Travelers 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• a decrease in the number of large asbestos exposures confronting the Company due to

additional settlement activity;

• fewer and less volatile asbestos-related bankruptcies; and

• the absence of new theories of liability or new classes of defendants.

While the Company believes that these trends indicate a reduction in the volatility associated with

the Company’s overall asbestos exposure, there nonetheless remains a high degree of uncertainty with

respect to future exposure from asbestos claims.

As in prior years, the annual claim review considered active policyholders and litigation cases for

potential product and ‘‘non-product’’ liability. The Home Office and Field Office categories, which

account for the vast majority of policyholders with active asbestos-related claims, again experienced an

overall reduction in new claim filings in 2008. The number of policyholders tendering asbestos claims

for the first time was consistent with the number tendering claims in 2007. Defense and indemnity costs

in these categories remain at similar levels to what the Company has experienced in recent years due to

the level of trial activity involving impaired individuals.

The Company’s quarterly asbestos reserve review includes an analysis of exposure and claim

payment patterns by policyholder category, as well as recent settlements, policyholder bankruptcies,

judicial rulings and legislative actions. Developing payment trends among policyholders in the Home

Office, Field Office and Assumed and International categories are also analyzed. In addition, the

Company reviews its historical gross and net loss and expense paid experience, year-by-year, to assess

any emerging trends, fluctuations, or characteristics suggested by the aggregate paid activity. For certain

policyholders an estimate of the gross ultimate exposure for indemnity and related claim adjustment

expense is determined, and for those policyholders the Company calculates, by each policy year, a

ceded reinsurance projection based on any applicable facultative and treaty reinsurance, past ceded

experience and reinsurance collections. Conventional actuarial methods are not utilized to establish

asbestos reserves nor have the Company’s evaluations resulted in any way of determining a meaningful

average asbestos defense or indemnity payment.

Net asbestos losses and expenses paid in 2008 were $658 million, compared with $317 million in

2007. The increase in net paid losses was the result of the ACandS payment in the third quarter of

2008. Excluding the ACandS settlement, payments in 2008 were $293 million. Approximately 59% and

20% of total net paid losses in 2008 and 2007, respectively, related to policyholders with whom the

Company had entered into settlement agreements limiting the Company’s liability.

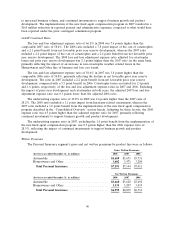

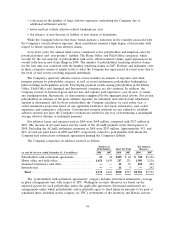

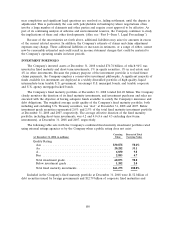

The Company categorizes its asbestos reserves as follows:

Number of Net Asbestos

Policyholders Total Net Paid Reserves

(at and for the year ended December 31, $ in millions) 2008 2007 2008 2007 2008 2007

Policyholders with settlement agreements .......... 23 22 $389 $62 $ 749 $1,152

Home office and field office .................... 1,651 1,659 217 211 1,983 2,116

Assumed reinsurance and other ................. ——41 35 182 224

International ............................... ——11 9—242

Total ................................... 1,674 1,681 $658 $317 $2,914 $3,734

The ‘‘policyholders with settlement agreements’’ category includes structured settlements, coverage

in place arrangements and, with respect to TPC, Wellington accounts. Reserves are based on the

expected payout for each policyholder under the applicable agreement. Structured settlements are

arrangements under which policyholders and/or plaintiffs agree to fixed financial amounts to be paid at

scheduled times. Included in this category are TPC’s settlements of the Statutory and Hawaii Actions

94