Metro PCS 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-8

Notes to Consolidated Financial Statements

1. Organization and Business Operations:

MetroPCS Communications, Inc. (“MetroPCS”), a Delaware corporation, together with its consolidated

subsidiaries (the “Company”), is a wireless telecommunications carrier that offers wireless broadband mobile

services. As of December 31, 2008, the Company offered services primarily in the metropolitan areas of Atlanta,

Dallas/Ft. Worth, Detroit, Las Vegas, Los Angeles, Miami, Orlando/Jacksonville, Philadelphia, San Francisco,

Sacramento and Tampa/Sarasota. In February 2009, the Company launched service in the Boston and New York

metropolitan areas. The Company sells products and services to customers through Company-owned retail stores as

well as through relationships with independent retailers.

On November 24, 2004, MetroPCS, through its wholly-owned subsidiaries, and C9 Wireless, LLC, an

independent third-party, formed a limited liability company called Royal Street Communications, LLC (“Royal

Street Communications”), to bid on spectrum auctioned by the FCC in Auction 58. The Company owns 85% of the

limited liability company member interest of Royal Street Communications, but may only elect two of the five

members of Royal Street Communications’ management committee (See Note 4). The consolidated financial

statements include the balances and results of operations of MetroPCS and its wholly-owned subsidiaries as well as

the balances and results of operations of Royal Street Communications and its wholly-owned subsidiaries

(collectively, “Royal Street”). The Company consolidates its interest in Royal Street in accordance with Financial

Accounting Standards Board (“FASB”) Interpretation No. 46-R, “Consolidation of Variable Interest Entities,”

(“FIN 46(R)”). Royal Street qualifies as a variable interest entity under FIN 46(R) because the Company is the

primary beneficiary of Royal Street and will absorb all of Royal Street’s expected losses. The redeemable minority

interest in Royal Street is included in long-term liabilities. All intercompany accounts and transactions between the

Company and Royal Street have been eliminated in the consolidated financial statements.

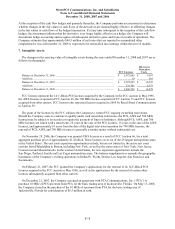

On March 14, 2007, the Company’s Board of Directors approved a 3 for 1 stock split of the Company’s common

stock effected by means of a stock dividend of two shares of common stock for each share of common stock issued

and outstanding on that date. All share, per share and conversion amounts relating to common stock and stock

options included in the accompanying consolidated financial statements have been retroactively adjusted to reflect

the stock split.

On April 24, 2007, MetroPCS consummated its initial public offering (the “Offering”) of 57,500,000 shares of

common stock priced at $23.00 per share (less underwriting discounts and commissions). MetroPCS offered

37,500,000 shares of common stock and certain of MetroPCS’ existing stockholders offered 20,000,000 shares of

common stock in the Offering, which included 7,500,000 shares sold by MetroPCS’ existing stockholders pursuant

to the underwriters’ exercise of their over-allotment option. Concurrent with the Offering, all outstanding shares of

preferred stock, including accrued but unpaid dividends, were converted into 150,962,644 shares of common stock.

The shares began trading on April 19, 2007 on the New York Stock Exchange under the symbol “PCS.”

2. Summary of Significant Accounting Policies:

Consolidation

The accompanying consolidated financial statements include the balances and results of operations of MetroPCS

and its wholly- and majority-owned subsidiaries. All intercompany balances and transactions have been eliminated

in consolidation.