Metro PCS 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-17

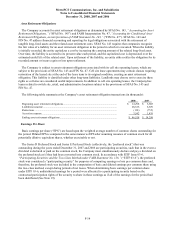

credit and capital markets, the auction rate securities held by the Company at December 31, 2008 continued to

experience failed auctions as the amount of securities submitted for sale in the auctions exceeded the amount of

purchase orders. In addition, all of the auction rate securities held by the Company have been downgraded or placed

on credit watch.

The estimated market value of the Company's auction rate security holdings at December 31, 2008 was

approximately $6.0 million, which reflects a $127.9 million cumulative adjustment to the original principal value of

$133.9 million. The estimated market value at December 31, 2007 was approximately $36.1 million, which

reflected a $97.8 million adjustment to the aggregate principal value at that date. Although the auction rate

securities continue to pay interest according to their stated terms, based on valuation models that rely exclusively on

unobservable inputs, the Company recorded an impairment charge of $30.9 million during the year ended December

31, 2008, reflecting an additional portion of the auction rate security holdings that the Company has concluded have

an other-than-temporary decline in value. The offsetting increase in fair value of approximately $0.8 million is

reported in accumulated other comprehensive loss in the consolidated balance sheets.

Historically, given the liquidity created by auctions, the Company’s auction rate securities were presented as

current assets under short-term investments on the Company's balance sheet. Given the failed auctions, the

Company's auction rate securities are illiquid until there is a successful auction for them or the Company sells them.

Accordingly, the entire amount of such remaining auction rate securities has been reclassified from current to non-

current assets and is presented in long-term investments on the accompanying balance sheets as of December 31,

2008 and 2007. The Company may incur additional impairments to its auction rate securities.

6. Derivative Instruments and Hedging Activities:

On November 21, 2006, Wireless entered into a three-year interest rate protection agreement to manage the

Company’s interest rate risk exposure and fulfill a requirement of Wireless’ Senior Secured Credit Facility. The

agreement covers a notional amount of $1.0 billion and effectively converts this portion of Wireless’ variable rate

debt to fixed-rate debt at an annual rate of 7.169%. The quarterly interest settlement periods began on February 1,

2007. The interest rate protection agreement expires on February 1, 2010. This financial instrument is reported in

other long-term liabilities at fair market value of approximately $38.8 million as of December 31, 2008. The net

change in fair value of $15.3 million is reported in accumulated other comprehensive loss in the consolidated

balance sheets, net of income taxes in the amount of approximately $5.9 million. As of December 31, 2007, this

financial instrument was reported in other long-term liabilities at fair market value of approximately $23.5 million.

The net change in fair value of $13.6 million was reported in accumulated other comprehensive loss in the

consolidated balance sheets, net of income taxes in the amount of approximately $9.9 million.

On April 30, 2008, Wireless entered into an additional two-year interest rate protection agreement to manage the

Company’s interest rate risk exposure. The agreement was effective on June 30, 2008 and covers a notional amount

of $500.0 million and effectively converts this portion of Wireless’ variable rate debt to fixed rate debt at an annual

rate of 5.464%. The monthly interest settlement periods began on June 30, 2008. This agreement expires on June

30, 2010. This financial instrument is reported in other long-term liabilities at fair market value of approximately

$16.2 million as of December 31, 2008. The net change in fair value of $16.2 million is reported in accumulated

other comprehensive loss in the accompanying consolidated balance sheet, net of income taxes in the amount of

approximately $6.5 million.

The interest rate protection agreements have been designated as cash flow hedges. If a derivative is designated as

a cash flow hedge and the hedging relationship qualifies for hedge accounting under the provisions of

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended (“SFAS No. 133”),

the effective portion of the change in fair value of the derivative is recorded in accumulated other comprehensive

income (loss) and reclassified to interest expense in the period in which the hedged transaction affects earnings. The

ineffective portion of the change in fair value of a derivative qualifying for hedge accounting is recognized in

earnings in the period of the change. For the year ended December 31, 2008, the change in fair value did not result

in ineffectiveness.