Metro PCS 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-23

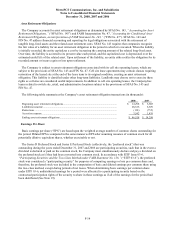

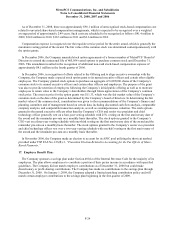

The estimated fair values of the Company’s financial instruments are as follows (in thousands):

2008 2007

Carrying

Amount Fair Value

Carrying

Amount Fair Value

Senior Secured Credit Facility........................................................ $ 1,564,000 $ 1,251,200 $ 1,580,000 $ 1,607,734

9¼% Senior Notes.......................................................................... 1,400,000 1,239,000 1,400,000 1,314,250

Cash flow hedging derivatives........................................................ 54,963 54,963 23,502 23,502

Long-term investments................................................................... 5,986 5,986 36,050 36,050

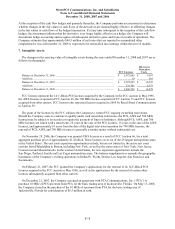

11. Concentrations:

The Company purchases a substantial portion of its wireless infrastructure equipment and handset equipment

from only a few major suppliers. Further, the Company generally relies on one key vendor in each of the following

areas: network infrastructure equipment, billing services, customer care, handset logistics and long distance services.

Loss of any of these suppliers could adversely affect operations temporarily until a comparable substitute could be

found. Verisign, the Company’s existing billing system provider, publicly announced that it plans to leave the

telecommunications services business, including the billing services business. On September 15, 2008, the

Company entered into a managed services agreement with Amdocs Software Systems Limited and Amdocs, Inc.

(“Amdocs”). The Company is currently transitioning its billing systems to Amdocs.

Local and long distance telephone and other companies provide certain communication services to the Company.

Disruption of these services could adversely affect operations in the short term until an alternative

telecommunication provider was found.

Concentrations of credit risk with respect to trade accounts receivable are limited due to the diversity of the

Company’s indirect retailer base.

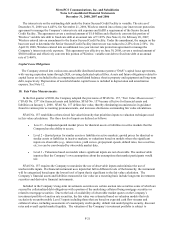

12. Commitments and Contingencies:

Operating and Capital Leases

The Company has entered into non-cancelable operating lease agreements to lease facilities, certain equipment

and sites for towers and antennas required for the operation of its wireless networks. Total rent expense for the years

ended December 31, 2008, 2007 and 2006 was $199.1 million, $125.1 million and $85.5 million, respectively.

The Company entered into various non-cancelable DAS capital lease agreements, with varying expiration terms

through 2024, covering dedicated optical fiber.

Future annual minimum rental payments required for all non-cancelable operating and capital leases at

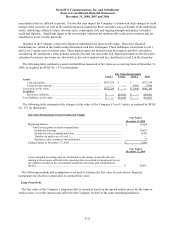

December 31, 2008 are as follows (in thousands):

Operating Leases Capital Leases

For the Year Ending December 31,

2009................................................................................................................ $ 204,296 $ 10,213

2010................................................................................................................ 209,999 10,521

2011................................................................................................................ 209,157 10,836

2012................................................................................................................ 198,270 11,162

2013................................................................................................................ 199,961 11,496

Thereafter ....................................................................................................... 731,327 132,271

Total minimum future lease payments............................................................ $ 1,753,010 186,499

Amount representing interest.......................................................................... (95,156)

Present value of minimum lease payments..................................................... 91,343

Current portion ............................................................................................... (1,009)

Long-term capital lease obligations ................................................................ $ 90,334