Metro PCS 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

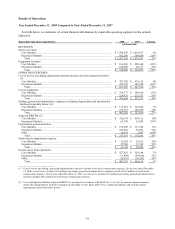

Interest Expense. Interest expense decreased $22.3 million, or 11%, to $179.4 million for the year ended

December 31, 2008 from $201.7 million for the year ended December 31, 2007. The decrease in interest expense

was primarily due to the capitalization of $64.2 million of interest during the twelve months ended December 31,

2008, compared to $34.9 million of interest capitalized during the same period in 2007. We capitalize interest costs

associated with our FCC licenses and property and equipment during the construction of a new market. The amount

of such capitalized interest depends on the carrying values of the FCC licenses and construction in progress involved

in those markets and the duration of the construction process. We expect capitalized interest to be significant during

the construction of new markets. In addition, our weighted average interest rate decreased to 7.78% for the twelve

months ended December 31, 2008 compared to 8.15% for the twelve months ended December 31, 2007 as a result

of a decrease in the borrowing rates under the senior secured credit facility. Average debt outstanding for the twelve

months ended December 31, 2008 and 2007 was $3.0 and $2.8 billion, respectively. The increase in average debt

outstanding was due to the issuance of an additional $400.0 million principal amount of our 9¼% senior notes in

June 2007.

Interest and Other Income. Interest and other income decreased $40.7 million, or approximately 64%, to $23.2

million for the year ended December 31, 2008 from $63.9 million for the year ended December 31, 2007. The

decrease in interest and other income was primarily due to the Company investing substantially all of its cash and

cash equivalents in money market funds consisting of U.S. treasury securities rather than in short-term investments

as the Company has done historically. In addition, interest income decreased due to lower cash balances when

compared to 2007 as well as a decrease on the return on our cash balances as a result of a decrease in interest rates.

Impairment Loss on Investment Securities. We can and have historically invested our substantial cash balances

in, among other things, securities issued and fully guaranteed by the United States or the states, highly rated

commercial paper and auction rate securities, money market funds meeting certain criteria, and demand deposits.

These investments are subject to credit, liquidity, market and interest rate risk. During the year ended December 31,

2007, we made an original investment of $133.9 million in principal in certain auction rate securities that were rated

AAA/Aaa at the time of purchase, substantially all of which are secured by collateralized debt obligations with a

portion of the underlying collateral being mortgage securities or related to mortgage securities. With the continued

liquidity issues experienced in global credit and capital markets, the auction rate securities held by us at December

31, 2008 continue to experience failed auctions as the amount of securities submitted for sale in the auctions exceeds

the amount of purchase orders. We recognized an additional other-than-temporary impairment loss on investment

securities in the amount of $30.9 million during the year ended December 31, 2008.

Provision for Income Taxes. Income tax expense was $130.0 million and $123.1 million for the years ended

December 31, 2008 and 2007, respectively. The effective tax rate was 46.5% and 54.4% for the years ended

December 31, 2008 and 2007, respectively. Our effective rates differ from the statutory federal rate of 35.0% due to

state and local taxes, non-deductible expenses and an increase in the valuation allowance related to the impairment

loss recognized on investment securities.

Net Income. Net income increased $49.0 million, or approximately 49%, to $149.4 million for the year ended

December 31, 2008 compared to $100.4 million for the year ended December 31, 2007. The increase in net income

was primarily attributable to an increase in income from operations, a decrease in interest expense and a decrease in

the impairment loss on investment securities. These items were partially offset by lower interest and other income

for the year ended December 31, 2008.