Metro PCS 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

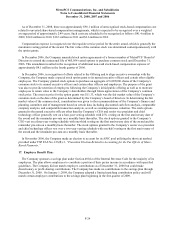

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-35

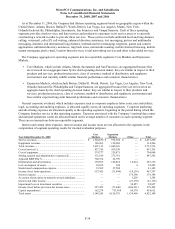

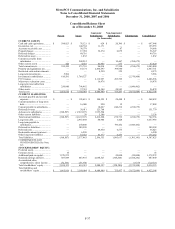

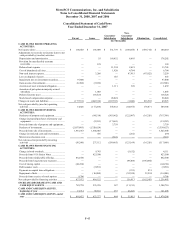

Year Ended December 31, 2007

Core

Markets

Expansion

Markets Other Total

Service revenues ....................................................................... $ 1,414,917 $ 504,280 $ — $ 1,919,197

Equipment revenues.................................................................. 220,364 96,173 — 316,537

Total revenues........................................................................... 1,635,281 600,453 — 2,235,734

Cost of service(1)...................................................................... 439,162 208,348 — 647,510

Cost of equipment..................................................................... 385,100 212,133 — 597,233

Selling, general and administrative expenses(2)....................... 167,542 184,478 — 352,020

Adjusted EBITDA(3)................................................................ 654,112 12,883 —

Depreciation and amortization.................................................. 117,344 53,851 7,007 178,202

(Gain) loss on disposal of assets ............................................... (3,061

)

461 3,255 655

Stock-based compensation expense.......................................... 10,635 17,389 — 28,024

Income (loss) from operations .................................................. 529,194 (58,818) (10,262) 460,114

Interest expense ........................................................................ — — 201,746 201,746

Accretion of put option in majority-owned subsidiary.............. — — 1,003 1,003

Interest and other income.......................................................... — — (63,936) (63,936)

Impairment loss on investment securities ................................. — — 97,800 97,800

Income (loss) before provision for income taxes...................... 529,194 (58,818) (246,875) 223,501

Capital expenditures ................................................................. 220,490 436,567 110,652 767,709

Total assets ............................................................................... 1,064,384 2,883,832 1,857,914 5,806,130

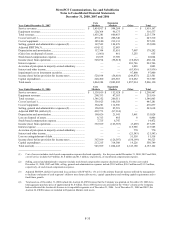

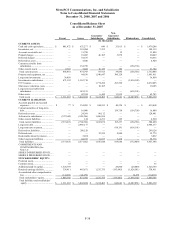

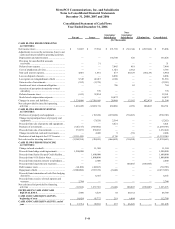

Year Ended December 31, 2006

Core

Markets

Expansion

Markets Other Total

Service revenues ....................................................................... $ 1,138,019 $ 152,928 $ — $ 1,290,947

Equipment revenues.................................................................. 208,333 47,583 — 255,916

Total revenues........................................................................... 1,346,352 200,511 — 1,546,863

Cost of service(1)...................................................................... 338,923 106,358 — 445,281

Cost of equipment..................................................................... 364,281 112,596 — 476,877

Selling, general and administrative expenses(2)....................... 158,100 85,518 — 243,618

Adjusted EBITDA (deficit)(3).................................................. 492,773 (97,214) —

Depreciation and amortization.................................................. 109,626 21,941 3,461 135,028

Loss on disposal of assets ......................................................... 8,313 485 8 8,806

Stock-based compensation expense.......................................... 7,725 6,747 — 14,472

Income (loss) from operations .................................................. 367,109 (126,387) (3,469) 237,253

Interest expense ........................................................................ — — 115,985 115,985

Accretion of put option in majority-owned subsidiary.............. — — 770 770

Interest and other income.......................................................... — — (21,543) (21,543)

Loss on extinguishment of debt ................................................ — — 51,518 51,518

Income (loss) before provision for income taxes...................... 367,109 (126,387) (150,199) 90,523

Capital expenditures ................................................................. 217,215 314,308 19,226 550,749

Total assets(4)........................................................................... 945,699 1,064,243 2,143,180 4,153,122

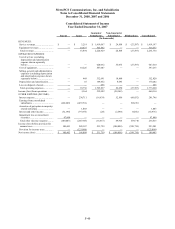

_____________________________

(1) Cost of service includes stock-based compensation expense disclosed separately. For the years ended December 31, 2008, 2007 and 2006,

cost of service includes $2.9 million, $1.8 million and $1.3 million, respectively, of stock-based compensation expense.

(2) Selling, general and administrative expenses include stock-based compensation expense disclosed separately. For the years ended

December 31, 2008, 2007 and 2006, selling, general and administrative expenses include $38.2 million, $26.2 million and $13.2 million,

respectively, of stock-based compensation expense.

(3) Adjusted EBITDA (deficit) is presented in accordance with SFAS No. 131 as it is the primary financial measure utilized by management

to facilitate evaluation of each segments’ ability to meet future debt service, capital expenditures and working capital requirements and to

fund future growth.

(4) Total assets as of December 31, 2006 include the Auction 66 AWS licenses that the Company was granted on November 29, 2006 for a

total aggregate purchase price of approximately $1.4 billion. These AWS licenses are presented in the “Other” column as the Company

had not allocated the Auction 66 licenses to its reportable segments as of December 31, 2006. As of December 31, 2008 and 2007, the

Auction 66 AWS licenses are included in Expansion Markets total assets.