Travelers 2008 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

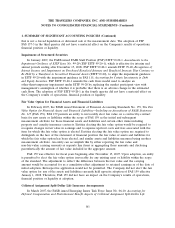

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Investment Impairments

The Company recognizes an impairment loss when an invested asset’s value declines below cost,

adjusted for accretion, amortization and previous other-than-temporary impairments (new cost basis),

and it is determined that the decline is other-than-temporary. Some of the factors considered in

evaluating whether a decline in fair value is other-than-temporary include: (1) the Company’s ability

and intent to retain the investment for a period of time sufficient to allow for an anticipated recovery

in value; (2) the recoverability of principal and interest for fixed maturity securities, or cost for equity

securities; (3) the length of time and extent to which the fair value has been less than amortized cost

for fixed maturity securities, or cost for equity securities; and (4) the financial condition, near-term and

long-term prospects for the issuer, including the relevant industry conditions and trends, and

implications of rating agency actions and offering prices. When the Company determines that an

invested asset is other-than-temporarily impaired, the invested asset is written down to fair value, and

the amount of the impairment is included in earnings as a realized investment loss. The fair value then

becomes the new cost basis of the investment, and any subsequent recoveries in fair value, other than

amounts accreted to the expected recovery amount, are recognized at disposition. Due to the subjective

nature of the Company’s analysis and estimates of fair value along with the judgment that must be

applied in the analysis, it is possible that the Company could reach a different conclusion whether or

not to impair a security if it had access to additional information about the investee. Additionally, it is

possible that the investee’s ability to meet future contractual obligations may be different than what the

Company determined during its analysis, which may lead to a different impairment conclusion in future

periods.

The Company recognizes a realized loss when impairment is deemed to be other-than-temporary

even if a decision to sell an invested asset has not been made. When the Company has decided to sell

a temporarily impaired available-for-sale invested asset and the Company does not expect the fair value

of the invested asset to fully recover prior to the expected time of sale, the invested asset is deemed to

be other-than-temporarily impaired in the period in which the decision to sell is made.

The Company’s process for identifying and reviewing invested assets for impairments during any

quarter includes the following:

• Identification and evaluation of investments that have possible indications of

other-than-temporary impairment, which includes an analysis of all investments with gross

unrealized investment losses that have fair values less than 80% of cost;

• Review and evaluation of external and internal portfolio managers’ recommendations for

other-than-temporary impairments of any other investments based on the investee’s current

financial condition, liquidity, near-term recovery prospects, the outlook for the business sectors

in which the investee operates and other factors (in addition to reviewing investments with an

estimated fair value of less than 80% of cost);

• Consideration of evidential matter, including an evaluation of factors or triggers that may or may

not cause individual investments to qualify as having other-than-temporary impairments; and

• Determination of the status of each analyzed investment as other-than-temporary or not, with

documentation of the rationale for the decision.

168