Metro PCS 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-27

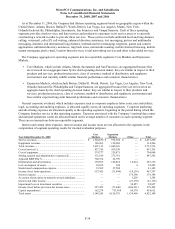

Options granted under the 1995 Plan are exercisable upon grant. Shares received upon exercising options prior to

vesting are restricted from sale based on a vesting schedule. In the event an option holder’s service with the

Company is terminated, MetroPCS may repurchase unvested shares issued under the 1995 Plan at the option

exercise price. Options granted under the 2004 Plan are only exercisable upon vesting. Upon exercise of options

under the Option Plans, new shares of common stock are issued to the option holder.

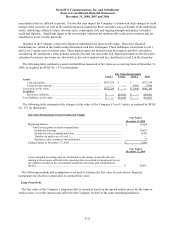

The value of the options is determined by using a Black-Scholes pricing model that includes the following

variables: 1) exercise price of the instrument, 2) fair market value of the underlying stock on date of grant,

3) expected life, 4) estimated volatility and 5) the risk-free interest rate. The Company utilized the following

weighted-average assumptions in estimating the fair value of the option grants in the years ended December 31,

2008, 2007 and 2006:

2008 2007 2006

Expected dividends............................................................................................................. 0.00% 0.00% 0.00%

Expected volatility .............................................................................................................. 45.20% 42.69% 35.04%

Risk-free interest rate.......................................................................................................... 2.49% 4.54% 4.64%

Expected lives in years ....................................................................................................... 5.00 5.00 5.00

Weighted-average fair value of options:

Granted at below fair value................................................................................................. $ — $ — $ 10.16

Granted at fair value ........................................................................................................... $ 6.95 $ 9.89 $ 3.75

Weighted-average exercise price of options:

Granted at below fair value................................................................................................. $ — $ — $ 1.49

Granted at fair value ........................................................................................................... $ 16.36 $ 22.41 $ 9.95

The Black-Scholes model requires the use of subjective assumptions including expectations of future dividends

and stock price volatility. Such assumptions are only used for making the required fair value estimate and should not

be considered as indicators of future dividend policy or stock price appreciation. Because changes in the subjective

assumptions can materially affect the fair value estimate, and because employee stock options have characteristics

significantly different from those of traded options, the use of the Black-Scholes option pricing model may not

provide a reliable estimate of the fair value of employee stock options.

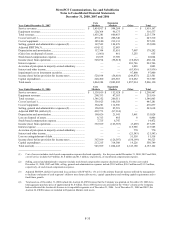

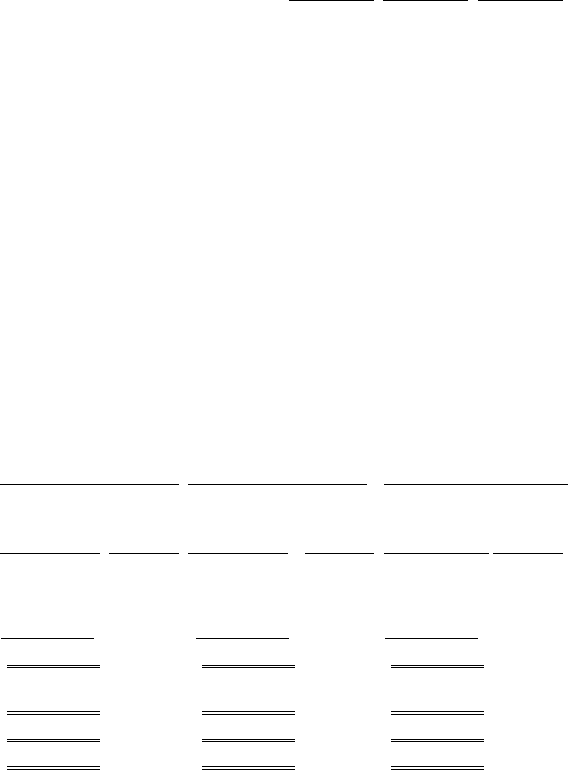

A summary of the status of the Company’s Option Plans as of December 31, 2008, 2007 and 2006, and changes

during the periods then ended, is presented in the table below:

2008 2007 2006

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding, beginning of year............................ 27,643,794 $ 11.70 23,499,462 $ 6.91 14,502,210 $ 4.18

Granted ................................................................ 6,566,165 $ 16.36 8,476,998 $ 22.41 11,369,793 $ 9.65

Exercised ............................................................. (2,810,245) $ 4.48 (2,562,056) $ 3.79 (1,148,328) $ 2.39

Forfeited .............................................................. (722,126) $ 18.09 (1,770,610) $ 10.81 (1,224,213) $ 4.22

Outstanding, end of year...................................... 30,677,588 $ 13.21 27,643,794 $ 11.70 23,499,462 $ 6.91

Options vested or expected to vest at

year-end............................................................. 29,633,907 $ 13.07 25,395,877 $ 11.36 20,127,759 $ 6.55

Options exercisable at year-end........................... 15,920,318 $ 10.04 12,524,250 $ 5.86 10,750,692 $ 3.78

Options vested at year-end................................... 15,836,608 $ 10.05 11,904,985 $ 5.82 8,940,615 $ 3.59

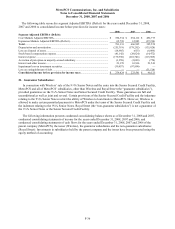

Options outstanding under the Option Plans as of December 31, 2008 have a total aggregate intrinsic value of

approximately $122.6 million and a weighted average remaining contractual life of 7.54 years. Options outstanding

under the Option Plans as of December 31, 2007 and 2006 have a weighted average remaining contractual life of

7.85 and 8.01 years, respectively. Options vested or expected to vest under the Option Plans as of December 31,

2008 have a total aggregate intrinsic value of approximately $121.6 million and a weighted average remaining

contractual life of 7.50 years. Options exercisable under the Option Plans as of December 31, 2008 have a total

aggregate intrinsic value of approximately $102.4 million and a weighted average remaining contractual life of

6.58 years.