Metro PCS 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-26

stock, or a combination of cash and common stock. The 2008 Remuneration Plan provides that each non-employee

director’s annual retainer and meeting fees will be paid in cash and each director will receive options to purchase

common stock. In accordance with the 2008 Remuneration Plan, no shares of common stock were issued to non-

employee members of the Board of Directors during the year ended December 31, 2008. During the years ended

December 31, 2007 and 2006, non-employee members of the Board of Directors were issued 31,230 and

49,725 shares of common stock, respectively, as payment of their annual retainer.

Stockholder Rights Plan

On March 27, 2007, in connection with the Offering, the Company adopted a Stockholder Rights Plan. Under the

Stockholder Rights Plan, each share of the Company’s common stock includes one right to purchase one one-

thousandth of a share of series A junior participating preferred stock. The rights will separate from the common

stock and become exercisable (1) ten calendar days after public announcement that a person or group of affiliated or

associated persons has acquired, or obtained the right to acquire, beneficial ownership of 15% of the Company’s

outstanding common stock or (2) ten business days following the start of a tender offer or exchange offer that would

result in a person’s acquiring beneficial ownership of 15% or more of the Company’s outstanding common stock. A

beneficial owner holding 15% or more of MetroPCS’ common stock is referred to as an “acquiring person” under

the Stockholder Rights Plan.

Initial Public Offering

On April 24, 2007, upon consummation of the Offering, the Company’s Third Amended and Restated Certificate

of Incorporation (the “Restated Certificate”), as filed with the Delaware Secretary of State, became effective. The

Restated Certificate provides for two classes of capital stock to be designated, respectively, Common Stock and

Preferred Stock. The total number of shares which the Company is authorized to issue is 1,100,000,000 shares.

1,000,000,000 shares are Common Stock, par value $0.0001 per share, and 100,000,000 shares are Preferred Stock,

par value $0.0001 per share. The Restated Certificate does not distinguish classes of common stock or preferred

stock.

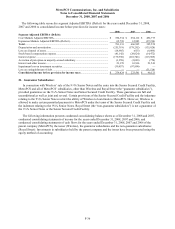

16. Share-Based Payments:

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS No. 123(R) using

the modified prospective transition method. Under that transition method, compensation expense recognized

beginning on that date includes: (a) compensation expense for all share-based payments granted prior to, but not yet

vested as of, January 1, 2006, based on the grant-date fair value estimated in accordance with the original provisions

of SFAS No. 123, and (b) compensation expense for all share-based payments granted on or after January 1, 2006,

based on the grant-date fair value estimated in accordance with the provisions of SFAS No. 123(R). Although there

was no material impact on the Company’s financial position, results of operations or cash flows from the adoption of

SFAS No. 123(R), the Company reclassified all deferred equity compensation on the consolidated balance sheet to

additional paid-in capital upon its adoption.

MetroPCS has two stock option plans (the “Option Plans”) under which it grants options to purchase common

stock of MetroPCS: the Second Amended and Restated 1995 Stock Option Plan, as amended (“1995 Plan”), and the

Amended and Restated 2004 Equity Incentive Compensation Plan (“2004 Plan”). The 1995 Plan was terminated in

November 2005 and no further awards can be made under the 1995 Plan, but all options previously granted will

remain valid in accordance with their original terms. In February 2007, the 2004 Plan was amended to increase the

number of shares of common stock reserved for issuance under the plan from 18,600,000 to a total of

40,500,000 shares. As of December 31, 2008, the maximum number of shares reserved for the 2004 Plan was

40,500,000 shares. Vesting periods and terms for stock option grants are determined by the plan administrator,

which is MetroPCS’ Board of Directors for the 1995 Plan and the Compensation Committee of the Board of

Directors of MetroPCS for the 2004 Plan. No option granted under the 1995 Plan has a term in excess of fifteen

years and no option granted under the 2004 Plan shall have a term in excess of ten years. Options granted during the

years ended December 31, 2008, 2007 and 2006 have a vesting period of one to four years.