Travelers 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.factors were partially offset by an increase in tax payments resulting from higher profitability, expenses

related to increased business volume and continued expenditures to support business growth and

product development, and higher interest payments.

Investing Activities

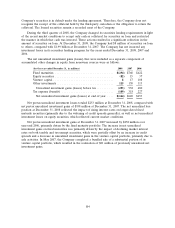

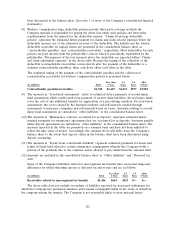

Net cash flows used in investing activities totaled $162 million, $2.53 billion and $3.06 billion in

2008, 2007 and 2006, respectively. Fixed maturity securities accounted for the majority of investment

purchases in all three years.

The Company’s consolidated total investments at December 31, 2008 declined $4.08 billion from

year-end 2007, reflecting the $2.12 billion of common share repurchases made during 2008, a

$1.19 billion pretax decline in the unrealized appreciation of investments since year-end 2007 (to an

unrealized loss position at December 31, 2008), the sale of Unionamerica and dividends to

shareholders, partially offset by investment purchases resulting from strong cash flows from operations.

The net unrealized loss position at December 31, 2008 reflected the impact of rising interest rates on

longer-dated fixed maturity securities primarily due to the widening of credit spreads generally.

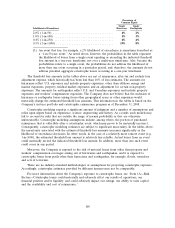

The Company’s management of the duration of the fixed maturity investment portfolio generally

produces a duration that exceeds the estimated duration of the Company’s net insurance liabilities. The

average duration of fixed maturities and short-term securities was 4.2 and 4.0 at December 31, 2008

and 2007, respectively.

The primary goals of the Company’s asset liability management process are to satisfy the insurance

liabilities, manage the interest rate risk embedded in those insurance liabilities and maintain sufficient

liquidity to cover fluctuations in projected liability cash flows. Generally, the expected principal and

interest payments produced by the Company’s fixed maturity portfolio adequately fund the estimated

runoff of the Company’s insurance reserves. Although this is not an exact cash flow match in each

period, the substantial degree by which the market value of the fixed maturity portfolio exceeds the

expected present value of the net insurance liabilities, as well as the positive cash flow from newly sold

policies and the large amount of high quality liquid bonds, provide assurance of the Company’s ability

to fund the payment of claims without having to sell illiquid assets or access credit facilities.

Financing Activities

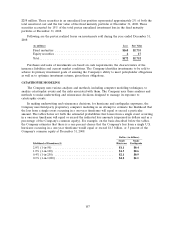

Net cash flows used in financing activities totaled $2.87 billion, $2.95 billion and $1.59 billion in

2008, 2007 and 2006, respectively. The 2008 total primarily reflected common share repurchases, the

repayment of debt and dividends to shareholders, partially offset by the net proceeds from debt

issuances and employee stock option exercises. The 2007 and 2006 totals primarily reflected common

share repurchases, the early redemption of debt, the repayment of maturing debt and dividends to

shareholders, partially offset by the issuance of debt and proceeds from employee stock option

exercises.

Debt Transactions.

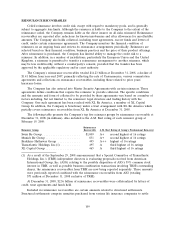

2008. On March 15, 2008, the Company’s $400 million, 3.75% senior notes matured and were

fully paid. On May 13, 2008, the Company issued $500 million aggregate principal amount of 5.80%

senior notes that will mature on May 15, 2018. The net proceeds of the issuance, after original issuance

discount and the deduction of underwriting expenses and commissions and other expenses, totaled

approximately $496 million. Interest on the senior notes is payable semi-annually on May 15 and

November 15, commencing November 15, 2008. The senior notes are redeemable in whole at any time

or in part from time to time, at the Company’s option, at a redemption price equal to the greater of

(a) 100% of the principal amount of senior notes to be redeemed or (b) the sum of the present values

of the remaining scheduled payments of principal and interest on the senior notes to be redeemed

114