Metro PCS 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-5

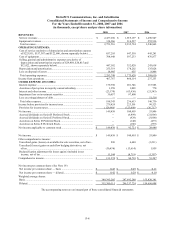

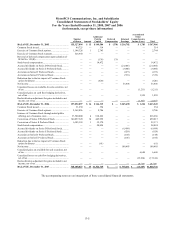

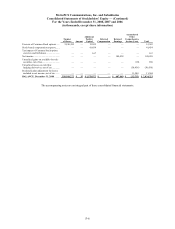

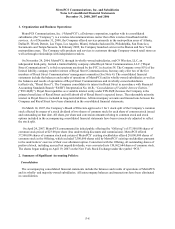

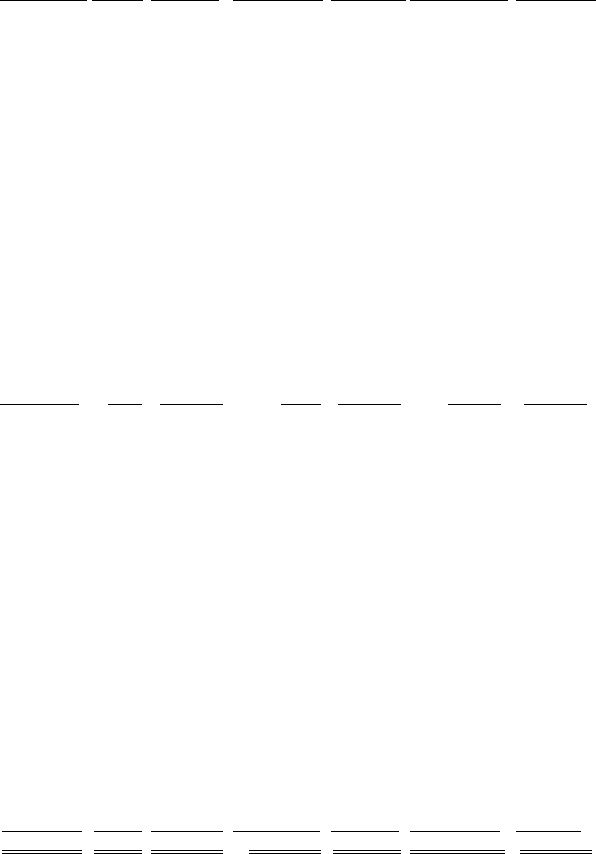

MetroPCS Communications, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity

For the Years Ended December 31, 2008, 2007 and 2006

(in thousands, except share information)

Number

of Shares Amount

Additional

Paid-In

Capital

Deferred

Compensation

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss) Total

BALANCE, December 31, 2005................................. 155,327,094 $ 15 $ 149,584 $ (178) $ 216,702 $ 1,783 $ 367,906

Common Stock issued................................................... 49,725 — 314 — — — 314

Exercise of Common Stock options.............................. 1,148,328 1 2,743 — — — 2,744

Exercise of Common Stock warrants............................ 526,950 — — — — — —

Reversal of deferred compensation upon adoption of

SFAS No. 123(R)......................................................... — — (178) 178 — — —

Stock-based compensation............................................ — — 14,472 — — — 14,472

Accrued dividends on Series D Preferred Stock........... — — — — (21,006) — (21,006)

Accrued dividends on Series E Preferred Stock ........... — — — — (3,000) — (3,000)

Accretion on Series D Preferred Stock ......................... — — — — (473) — (473)

Accretion on Series E Preferred Stock ......................... — — — — (339) — (339)

Reduction due to the tax impact of Common Stock

option forfeitures ......................................................... — — (620) — — — (620)

Net income .................................................................... — — — — 53,806 — 53,806

Unrealized losses on available-for-sale securities, net

of tax ............................................................................ — — — — — (1,211) (1,211)

Unrealized gains on cash flow hedging derivatives,

net of tax ...................................................................... — — — — — 1,959 1,959

Reclassification adjustment for gains included in net

income, net of tax ........................................................ — — — — — (1,307) (1,307)

BALANCE, December 31, 2006................................. 157,052,097 $ 16 $ 166,315 $ — $ 245,690 $ 1,224 $ 413,245

Common Stock issued................................................... 31,230 — 354 — — — 354

Exercise of Common Stock options.............................. 2,562,056 — 9,706 — — — 9,706

Issuance of Common Stock through initial public

offering, net of issuance costs ..................................... 37,500,000 4 818,262 — — — 818,266

Conversion of Series D Preferred Stock ....................... 144,857,320 14 449,999 — — — 450,013

Conversion of Series E Preferred Stock ....................... 6,105,324 1 52,170 — — — 52,171

Stock-based compensation............................................ — — 28,024 — — — 28,024

Accrued dividends on Series D Preferred Stock........... — — — — (6,499) — (6,499)

Accrued dividends on Series E Preferred Stock ........... — — — — (929) — (929)

Accretion on Series D Preferred Stock ......................... — — — — (148) — (148)

Accretion on Series E Preferred Stock ......................... — — — — (106) — (106)

Reduction due to the tax impact of Common Stock

option forfeitures ......................................................... — — (61) — — — (61)

Net income .................................................................... — — — — 100,403 — 100,403

Unrealized gains on available-for-sale securities, net

of tax ............................................................................ — — — — — 6,640 6,640

Unrealized losses on cash flow hedging derivatives,

net of tax ...................................................................... — — — — — (13,614) (13,614)

Reclassification adjustment for gains included in net

income, net of tax ........................................................ — — — — — (8,719) (8,719)

BALANCE, December 31, 2007................................. 348,108,027 $ 35 $1,524,769 $ — $ 338,411 $ (14,469) $1,848,746

The accompanying notes are an integral part of these consolidated financial statements.