Metro PCS 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-30

18. Income Taxes:

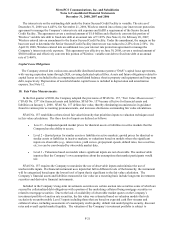

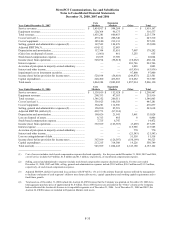

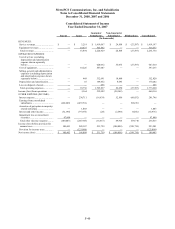

The provision for taxes on income consisted of the following (in thousands):

2008 2007 2006

Current:

Federal................................................................................................... $ 156 $ 257 $ 674

State ...................................................................................................... 5,483 4,317 3,702

5,639 4,574 4,376

Deferred:

Federal................................................................................................... 99,899 113,611 29,959

State ...................................................................................................... 24,448 4,913 2,382

124,347 118,524 32,341

Provision for income taxes.................................................................... $ 129,986 $ 123,098 $ 36,717

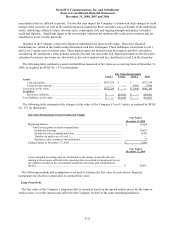

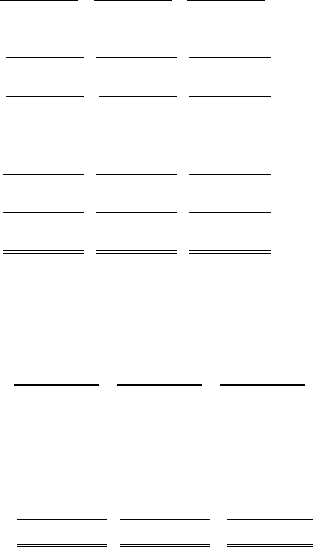

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%) to the

provision for income taxes reflected in the consolidated statements of income and comprehensive income for the

years ended December 31, 2008, 2007 and 2006 is as follows (in thousands):

2008 2007 2006

U.S. federal income tax provision at statutory rate...................................... $ 97,798 $ 78,225 $ 31,683

Increase (decrease) in income taxes resulting from:

State income taxes, net of federal income tax impact.................................. 18,458 6,423 2,386

Change in valuation allowance.................................................................... 11,940 35,717 (194)

Provision for tax uncertainties ..................................................................... 1,627 1,976 2,557

Permanent items .......................................................................................... 163 371 218

Other............................................................................................................ — 386 67

Provision for income taxes .......................................................................... $ 129,986 $ 123,098 $ 36,717

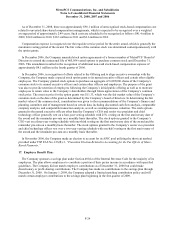

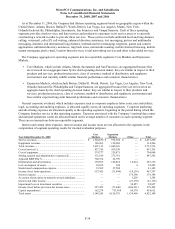

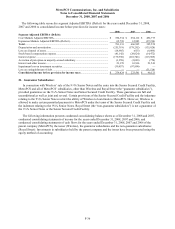

Deferred taxes are provided for those items reported in different periods for income tax and financial reporting

purposes. The Company’s net deferred tax liability consisted of the following deferred tax assets and liabilities (in

thousands):