Travelers 2008 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5. REINSURANCE (Continued)

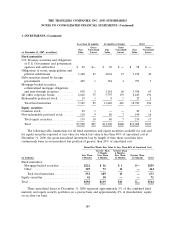

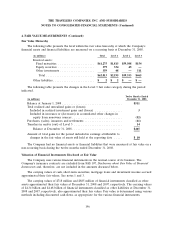

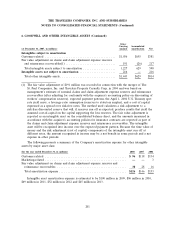

Reinsurance recoverables include amounts recoverable on both paid and unpaid claims and were

as follows:

(at December 31, in millions) 2008 2007

Gross reinsurance recoverables on paid and unpaid claims and claim adjustment

expenses ..................................................... $ 9,376 $10,731

Allowance for uncollectible reinsurance ................................ (618) (688)

Net reinsurance recoverables ........................................ 8,758 10,043

Structured settlements ............................................. 3,517 3,615

Mandatory pools and associations .................................... 1,957 1,983

Total reinsurance recoverables ....................................... $14,232 $15,641

Terrorism Risk Insurance Acts

On November 26, 2002, the Terrorism Risk Insurance Act of 2002 (the Terrorism Act) was enacted

into Federal law and established the Terrorism Risk Insurance Program (the Program), a temporary

Federal program in the Department of the Treasury, that provided for a system of shared public and

private compensation for certain insured losses resulting from acts of terrorism or war committed by or

on behalf of a foreign interest. The Program was scheduled to terminate on December 31, 2005. In

December 2005, the Terrorism Risk Insurance Extension Act of 2005 (the Terrorism Extension Act) was

enacted into Federal law, reauthorizing the Program through December 31, 2007, while reducing the

Federal role under the Program. In December 2007, the Terrorism Risk Insurance Program

Reauthorization Act of 2007 was enacted into Federal law, extending coverage to include domestic acts

of terrorism and reauthorizing the Program through 2014. The three acts are hereinafter collectively

referred to as ‘‘the Acts.’’

In order for a loss to be covered under the Program (subject losses), the loss must meet certain

aggregate industry loss minimums and must be the result of an event that is certified as an act of

terrorism by the U.S. Secretary of the Treasury. The annual aggregate industry loss minimum is

$100 million through 2014. The original Program excluded from participation certain of the following

types of insurance: Federal crop insurance, private mortgage insurance, financial guaranty insurance,

medical malpractice insurance, health or life insurance, flood insurance, and reinsurance. The Terrorism

Extension Act exempted from coverage certain additional types of insurance, including commercial

automobile, professional liability (other than directors and officers’), surety, burglary and theft, and

farm-owners multi-peril. In the case of a war declared by Congress, only workers’ compensation losses

are covered by the Acts. The Acts generally require that all commercial property casualty insurers

licensed in the United States participate in the Program. Under the Program, a participating insurer is

entitled to be reimbursed by the Federal Government for 85% of subject losses, after an insurer

deductible, subject to an annual cap. The Federal reimbursement percentage is 85% through 2014.

The deductible for any calendar year is equal to 20% of the insurer’s direct earned premiums for

covered lines for the calendar year. The Company’s estimated deductible under the Program is

$2.16 billion for 2009. The annual cap limits the amount of aggregate subject losses for all participating

insurers to $100 billion. Once subject losses have reached the $100 billion aggregate during a program

year, participating insurers will not be liable under the Program for additional covered terrorism losses

199