Travelers 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2007, medium-term notes with a cumulative par value of $72 million and interest rates ranging

from 6.85% to 7.37% matured and were fully paid.

2006. In June 2006, the Company issued $400 million aggregate principal amount of 6.25% senior

unsecured notes due June 20, 2016 and $400 million aggregate principal amount of 6.75% senior

unsecured notes due June 20, 2036. The notes were issued at a discount, resulting in effective interest

rates of 6.30% and 6.86%, respectively. Net proceeds from the issuances (after original issue discount

and expenses) totaled approximately $786 million, which the Company applied to the redemption of

approximately $593 million of 7.60% subordinated debentures (described in more detail below),

$150 million of 6.75% senior notes that matured on November 15, 2006 and $56 million of

medium-term notes that matured in the second half of the year.

In November 2006, the Company redeemed $593 million of 7.60% subordinated debentures

originally issued in 2001 and due October 15, 2050. The debentures were redeemable by the Company

on or after November 13, 2006. In November 2001, St. Paul Capital Trust I, a business trust, issued

$575 million of preferred securities, the proceeds of which, along with $18 million in capital provided

by the Company, were used to purchase the subordinated debentures issued by the Company. Upon the

Company’s redemption of its subordinated debentures in November 2006, St. Paul Capital Trust I in

turn used the proceeds to redeem its preferred securities. St. Paul Capital Trust I was then liquidated,

and the Company received an $18 million distribution of capital. The Company recorded a $42 million

pretax gain on the redemption of the subordinated debentures, representing the remaining unamortized

fair value adjustment recorded at the merger date. A portion of the proceeds from the June 2006 debt

issuances described above was used to fund this redemption.

The Company’s debt-to-capital ratio of 19.5% at December 31, 2008 was slightly below its 20%

targeted level.

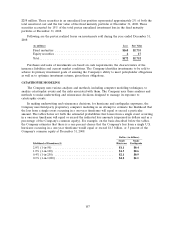

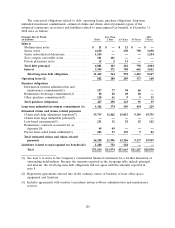

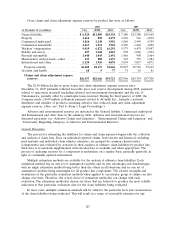

The amounts of debt obligations, other than commercial paper, that becomes due in 2009, 2010

and 2011, are $143 million, $273 million and $11 million, respectively.

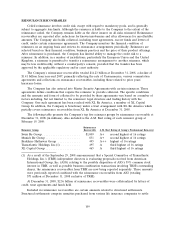

Dividends. Dividends paid to shareholders totaled $715 million, $742 million and $702 million in

2008, 2007 and 2006, respectively. On February 4, 2009, the Company’s board of directors declared a

quarterly dividend of $0.30 per share, payable March 31, 2009 to shareholders of record on March 10,

2009. The declaration and payment of future dividends to holders of the Company’s common stock will

be at the discretion of the Company’s board of directors and will depend upon many factors, including

the Company’s financial position, earnings, capital requirements of the Company’s operating

subsidiaries, legal requirements, regulatory constraints and other factors as the board of directors

deems relevant. Dividends would be paid by the Company only if declared by its board of directors out

of funds legally available, subject to any other restrictions that may be applicable to the Company.

Share Repurchases. In January 2008, the board of directors authorized an additional $5 billion for

the repurchase of the Company’s common shares. Under the authorization, repurchases may be made

from time to time in the open market, pursuant to preset trading plans meeting the requirements of

Rule 10b5-1 under the Securities Exchange Act of 1934, in private transactions or otherwise. The

authorization does not have a stated expiration date. The timing and actual number of shares to be

repurchased in the future will depend on a variety of factors, including corporate and regulatory

requirements, price, catastrophe losses and other market conditions. Share repurchase levels in prior

periods may not be indicative of future repurchase activity. Notwithstanding the Company’s financial

strength and liquidity, in light of the recent disruption in the financial markets, the Company reduced

its level of share repurchases in the fourth quarter of 2008 compared to prior quarters and will likely

reduce its share repurchases in 2009 as compared to the level of repurchases in preceding years,

although the Company’s plans may change depending on market conditions, potential investment

opportunities, the Company’s share price performance or other factors. This potential reduction in

117