Metro PCS 2008 Annual Report Download - page 115

Download and view the complete annual report

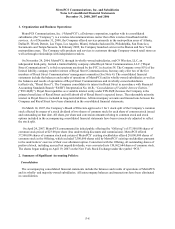

Please find page 115 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-13

from the date of the digital television transition for 700 MHz licenses, the renewal of PCS, AWS and 700 MHz

licenses is generally a routine matter without substantial cost and the Company has determined that no legal,

regulatory, contractual, competitive, economic, or other factors currently exist that limit the useful life of its PCS,

AWS and 700 MHz licenses. As such, under the provisions of SFAS No. 142, “Goodwill and Other Intangible

Assets,” the Company does not amortize PCS, AWS and 700 MHz licenses and microwave relocation costs as they

are considered to have indefinite lives and together represent the cost of the Company’s spectrum. The Company is

required to test indefinite-lived intangible assets, consisting of PCS, AWS, and 700 MHz licenses and microwave

relocation costs, for impairment on an annual basis based upon a fair value approach. Indefinite-lived intangible

assets must be tested between annual tests if events or changes in circumstances indicate that the asset might be

impaired. These events or circumstances could include a significant change in the business climate, including a

significant sustained decline in an entity’s market value, legal factors, operating performance indicators,

competition, sale or disposition of a significant portion of the business, or other factors. The Company completed its

impairment tests during the third quarter of 2008. There have been no indicators of impairment and no impairment

has been recognized through December 31, 2008.

Advertising and Promotion Costs

Advertising and promotion costs are expensed as incurred. Advertising costs totaled $99.0 million, $73.2 million

and $46.4 million during the years ended December 31, 2008, 2007 and 2006, respectively.

Income Taxes

The Company records income taxes pursuant to SFAS No. 109, “Accounting for Income Taxes,”

(“SFAS No. 109”). SFAS No. 109 uses an asset and liability approach to account for income taxes, wherein deferred

taxes are provided for book and tax basis differences for assets and liabilities. In the event differences between the

financial reporting basis and the tax basis of the Company’s assets and liabilities result in deferred tax assets, a

valuation allowance is provided for a portion or all of the deferred tax assets when there is sufficient uncertainty

regarding the Company’s ability to recognize the benefits of the assets in future years.

On January 1, 2007, the Company adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income

Taxes,” (“FIN 48”), which clarifies the accounting for uncertainty in income taxes recognized in the financial

statements in accordance with SFAS No. 109. FIN 48 provides guidance on the financial statement recognition and

measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on de-

recognition, classification, interest and penalties, accounting in interim periods, disclosures, and transition issues.

The adoption of FIN 48 did not have a significant impact on the Company’s financial statements. There was no

cumulative effect adjustment related to adopting FIN 48.

Other Comprehensive Income (Loss)

Unrealized gains on available-for-sale securities and cash flow hedging derivatives are reported in accumulated

other comprehensive loss as a separate component of stockholders’ equity until realized. Realized gains and losses

on available-for-sale securities are included in interest and other income. Gains or losses on cash flow hedging

derivatives reported in accumulated other comprehensive loss are reclassified to earnings in the period in which

earnings are affected by the underlying hedged transaction.

Stock-Based Compensation

The Company accounts for share-based awards exchanged for employee services in accordance with

SFAS No. 123(R), “Share-Based Payment,” (“SFAS No. 123(R)”) under the modified prospective method of

adoption. Under SFAS No. 123(R), share-based compensation cost is measured at the grant date, based on the

estimated fair value of the award, and is recognized as expense over the employee’s requisite service period.