fair value for which fair value is less than 80% of amortized cost at

December 31, 2008, the gross unrealized investment loss by length of time those securities have

continuously been in an unrealized loss position of greater than 20% of amortized cost:

Period For Which Fair Value Is Less Than 80% of Amortized Cost

Greater Than Greater Than

3 Months, 6 Months,

Less Than Less Than Less Than Greater Than

(in millions) 3 Months 6 Months 12 Months 12 Months Total

Fixed maturities:

Mortgage-backed securities ........... $222 $ 36 $ 1 $— $259

Other .......................... 329 73 12 — 414

Total fixed maturities .............. 551 109 13 — 673

Equity securities .................... 41 30 — — 71

Total ............................. $592 $139 $13 $— $744

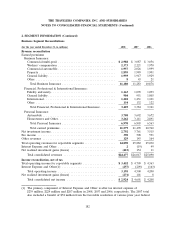

These unrealized losses at December 31, 2008 represent approximately 1% of the combined fixed

maturity and equity security portfolios on a pretax basis and approximately 2% of shareholders’ equity

on an after-tax basis.

189