Travelers 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compared with $546 million in 2007. The cost of catastrophes in 2008, net of reinsurance and including

hurricane-related assessments of $141 million (discussed below), totaled $1.41 billion, compared with

$167 million in 2007. Hurricanes Ike and Gustav, as well as several other storms throughout the United

States, accounted for the cost of catastrophes in 2008. Net income in 2007 also included a benefit of

$86 million resulting from the favorable resolution of various prior year federal tax matters and a

pretax loss of $39 million related to the Company’s redemption of its 4.50% contingently convertible

debentures.

Hurricane-related assessments include assessments from state-created insurance and windstorm

insurance entities such as Citizens Property Insurance Corporation in Florida, Louisiana Citizens

Property Insurance Corporation and the Texas Windstorm Insurance Association. Assessments are

levied on insurers writing business in those states to fund the operating deficits of such entities during

periods of significant storm activity. Hurricane-related assessments are reported as a component of

‘‘General and Administrative Expenses’’ as the amounts paid to such entities are not insured losses of

the Company.

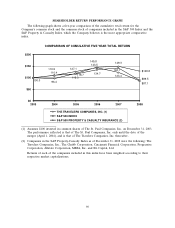

Net income of $6.86 per common share in 2007 was 16% higher than the $5.91 per common share

in 2006. Net income in 2007 totaled $4.60 billion, 9% higher than $4.21 billion in 2006. The higher rate

of growth in per share income compared with the rate of growth in actual income in 2007 over 2006

reflected the impact of the Company’s significant common share repurchases since its repurchase

program began in the second quarter of 2006. The increase in net income in 2007 reflected growth in

net investment income, a higher level of net favorable prior year reserve development, an increase in

net realized investment gains, favorable current accident year results and increased business volume,

partially offset by an increase in expenses and a decline in fee income. Net favorable prior year reserve

development totaled $546 million in 2007, compared with net favorable prior year reserve development

of $394 million in 2006. Expenses in 2007 included a net pretax benefit of $163 million due to the

implementation of the new fixed, value-based compensation program for the majority of the Company’s

agents. Catastrophe losses in 2007 totaled $167 million, compared with $103 million in 2006. Net

income in both 2007 and 2006 included after-tax benefits of $86 million due to the favorable resolution

of various prior year tax matters. The 2007 total also included net realized investment gains of

$154 million, compared with net realized investment gains of $11 million in 2006.

Revenues

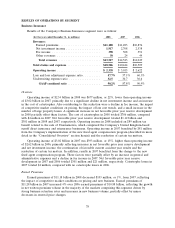

Earned Premiums

Earned premiums in 2008 totaled $21.58 billion, an increase of $109 million, or less than 1%, over

2007. In March 2007, the Company sold its Mexican surety subsidiary, Afianzadora Insurgentes, S.A. de

C.V. (Afianzadora Insurgentes), which accounted for $27 million of earned premiums in 2007 prior to

its sale. In April 2007, the Company sold Mendota Insurance Company and its subsidiaries (collectively,

Mendota), which primarily offered nonstandard automobile coverage and accounted for $46 million of

earned premiums in 2007 prior to its sale. Adjusting for these sales in 2007, consolidated earned

premiums in 2008 increased by $182 million, or 1%, over 2007. In the Business Insurance segment,

earned premiums in 2008 declined 1% from 2007 despite continued strong business retention rates,

reflecting the impact of competitive market conditions on pricing and new business. In the Financial,

Professional & International Insurance segment, earned premium growth of 2% in 2008 (adjusted for

the sale of Afianzadora Insurgentes) was driven by changes in the terms of certain reinsurance treaties

for Bond & Financial Products. In the Personal Insurance segment, earned premium growth of 3% in

2008 (adjusted for the sale of Mendota) reflected continued strong business retention rates and new

business volume, coupled with continued renewal price increases.

Earned premiums in 2007 totaled $21.47 billion, an increase of $710 million, or 3%, over 2006.

Afianzadora Insurgentes and Mendota accounted for $78 million and $176 million of earned premiums,

71