Metro PCS 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

CPU to cost of service, which we consider to be the most directly comparable GAAP financial measure to CPU.

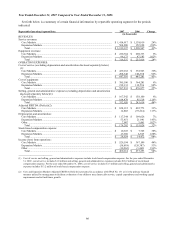

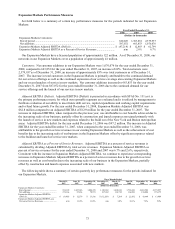

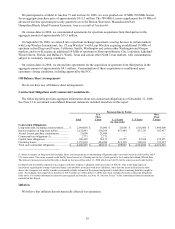

Year Ended December 31,

2006 2007 2008

(In thousands, except average number of customers and

CPU)

Calculation of Cost Per User (CPU):

Cost of service ........................................................................................ $ 445,281 $ 647,510 $ 857,295

Add: General and administrative expenses .......................................... 138,998 198,955 235,289

Add: Net loss on equipment transactions unrelated to initial

customer acquisition............................................................................ 41,538 49,331 95,282

Less: Stock-based compensation expense included in cost of

service and general and administrative expense .................................. (14,472) (28,024) (41,142)

Less: Pass through charges .................................................................. (45,640) (95,946) (136,801)

Total costs used in the calculation of CPU ............................................. $ 565,705 $ 771,826 $ 1,009,923

Divided by: Average number of customers ............................................ 2,398,682 3,508,497 4,631,168

CPU ........................................................................................................ $ 19.65 $ 18.33 $ 18.17

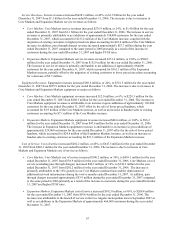

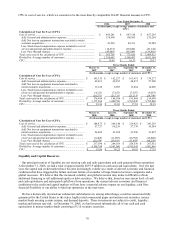

Three Months Ended

March 31,

2007

June 30,

2007

September 30,

2007

December 31,

2007

(In thousands, except average number of customers and CPU)

Calculation of Cost Per User (CPU):

Cost of service ......................................................................... $ 145,335 $ 162,227 $ 163,671 $ 176,277

Add: General and administrative expenses ........................... 42,831 49,352 48,871 57,900

Add: Net loss on equipment transactions unrelated to

initial customer acquisition................................................... 13,160 9,903 11,664 14,606

Less: Stock-based compensation expense included in cost

of service and general and administrative expense............... (4,211) (7,653) (7,107) (9,053)

Less: Pass through charges ................................................... (20,271) (25,721) (25,215) (24,740)

Total costs used in the calculation of CPU .............................. $ 176,844 $ 188,108 $ 191,884 $ 214,990

Divided by: Average number of customers ............................. 3,175,284 3,480,780 3,592,045 3,785,880

CPU ......................................................................................... $ 18.56 $ 18.01 $ 17.81 $ 18.93

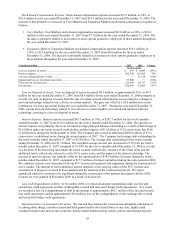

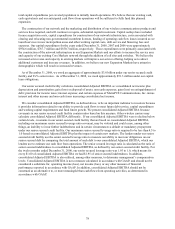

Three Months Ended

March 31,

2008

June 30,

2008

September 30,

2008

December 31,

2008

(In thousands, except average number of customers and CPU)

Calculation of Cost Per User (CPU):

Cost of service ......................................................................... $ 188,473 $ 206,140 $ 219,423 $ 243,259

Add: General and administrative expenses ........................... 57,727 60,239 57,738 59,584

Add: Net loss on equipment transactions unrelated to

initial customer acquisition................................................... 26,409 21,380 23,596 23,897

Less: Stock-based compensation expense included in cost

of service and general and administrative expense............... (8,465) (11,007) (10,782) (10,888)

Less: Pass through charges ................................................... (26,554) (30,583) (31,445) (48,220)

Total costs used in the calculation of CPU .............................. $ 237,590 $ 246,169 $ 258,530 $ 267,632

Divided by: Average number of customers ............................. 4,198,794 4,501,980 4,741,043 5,082,856

CPU ......................................................................................... $ 18.86 $ 18.23 $ 18.18 $ 17.55

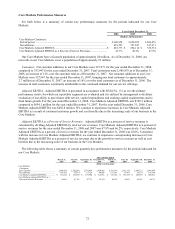

Liquidity and Capital Resources

Our principal sources of liquidity are our existing cash and cash equivalents and cash generated from operations.

At December 31, 2008, we had a total of approximately $697.9 million in cash and cash equivalents. Over the last

year, the capital and credit markets have become increasingly volatile as a result of adverse economic and financial

conditions that have triggered the failure and near failure of a number of large financial services companies and a

global recession. We believe that this increased volatility and global recession may make it difficult to obtain

additional financing or sell additional equity or debt securities. We believe that, based on our current level of cash

and cash equivalents and anticipated cash flows from operations, the current adverse economic and financial

conditions in the credit and capital markets will not have a material adverse impact on our liquidity, cash flow,

financial flexibility or our ability to fund our operations in the near-term.

We have historically invested our substantial cash balances in, among other things, securities issued and fully

guaranteed by the United States or the states, highly rated commercial paper and auction rate securities, money

market funds meeting certain criteria, and demand deposits. These investments are subject to credit, liquidity,

market and interest rate risk. At December 31, 2008, we had invested substantially all of our cash and cash

equivalents in money market funds consisting of U.S. treasury securities.