Metro PCS 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

equal to the expected term. The expected term of employee stock options represents the weighted-average period the

stock options are expected to remain outstanding. The expected term assumption is estimated based primarily on the

stock options’ vesting terms and remaining contractual life and employees’ expected exercise and post-vesting

employment termination behavior. The risk-free interest rate assumption is based upon observed interest rates on the

grant date appropriate for the term of the employee stock options. The dividend yield assumption is based on the

expectation of no future dividend payouts by us.

As share-based compensation expense under SFAS No. 123(R) is based on awards ultimately expected to vest, it

is reduced for estimated forfeitures. SFAS No. 123(R) requires forfeitures to be estimated at the time of grant and

revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. We recognized stock-

based compensation expense of approximately $41.1 million, $28.0 million and $14.5 million for the years ended

December 31, 2008, 2007 and 2006, respectively.

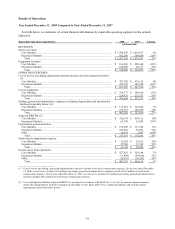

The value of the options is determined by using a Black-Scholes pricing model that includes the following

variables: 1) exercise price of the instrument, 2) fair market value of the underlying stock on date of grant,

3) expected life, 4) estimated volatility and 5) the risk-free interest rate. We utilized the following weighted-average

assumptions in estimating the fair value of the options grants for the years ended December 31, 2008 and 2007:

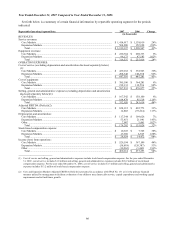

December 31,

2008

December 31,

2007

Expected dividends..................................................................................................... 0.00% 0.00%

Expected volatility...................................................................................................... 45.20% 42.69%

Risk-free interest rate ................................................................................................. 2.49% 4.54%

Expected lives in years ............................................................................................... 5.00 5.00

Weighted-average fair value of options:

Granted at below fair value ....................................................................................... $ — $ —

Granted at fair value.................................................................................................. $ 6.95 $ 9.89

Weighted-average exercise price of options:

Granted at below fair value ....................................................................................... $ — $ —

Granted at fair value.................................................................................................. $ 16.36 $ 22.41

The Black-Scholes model requires the use of subjective assumptions including expectations of future dividends

and stock price volatility. Such assumptions are only used for making the required fair value estimate and should not

be considered as indicators of future dividend policy or stock price appreciation. Because changes in the subjective

assumptions can materially affect the fair value estimate, and because employee stock options have characteristics

significantly different from those of traded options, the use of the Black-Scholes option pricing model may not

provide a reliable estimate of the fair value of employee stock options.

Compensation expense is recognized over the requisite service period for the entire award, which is generally the

maximum vesting period of the award.

Customer Recognition and Disconnect Policies

When a new customer subscribes to our service, the first month of service is included with the handset purchase.

Under GAAP, we are required to allocate the purchase price to the handset and to the wireless service revenue.

Generally, the amount allocated to the handset will be less than our cost, and this difference is included in Cost Per

Gross Addition, or CPGA. We recognize new customers as gross customer additions upon activation of service. We

offer our customers the Metro Promise, which allows a customer to return a newly purchased handset for a full

refund prior to the earlier of 30 days or 60 minutes of use. Customers who return their phones under the Metro

Promise are reflected as a reduction to gross customer additions. Customers’ monthly service payments are due in

advance every month. Our customers must pay their monthly service amount by the payment date or their service

will be suspended, or hotlined, and the customer will not be able to make or receive calls on our network. However,

a hotlined customer is still able to make E-911 calls in the event of an emergency. There is no service grace period.

Any call attempted by a hotlined customer is routed directly to our interactive voice response system and customer

service center in order to arrange payment. If the customer pays the amount due within 30 days of the original

payment date then the customer’s service is restored. If a hotlined customer does not pay the amount due within

30 days of the payment date the account is disconnected and counted as churn. Once an account is disconnected we

charge a $15 reconnect fee upon reactivation to reestablish service and the revenue associated with this fee is

deferred and recognized over the estimated life of the customer.