Metro PCS 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

ringtones, ring back tones, downloads, games and content applications, unlimited directory assistance, location

services and other value-added services. As of December 31, 2008, approximately 80% of our customers have

selected a $40 or higher rate plan. Our flat-rate plans differentiate our service from the more complex plans and

long-term contract requirements of traditional wireless carriers. In addition, the above products and services are

offered by us in the Royal Street markets under the MetroPCS brand.

Critical Accounting Policies and Estimates

On January 1, 2008, we adopted the provisions of Statement of Financial Accounting Standards, or SFAS,

No. 157, “Fair Value Measurements,” or SFAS No. 157, for financial assets and liabilities. SFAS No. 157 defines

fair value, thereby eliminating inconsistencies in guidance found in various prior accounting pronouncements, and

increases disclosures surrounding fair value calculations. SFAS No. 157 establishes a three-tiered fair value

hierarchy that prioritizes inputs to valuation techniques used in fair value calculations. SFAS No. 157 requires us to

maximize the use of observable inputs and minimize the use of unobservable inputs. If a financial instrument uses

inputs that fall in different levels of the hierarchy, the instrument will be categorized based upon the lowest level of

input that is significant to the fair value calculation.

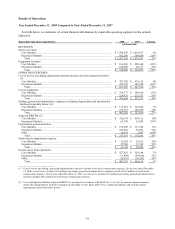

The following discussion and analysis of our financial condition and results of operations are based upon our

consolidated financial statements, which have been prepared in accordance with accounting principles generally

accepted in the United States of America, or GAAP. You should read this discussion and analysis in conjunction

with our consolidated financial statements and the related notes thereto contained elsewhere in this report. The

preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that

affect the reported amounts of certain assets, liabilities, revenues and expenses, and related disclosure of contingent

assets and liabilities at the date of the financial statements. We base our estimates on historical experience and on

various other assumptions that we believe to be reasonable under the circumstances, the results of which form the

basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other

sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies affect our more significant judgments and estimates used in

the preparation of our consolidated financial statements.

Revenue Recognition

Our wireless services are provided on a month-to-month basis and are paid in advance. We recognize revenues

from wireless services as they are rendered. Amounts received in advance are recorded as deferred revenue.

Suspending service for non-payment is known as hotlining. We do not recognize revenue on hotlined customers.

Revenues and related costs from the sale of accessories are recognized at the point of sale. The cost of handsets

sold to indirect retailers are included in deferred charges until they are sold to and activated by customers. Amounts

billed to indirect retailers for handsets are recorded as accounts receivable and deferred revenue upon shipment by

us and are recognized as equipment revenues when service is activated by customers.

Our customers have the right to return handsets within a specified time or within a certain amount of use,

whichever occurs first. We record an estimate for returns as contra-revenue at the time of recognizing revenue. Our

assessment of estimated returns is based on historical return rates. If our customers’ actual returns are not consistent

with our estimates of their returns, revenues may be different than initially recorded.

We follow the provisions of Emerging Issues Task Force or EITF, No. 00-21, “Accounting for Revenue

Arrangements with Multiple Deliverables,” or EITF No. 00-21. EITF No. 00-21, addresses the accounting for

arrangements that involve the delivery or performance of multiple products, services and/or rights to use assets.

Revenue arrangements with multiple deliverables are divided into separate units of accounting and the consideration

received is allocated among the separate units of accounting using the residual method of accounting.

We determined that the sale of wireless services through our direct and indirect sales channels with an

accompanying handset constitutes revenue arrangements with multiple deliverables. In accordance with EITF

No. 00-21, we divide these arrangements into separate units of accounting and allocate the consideration between

the handset and the wireless service using the residual method of accounting. Consideration received for the

wireless service is recognized at fair value as service revenue when earned, and any remaining consideration

received is recognized as equipment revenue when the handset is delivered and accepted by the customer.