Metro PCS 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-10

Cash and Cash Equivalents

The Company includes as cash and cash equivalents (i) cash on hand, (ii) cash in bank accounts, (iii) investments

in money market funds, and (iv) treasury securities with an original maturity of 90 days or less.

Inventories

Substantially all of the Company’s inventories are stated at the lower of average cost or market. Inventories

consist mainly of handsets that are available for sale to customers and independent retailers.

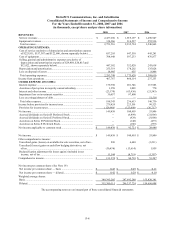

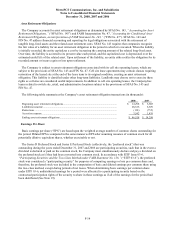

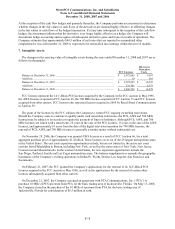

Allowance for Uncollectible Accounts Receivable

The Company maintains allowances for uncollectible accounts for estimated losses resulting from the inability of

independent retailers to pay for equipment purchases and for amounts estimated to be uncollectible from other

carriers. The following table summarizes the changes in the Company’s allowance for uncollectible accounts (in

thousands):

2008 2007 2006

Balance at beginning of period.................................................................... $ 2,908 $ 1,950 $ 2,383

Additions:

Charged to expense................................................................................... 8 129 31

Direct reduction to revenue and other accounts........................................ 1,337 1,037 929

Deductions................................................................................................... (147) (208) (1,393)

Balance at end of period .............................................................................. $ 4,106 $ 2,908 $ 1,950

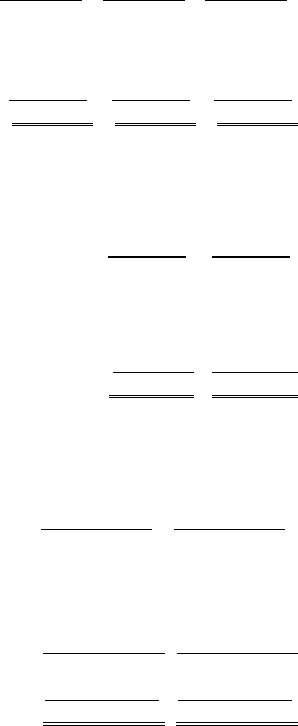

Prepaid Charges

Prepaid charges consisted of the following (in thousands):

2008 2007

Prepaid vendor purchases ................................................................................................ $ 17,829 $ 37,054

Prepaid rent ..................................................................................................................... 23,689 13,996

Prepaid maintenance and support contracts..................................................................... 4,482 3,961

Prepaid insurance ............................................................................................................ 2,165 2,162

Prepaid advertising .......................................................................................................... 2,331 264

Other................................................................................................................................ 5,851 3,032

Prepaid charges................................................................................................................ $ 56,347 $ 60,469

Property and Equipment

Property and equipment, net, consisted of the following (in thousands):

2008 2007

Construction-in-progress ..................................................................................... $ 898,454 $ 393,282

Network infrastructure......................................................................................... 2,522,206 1,901,119

Office equipment................................................................................................. 63,848 44,059

Leasehold improvements..................................................................................... 47,784 33,410

Furniture and fixtures .......................................................................................... 10,273 7,833

Vehicles............................................................................................................... 311 207

3,542,876 2,379,910

Accumulated depreciation and amortization ....................................................... (695,125) (488,499)

Property and equipment, net................................................................................ $ 2,847,751 $ 1,891,411

Property and equipment are stated at cost. Additions and improvements are capitalized, while expenditures that

do not enhance or extend the asset’s useful life are charged to operating expenses as incurred. When the Company

sells, disposes of or retires property and equipment, the related gains or losses are included in operating results.

Depreciation is applied using the straight-line method over the estimated useful lives of the assets once the assets are

placed in service, which are seven to ten years for network infrastructure assets, three to ten years for capitalized