Metro PCS 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

F-6

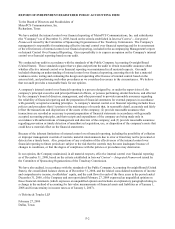

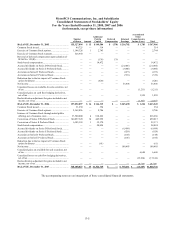

MetroPCS Communications, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity — (Continued)

For the Years Ended December 31, 2008, 2007 and 2006

(in thousands, except share information)

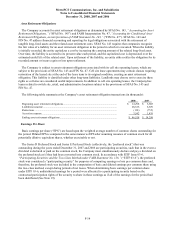

Number

of Shares Amount

Additional

Paid-In

Capital

Deferred

Compensation

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss) Total

Exercise of Common Stock options ...... 2,810,245 — 12,582 — — — 12,582

Stock-based compensation expense....... — — 41,454 — — — 41,454

Tax impact of Common Stock option

exercises and forfeitures....................... — — 167 — — — 167

Net income ............................................. — — — — 149,438 — 149,438

Unrealized gains on available-for-sale

securities, net of tax.............................. — — — — — 830 830

Unrealized losses on cash flow

hedging derivatives, net of tax ............. — — — — — (30,438) (30,438)

Reclassification adjustment for losses

included in net income, net of tax ........ — — — — — 11,544 11,544

BALANCE, December 31, 2008 ......... 350,918,272 $ 35 $ 1,578,972 $ — $ 487,849 $ (32,533) $ 2,034,323

The accompanying notes are an integral part of these consolidated financial statements.