Metro PCS 2008 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-19

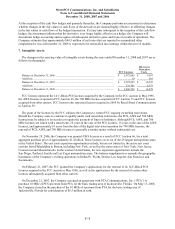

The Company participated as a bidder in FCC Auction 73, and on June 26, 2008, the Company was granted one

12 MHz 700 MHz license for a total aggregate purchase price of approximately $313.3 million. This 700 MHz

license supplements the 10 MHz of AWS spectrum previously granted to the Company in the Boston-Worcester,

Massachusetts/New Hampshire/Rhode Island/Vermont Economic Area as a result of FCC Auction 66.

On various dates in 2008, the Company consummated agreements for spectrum acquisitions from third-parties in

the aggregate amount of approximately $15.3 million.

On September 26, 2008, the Company entered into a spectrum exchange agreement covering licenses in certain

markets with Leap Wireless International, Inc. (“Leap Wireless”) with Leap Wireless acquiring an additional 10

MHz of spectrum in San Diego and Fresno, California; Seattle, Washington and certain other Washington and

Oregon markets, and the Company acquiring an additional 10 MHz of spectrum in Shreveport-Bossier City,

Louisiana; Lakeland-Winter Haven, Florida; and Dallas-Ft. Worth, Texas and certain other North Texas markets,

with consummation subject to customary closing conditions.

During the year ended December 31, 2008, the Company entered into various agreements for the acquisition and

exchange of spectrum in the aggregate amount of approximately $8.3 million. Consummation of these acquisitions

is conditioned upon customary closing conditions, including approval by the FCC.

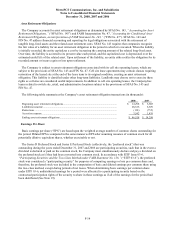

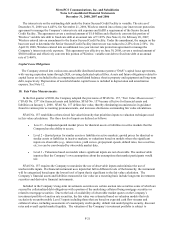

8. Accounts Payable and Accrued Expenses:

Accounts payable and accrued expenses consisted of the following (in thousands):

2008 2007

Accounts payable ....................................................................................................................... $ 148,309 $ 131,177

Book overdraft............................................................................................................................ 104,752 25,399

Accrued accounts payable .......................................................................................................... 178,085 155,733

Accrued liabilities....................................................................................................................... 15,803 16,285

Payroll and employee benefits.................................................................................................... 34,047 29,380

Accrued interest.......................................................................................................................... 33,521 33,892

Taxes, other than income............................................................................................................ 46,705 41,044

Income taxes............................................................................................................................... 7,210 6,539

Accounts payable and accrued expenses .................................................................................... $ 568,432 $ 439,449

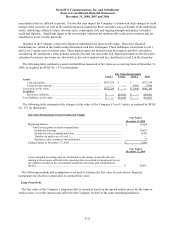

9. Long-Term Debt:

Long-term debt consisted of the following (in thousands):

2008 2007

9¼% Senior Notes.................................................................................................................. $ 1,400,000 $ 1,400,000

Senior Secured Credit Facility................................................................................................ 1,564,000 1,580,000

Capital lease obligations......................................................................................................... 91,343 —

Total ...................................................................................................................................... 3,055,343 2,980,000

Add: unamortized premium on debt ....................................................................................... 19,649 22,177

Total debt............................................................................................................................... 3,074,992 3,002,177

Less: current maturities .......................................................................................................... (17,009) (16,000)

Total long-term debt.............................................................................................................. $ 3,057,983 $ 2,986,177