Metro PCS 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential loss arising from adverse changes in market prices and rates, including interest rates.

We do not routinely enter into derivatives or other financial instruments for trading, speculative or hedging

purposes, unless it is hedging interest rate risk exposure or is required by our senior secured credit facility. We do

not currently conduct business internationally, so we are generally not subject to foreign currency exchange rate

risk.

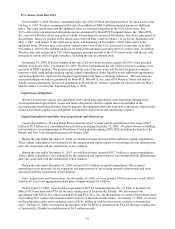

As of December 31, 2008, we had approximately $1.6 billion in outstanding indebtedness under our senior

secured credit facility that bears interest at floating rates based on the London Inter Bank Offered Rate, or LIBOR,

plus 2.25%. The interest rate on the outstanding debt under our senior secured credit facility as of December 31,

2008 was 6.443%. On November 21, 2006, to manage our interest rate risk exposure and fulfill a requirement of our

senior secured credit facility, we entered into a three-year interest rate protection agreement. This agreement covers

a notional amount of $1.0 billion and effectively converts this portion of our variable rate debt to fixed-rate debt at

an annual rate of 7.169%. The quarterly interest settlement periods began on February 1, 2007. The interest rate

swap agreement expires in 2010. On April 30, 2008, to manage our interest rate risk exposure, we entered into a

two-year interest rate protection agreement. The agreement was effective on June 30, 2008, covers a notional

amount of $500.0 million and effectively converts this portion of our variable rate debt to fixed rate debt at an

annual rate of 5.464%. The monthly interest settlement periods began on June 30, 2008. The interest rate protection

agreement expires on June 30, 2010. If market LIBOR rates increase 100 basis points over the rates in effect at

December 31, 2008, annual interest expense on the approximately $64.0 million in variable rate debt would increase

approximately $0.6 million.

Item 8. Financial Statements and Supplementary Data

The information required by this item is included in Part IV, Item 15(a)(1) and are presented beginning on Page

F-1.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be

disclosed in our Exchange Act reports is recorded, processed, summarized and reported as required by the SEC and

that such information is accumulated and communicated to management, including our CEO and CFO, as

appropriate, to allow for appropriate and timely decisions regarding required disclosure. Our management, with

participation by our CEO and CFO, has designed the Company’s disclosure controls and procedures to provide

reasonable assurance of achieving these desired objectives. As required by SEC Rule 13a-15(b), we conducted an

evaluation, with the participation of our CEO and CFO, of the effectiveness of the design and operation of our

disclosure controls and procedures as of December 31, 2008, the end of the period covered by this report. In

designing and evaluating the disclosure controls and procedures (as defined by SEC Rule 13a-15(e)), our

management recognizes that any controls and procedures, no matter how well designed and operated, can provide

only reasonable assurance of achieving the desired control objectives, and management is necessarily required to

apply judgment in evaluating the cost-benefit relationship of possible controls and objectives. Based upon that

evaluation, our CEO and CFO have concluded that our disclosure controls and procedures are effective as of

December 31, 2008.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial

reporting. Our internal controls over financial reporting are designed to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements for external purposes in accordance with

generally accepted accounting principles in the United States.