Travelers 2008 Annual Report Download - page 101

Download and view the complete annual report

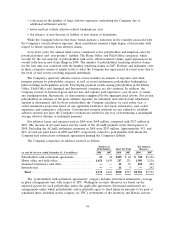

Please find page 101 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in part to claim initiatives and fewer than expected late reported homeowners’ claims related to

non-catastrophe weather events that occurred in the fourth quarter of 2006. In addition, a portion of

net favorable prior year reserve development in the Homeowners and Other line of business in 2007

was attributable to a decrease in the number of claims due to changes in the marketplace, including

higher deductibles and fewer small-dollar claims.

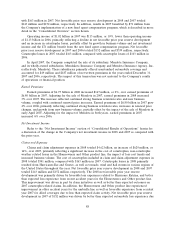

Claims and claim adjustment expenses in 2007 totaled $3.99 billion, an increase of $390 million, or

11%, over 2006, primarily reflecting a decline in net favorable prior year reserve development, an

increase in catastrophe losses and higher business volume, partially offset by the impact of the sale of

Mendota.

Net favorable prior year reserve development of $359 million in 2006 was driven by better than

expected loss experience in the auto bodily injury and non-catastrophe related Homeowners and Other

lines of business, and a reduction in loss estimates for the 2005 hurricanes. In the Automobile line of

business, the improvement in 2006 was partially driven by better than expected results from changes in

claim handling practices. These changes included practices which have allowed case reserves to be

established more accurately earlier in the claim settlement process, thereby changing historical loss

development patterns. In addition, industry and Company initiatives to fight fraud in several states led

to a decrease in the total number of claims and a change in historical loss development patterns. In the

Homeowners and Other line of business, favorable prior year reserve development in 2006 was partially

driven by a significant decrease in the number of claims, attributable to changes in the marketplace,

including higher deductibles and fewer small-dollar claims. These changes also resulted in a change in

historical loss development patterns. In addition, for 2006, non-catastrophe related Homeowners and

Other loss experience was favorable due to continued evidence of a less than expected impact from

‘‘demand surge,’’ which refers to significant short-term increases in building material and labor costs

due to a sharp increase in demand for those materials and services. Approximately $100 million of net

favorable prior year reserve development in 2006 resulted from a reduction in loss estimates for

catastrophes incurred in 2005, primarily due to lower than expected additional living expense losses

related to Hurricane Katrina.

Catastrophe losses in 2007 totaled $163 million, $60 million higher than the 2006 total of

$103 million. Catastrophe losses in 2007 were primarily the result of wildfires in California and several

storms throughout the United States, whereas the 2006 total was driven by several wind, rain, hail and

snow storms throughout the year in the United States.

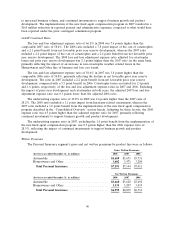

The amortization of deferred acquisition costs totaled $1.41 billion in 2008, compared with

$1.31 billion in 2007. The growth in amortization costs in 2008 primarily reflected the higher level of

amortized commission expense in 2008 resulting from the Company’s implementation of a new fixed

agent compensation program in 2007, as well as an increase in business volume.

The amortization of deferred acquisition costs totaled $1.31 billion in 2007, $156 million, or 14%,

higher than the comparable 2006 total of $1.15 billion. The increase included $94 million from the

implementation of the new fixed agent compensation program in 2007 described in more detail in the

‘‘Consolidated Overview’’ section herein, as well as growth in business volume, partially offset by the

impact of the sale of Mendota.

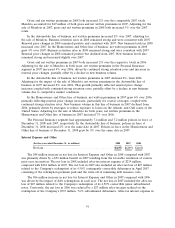

General and administrative expenses totaled $829 million in 2008, an increase of $130 million, or

19% over the 2007 total of $699 million. The increase in 2008 included the impact of $77 million of

hurricane-related assessments. The remaining increase reflected growth in business volume and

continued investments to support business growth and product development.

General and administrative expenses totaled $699 million in 2007, a decrease of $105 million, or

13%, from the 2006 total of $804 million. The decrease in expenses in 2007 primarily reflected a

decline in commission expenses resulting from the implementation of the new fixed agent compensation

program, as well as the impact of the sale of Mendota, which were partially offset by expenses related

89