Travelers 2008 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2008 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

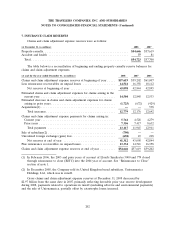

4. FAIR VALUE MEASUREMENTS (Continued)

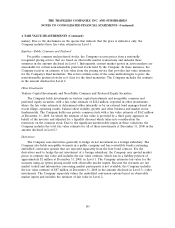

The carrying value and fair value of the Company’s debt at December 31, 2008 was $6.18 billion

and $5.44 billion, respectively. The respective totals at December 31, 2007 were $6.24 billion and

$6.06 billion. The Company utilizes a pricing service to estimate fair value measurements for

approximately 96% of its debt, other than commercial paper. The pricing service utilizes market

quotations for debt that have quoted prices in active markets. When quoted prices are unavailable, the

pricing service prepares estimates of fair value measurements for these securities using its proprietary

pricing applications which include available relevant market information, benchmark curves,

benchmarking of like securities, sector groupings and matrix pricing.

For some debt securities, primarily the junior subordinated debentures, the pricing service is

unable to provide an estimate of fair value. For these securities, the Company utilizes pricing estimates

from a nationally recognized broker/dealer to estimate fair value. The broker/dealer prepares estimates

of fair value for these securities using its proprietary pricing applications which include relevant market

information, benchmark curves, benchmarking of like securities, sector groupings and matrix pricing. If

estimates of fair value are unavailable from the pricing service or the broker/dealer, the Company

produces an estimate of fair value based on internally developed valuation techniques which are based

on discounted cash flow methodology and incorporates all available relevant observable market inputs.

The Company bases all of its estimates of fair value for its debt on the bid price as it represents what a

third party market participant would be willing to pay in an arm’s length transaction.

The fair value of commercial paper included in debt outstanding at December 31, 2008 and 2007

approximated its book value because of its short-term nature.

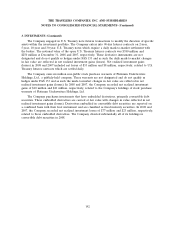

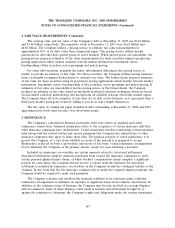

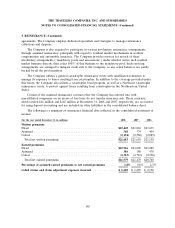

5. REINSURANCE

The Company’s consolidated financial statements reflect the effects of assumed and ceded

reinsurance transactions. Assumed reinsurance refers to the acceptance of certain insurance risks that

other insurance companies have underwritten. Ceded reinsurance involves transferring certain insurance

risks (along with the related written and earned premiums) the Company has underwritten to other

insurance companies who agree to share these risks. The primary purpose of ceded reinsurance is to

protect the Company, at a cost, from volatility in excess of the amount it is prepared to accept.

Reinsurance is placed on both a quota-share and excess of loss basis. Ceded reinsurance arrangements

do not discharge the Company as the primary insurer, except for cases involving a novation.

Included in reinsurance recoverables are certain amounts related to structured settlements.

Structured settlements comprise annuities purchased from various life insurance companies to settle

certain personal physical injury claims, of which workers’ compensation claims comprise a significant

portion. In cases where the Company did not receive a release from the claimant, the structured

settlement is included in reinsurance recoverables as the Company retains the contingent liability to the

claimant. In the event that the life insurance company fails to make the required annuity payments, the

Company would be required to make such payments.

The Company evaluates and monitors the financial condition of its reinsurers under voluntary

reinsurance arrangements to minimize its exposure to significant losses from reinsurer insolvencies. In

addition, in the ordinary course of business, the Company may become involved in coverage disputes

with its reinsurers. Some of these disputes could result in lawsuits and arbitrations brought by or

against the reinsurers to determine the Company’s rights and obligations under the various reinsurance

197