Travelers 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

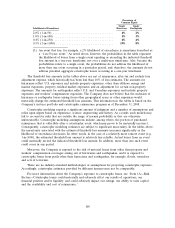

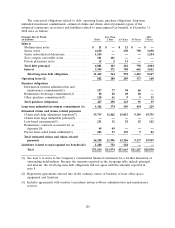

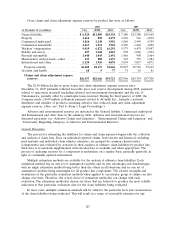

share repurchases in 2009 reflects uncertainty with regard to current economic conditions and not a

fundamental change in the Company’s capital management strategy. The following table summarizes

repurchase activity in 2008 and remaining repurchase capacity at December 31, 2008.

Number of Remaining capacity

shares Cost of shares Average price paid under share repurchase

Quarterly Period Ending purchased repurchased per share program

March 31, 2008 .............. 20,831,251 $1,000,332,704 $48.02 $4,931,853,967

June 30, 2008 ............... 15,287,182 750,014,344 49.06 4,181,839,623

September 30, 2008 ........... 6,197,529 271,984,984 43.89 3,909,854,639

December 31, 2008 ........... 2,712,550 99,997,100 36.86 3,809,857,539

Total .................... 45,028,512 $2,122,329,132 $47.13 $3,809,857,539

Since the inception of the repurchase authorizations in May 2006, the Company has repurchased a

cumulative total of 123.9 million shares for a total cost of $6.19 billion, or $49.98 per share, through

December 31, 2008.

In 2008, 2007 and 2006, the Company acquired 0.8 million, 1.7 million and 1.2 million shares,

respectively, of common stock from employees as treasury stock primarily to cover payroll withholding

taxes related to the vesting of restricted stock awards and exercises of stock options.

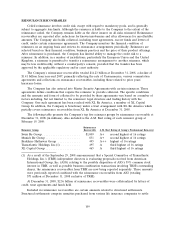

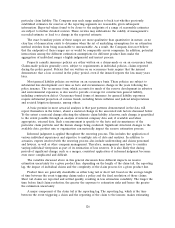

Capital Resources

Capital resources reflect the overall financial strength of the Company and its ability to borrow

funds at competitive rates and raise new capital to meet its needs. The following table summarizes the

components of the Company’s capital structure at December 31, 2008 and 2007.

(at December 31, in millions) 2008 2007

Debt:

Short-term ............................................. $ 242 $ 649

Long-term ............................................. 5,938 5,577

Net unamortized fair value adjustments and debt issuance costs ...... 116

Total debt ............................................ 6,181 6,242

Preferred shareholders’ equity ................................ 89 112

Common shareholders’ equity:

Common stock and retained earnings, less treasury stock ........... 26,130 25,834

Accumulated other changes in equity from nonowner sources ........ (900) 670

Total shareholders’ equity ................................ 25,319 26,616

Total capitalization .................................... $31,500 $32,858

The $1.36 billion decrease in total capitalization from year-end 2007 reflected the impact of

$2.12 billion of common share repurchases, a net after-tax $764 million decline in net unrealized

appreciation on investments (to a net unrealized loss position at December 31, 2008), $715 million of

dividends to shareholders, a $405 million decline primarily due to a reduction in the fair value of

pension plan assets, and, to a lesser degree, the impact of changes in foreign currency exchange rates.

These factors were partially offset by net income in 2008. The net unrealized loss position at

December 31, 2008 reflected the impact of rising interest rates on longer-dated fixed maturity securities

primarily due to the widening of credit spreads generally.

Line of Credit Agreement. The Company maintains an $800 million commercial paper program, of

which $100 million was outstanding at December 31, 2008, with back-up liquidity consisting of a bank

118