Metro PCS 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-36

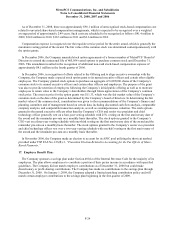

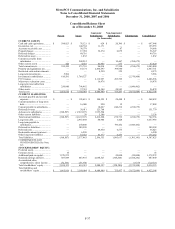

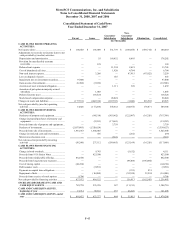

The following table reconciles segment Adjusted EBITDA (Deficit) for the years ended December 31, 2008,

2007 and 2006 to consolidated income before provision for income taxes:

2008 2007 2006

Segment Adjusted EBITDA (Deficit):

Core Markets Adjusted EBITDA................................................................................. $ 720,334 $ 654,112 $ 492,773

Expansion Markets Adjusted EBITDA (Deficit) ......................................................... 62,799 12,883 (97,214)

Total............................................................................................................................ 783,133 666,995 395,559

Depreciation and amortization..................................................................................... (255,319) (178,202) (135,028)

Loss on disposal of assets ............................................................................................ (18,905) (655) (8,806)

Stock-based compensation expense............................................................................. (41,142) (28,024) (14,472)

Interest expense ........................................................................................................... (179,398) (201,746) (115,985)

Accretion of put option in majority-owned subsidiary................................................. (1,258) (1,003) (770)

Interest and other income............................................................................................. 23,170 63,936 21,543

Impairment loss on investment securities .................................................................... (30,857) (97,800) —

Loss on extinguishment of debt ................................................................................... — — (51,518)

Consolidated income before provision for income taxes......................................... $ 279,424 $ 223,501 $ 90,523

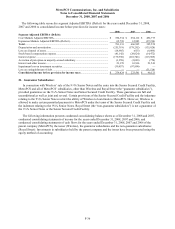

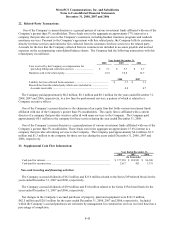

21. Guarantor Subsidiaries:

In connection with Wireless’ sale of the 91/4% Senior Notes and the entry into the Senior Secured Credit Facility,

MetroPCS and all of MetroPCS’ subsidiaries, other than Wireless and Royal Street (the “guarantor subsidiaries”),

provided guarantees on the 91/4% Senior Notes and Senior Secured Credit Facility. These guarantees are full and

unconditional as well as joint and several. Certain provisions of the Senior Secured Credit Facility and the indenture

relating to the 9¼% Senior Notes restrict the ability of Wireless to loan funds to MetroPCS. However, Wireless is

allowed to make certain permitted payments to MetroPCS under the terms of the Senior Secured Credit Facility and

the indenture relating to the 9¼% Senior Notes. Royal Street (the “non-guarantor subsidiaries”) is not a guarantor of

the 91/4% Senior Notes or the Senior Secured Credit Facility.

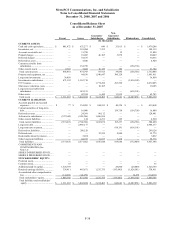

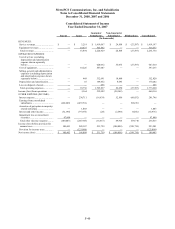

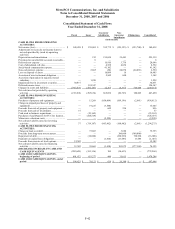

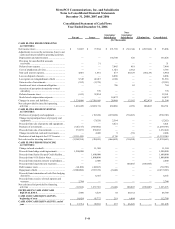

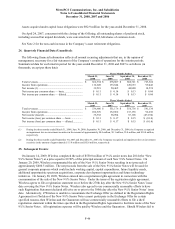

The following information presents condensed consolidating balance sheets as of December 31, 2008 and 2007,

condensed consolidating statements of income for the years ended December 31, 2008, 2007 and 2006, and

condensed consolidating statements of cash flows for the years ended December 31, 2008, 2007 and 2006 of the

parent company (MetroPCS), the issuer (Wireless), the guarantor subsidiaries and the non-guarantor subsidiaries

(Royal Street). Investments in subsidiaries held by the parent company and the issuer have been presented using the

equity method of accounting.