Metro PCS 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-18

At the inception of the cash flow hedges and quarterly thereafter, the Company performs an assessment to determine

whether changes in the fair values or cash flows of the derivatives are deemed highly effective in offsetting changes

in the fair values or cash flows of the hedged transaction. If at any time subsequent to the inception of the cash flow

hedges, the assessment indicates that the derivative is no longer highly effective as a hedge, the Company will

discontinue hedge accounting and recognize all subsequent derivative gains and losses in results of operations. The

Company estimates that approximately $44.5 million of net losses that are reported in accumulated other

comprehensive loss at December 31, 2008 is expected to be reclassified into earnings within the next 12 months.

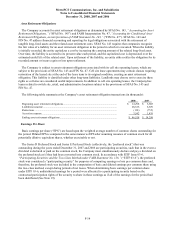

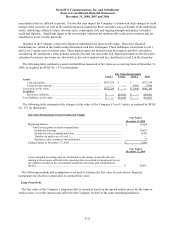

7. Intangible Assets:

The changes in the carrying value of intangible assets during the years ended December 31, 2008 and 2007 are as

follows (in thousands):

FCC Licenses

Microwave

Relocation

Costs

Balance at December 31, 2006 ....................................................................................... $ 2,072,885 $ 9,187

Additions ........................................................................................................................ 10 918

Balance at December 31, 2007 ....................................................................................... $ 2,072,895 $ 10,105

Additions ........................................................................................................................ 333,701 6,373

Balance at December 31, 2008 ....................................................................................... $ 2,406,596 $ 16,478

FCC licenses represent the 14 C-Block PCS licenses acquired by the Company in the FCC auction in May 1996,

the AWS licenses acquired in FCC Auction 66, the 700 MHz license acquired in FCC Auction 73 and FCC licenses

acquired from other carriers. FCC licenses also represent licenses acquired in 2005 by Royal Street Communications

in Auction 58.

The grant of the licenses by the FCC subjects the Company to certain FCC ongoing ownership restrictions.

Should the Company cease to continue to qualify under such ownership restrictions, the PCS, AWS and 700 MHz

licenses may be subject to revocation or require the payment of fines or forfeitures. Although PCS, AWS, and 700

MHz licenses are issued with a stated term, 10 years in the case of the PCS licenses, 15 years in the case of the AWS

licenses, and approximately 10 years from the date of the digital television transition for 700 MHz licenses, the

renewal of PCS, AWS, and 700 MHz licenses is generally a routine matter without substantial cost.

On November 29, 2006, the Company was granted AWS licenses as a result of FCC Auction 66, for a total

aggregate purchase price of approximately $1.4 billion. These licenses cover six of the 25 largest metropolitan areas

in the United States. The east coast expansion opportunities include, but are not limited to, the entire east coast

corridor from Philadelphia to Boston, including New York, as well as the entire states of New York, New Jersey,

Connecticut and Massachusetts. In the western United States, the new expansion opportunities include the

San Diego, Portland, Seattle and Las Vegas metropolitan areas. The balance supplements or expands the geographic

boundaries of the Company’s existing operations in Dallas/Ft. Worth, Detroit, Los Angeles, San Francisco and

Sacramento.

On February 21, 2007, the FCC granted the Company’s applications for the renewal of its 14 C-Block PCS

licenses acquired in the FCC auction in May 1996, as well as the applications for the renewal of certain other

licenses subsequently acquired from other carriers.

On December 21, 2007, the Company executed an agreement with PTA Communications, Inc. (“PTA”) to

purchase 10 MHz of PCS spectrum from PTA for the basic trading area of Jacksonville, Florida. On May 13, 2008,

the Company closed on the purchase of the 10 MHz of spectrum from PTA for the basic trading area of

Jacksonville, Florida for consideration of $6.5 million in cash.