Metro PCS 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

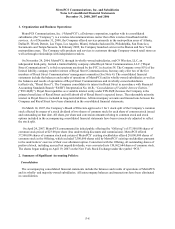

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-14

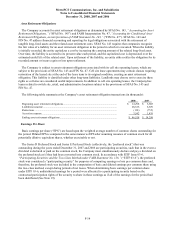

Asset Retirement Obligations

The Company accounts for asset retirement obligations as determined by SFAS No. 143, “Accounting for Asset

Retirement Obligations,” (“SFAS No. 143”) and FASB Interpretation No. 47, “Accounting for Conditional Asset

Retirement Obligations, an interpretation of FASB Statement No. 143,” (“FIN No. 47”). SFAS No. 143 and

FIN No. 47 address financial accounting and reporting for legal obligations associated with the retirement of

tangible long-lived assets and the related asset retirement costs. SFAS No. 143 requires that companies recognize

the fair value of a liability for an asset retirement obligation in the period in which it is incurred. When the liability

is initially recorded, the entity capitalizes a cost by increasing the carrying amount of the related long-lived asset.

Over time, the liability is accreted to its present value each period, and the capitalized cost is depreciated over the

estimated useful life of the related asset. Upon settlement of the liability, an entity either settles the obligation for its

recorded amount or incurs a gain or loss upon settlement.

The Company is subject to asset retirement obligations associated with its cell site operating leases, which are

subject to the provisions of SFAS No. 143 and FIN No. 47. Cell site lease agreements may contain clauses requiring

restoration of the leased site at the end of the lease term to its original condition, creating an asset retirement

obligation. This liability is classified under other long-term liabilities. Landlords may choose not to exercise these

rights as cell sites are considered useful improvements. In addition to cell site operating leases, the Company has

leases related to switch site, retail, and administrative locations subject to the provisions of SFAS No. 143 and

FIN No. 47.

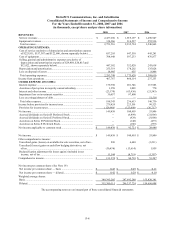

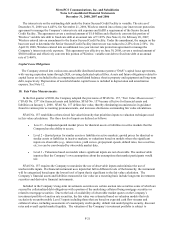

The following table summarizes the Company’s asset retirement obligation transactions (in thousands):

2008 2007

Beginning asset retirement obligations................................................................................ $ 14,298 $ 6,685

Liabilities incurred .............................................................................................................. 28,816 6,929

Reductions........................................................................................................................... (138) (755)

Accretion expense ............................................................................................................... 3,542 1,439

Ending asset retirement obligations..................................................................................... $ 46,518 $ 14,298

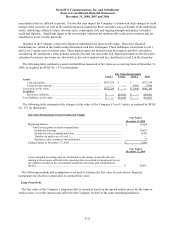

Earnings Per Share

Basic earnings per share (“EPS”) are based upon the weighted average number of common shares outstanding for

the period. Diluted EPS is computed in the same manner as EPS after assuming issuance of common stock for all

potentially dilutive equivalent shares, whether exercisable or not.

The Series D Preferred Stock and Series E Preferred Stock (collectively, the “preferred stock”) that was

outstanding during the years ended December 31, 2007 and 2006 are participating securities, such that in the event a

dividend is declared or paid on the common stock, the Company must simultaneously declare and pay a dividend on

the preferred stock as if they had been converted into common stock. In accordance with EITF Issue 03-6,

“Participating Securities and the Two-Class Method under FASB Statement No. 128,” (“EITF 03-6”), the preferred

stock was considered a “participating security” for purposes of computing earnings or loss per common share and,

therefore, the preferred stock was included in the computation of basic and diluted earnings per common share using

the two-class method, except during periods of net losses. When determining basic earnings per common share

under EITF 03-6, undistributed earnings for a period were allocated to a participating security based on the

contractual participation rights of the security to share in those earnings as if all of the earnings for the period had

been distributed (See Note 19).