Travelers 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

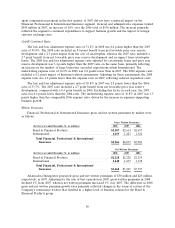

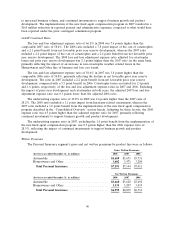

Gross and net written premiums in 2008 both increased 2% over the comparable 2007 totals.

Mendota accounted for $49 million of both gross and net written premiums in 2007. Adjusting for the

sale of Mendota in 2007, gross and net written premiums in 2008 both increased 3% over the 2007

totals.

In the Automobile line of business, net written premiums increased 2% over 2007, adjusting for

the sale of Mendota. Business retention rates in 2008 remained strong and were consistent with 2007.

Renewal price changes in 2008 remained positive and consistent with 2007. New business levels in 2008

increased over 2007. In the Homeowners and Other line of business, net written premiums in 2008

grew 4% over 2007. Business retention rates in 2008 remained strong and were consistent with 2007.

Renewal price changes in 2008 remained positive but declined from 2007. New business levels also

remained strong and increased slightly over 2007.

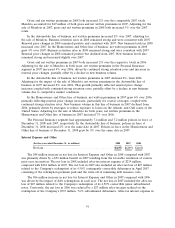

Gross and net written premiums in 2007 both increased 2% over the respective totals in 2006.

Adjusting for the sale of Mendota in both years, net written premiums in the Personal Insurance

segment in 2007 increased 4% over 2006, driven by continued strong retention rates and increases in

renewal price changes, partially offset by a decline in new business volume.

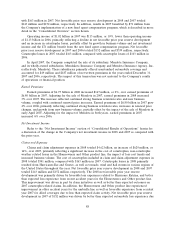

In the Automobile line of business, net written premiums in 2007 declined 2%, from 2006.

Adjusting for the impact of the sale of Mendota, net written premiums in the Automobile line of

business in 2007 increased 2% over 2006. That growth primarily reflected renewal price change

increases coupled with continued strong retention rates, partially offset by a decline in new business

volume due to competitive market conditions.

In the Homeowners and Other line of business, net written premiums in 2007 grew 6% over 2006,

primarily reflecting renewal price change increases, particularly for coastal coverages, coupled with

continued strong retention rates. New business volume in this line of business in 2007 declined from

2006, primarily driven by strategies to reduce exposure to losses on the Atlantic and Gulf coasts of the

United States. Adjusting for the sale of Mendota for both years, net written premiums in the

Homeowners and Other line of business in 2007 increased 7% over 2006.

The Personal Insurance segment had approximately 7.4 million and 7.2 million policies in force at

December 31, 2008 and 2007, respectively. In the Automobile line of business, policies in force at

December 31, 2008 increased 2% over the same date in 2007. Policies in force in the Homeowners and

Other line of business at December 31, 2008 grew by 3% over the same date in 2007.

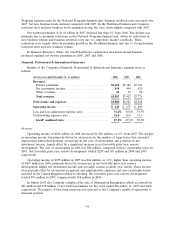

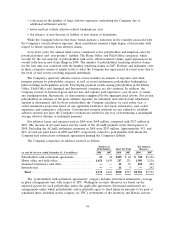

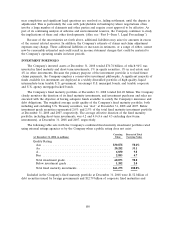

Interest Expense and Other

(for the year ended December 31, in millions) 2008 2007 2006

Net loss ....................................... $(257) $(209) $(163)

The $48 million increase in net loss for Interest Expense and Other in 2008 compared with 2007

was primarily driven by a $52 million benefit in 2007 resulting from the favorable resolution of various

prior year tax matters. The net loss in 2008 included after-tax interest expense of $239 million,

compared with $224 million in 2007. The net loss in 2007 also included an after-tax loss of $25 million

related to the Company’s redemption of its 4.50% contingently convertible debentures in April 2007,

consisting of the redemption premium paid and the write-off of remaining debt issuance costs.

The $46 million increase in net loss for Interest Expense and Other in 2007 compared with 2006

was driven by the impact of debt redemptions in each year. The net loss in 2007 included the after-tax

loss of $25 million related to the Company’s redemption of its 4.50% convertible junior subordinated

notes. Conversely, the net loss in 2006 was reduced by a $27 million after-tax gain realized on the

redemption of the Company’s $593 million, 7.6% subordinated debentures. After-tax interest expense in

91