Metro PCS 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

9¼% Senior Notes Due 2014

On November 3, 2006, Wireless consummated the sale of $1.0 billion principal amount of its initial senior notes.

On June 6, 2007, Wireless consummated the sale of an additional $400.0 million principal amount of additional

notes. The initial senior notes and the additional notes are referred to together as the 9¼% senior notes. The

9¼% senior notes are unsecured obligations and are guaranteed by MetroPCS Communications, Inc., MetroPCS,

Inc., and all of Wireless direct and indirect wholly-owned domestic restricted subsidiaries, but are not guaranteed by

Royal Street. Interest is payable on the initial senior notes on May 1 and November 1 of each year, beginning with

May 1, 2007, with respect to the initial senior notes, and beginning on November 1, 2007 with respect to the

additional notes. Wireless may, at its option, redeem some or all of the 9¼% senior notes at any time on or after

November 1, 2010 for the redemption prices set forth in the indenture governing the 9¼% senior notes. In addition,

Wireless may also redeem up to 35% of the aggregate principal amount of the 9¼% senior notes with the net cash

proceeds of certain sales of equity securities, including the sale of common stock.

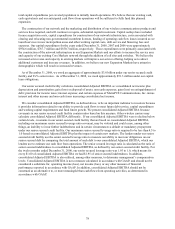

On January 14, 2009, Wireless completed the sale of the new notes at a price equal to 89.50% of the principal

amount of such new notes. On January 20, 2009, Wireless consummated the sale of the new notes resulting in net

proceeds of $480.5 million. The net proceeds from the sale of the new notes will be used for general corporate

purposes which could include working capital, capital expenditures, future liquidity needs, additional opportunistic

spectrum acquisitions, corporate development opportunities and future technology initiatives. The new notes are

unsecured obligations and are guaranteed by MetroPCS, MetroPCS, Inc., and all of Wireless’ direct and indirect

wholly-owned subsidiaries, but are not guaranteed by Royal Street. Interest is payable on the new notes on May 1

and November 1 of each year, beginning on May 1, 2009.

Capital Lease Obligations

We have entered into various non-cancelable DAS capital lease agreements, with expirations through 2024,

covering dedicated optical fiber. Assets and future obligations related to capital leases are included in the

accompanying consolidated balance sheet in property and equipment and long-term debt, respectively. Depreciation

of assets held under capital lease obligations is included in depreciation and amortization expense.

Capital Expenditures and Other Asset Acquisitions and Dispositions

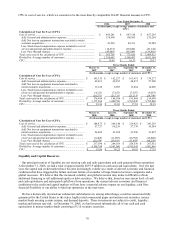

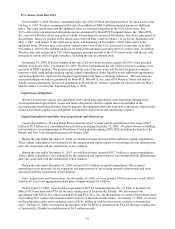

Capital Expenditures. We and Royal Street currently expect to incur capital expenditures in the range of $0.7

billion to $0.9 billion on a consolidated basis for the year ending December 31, 2009. We plan to focus on building

out networks to cover approximately 40 million of total population during 2009-2010, including the launch of the

Boston and New York metropolitan areas in February 2009.

During the year ended December 31, 2008, we and Royal Street incurred $954.6 million in capital expenditures.

These capital expenditures were primarily for the expansion and improvement of our existing network infrastructure

and costs associated with the construction of new markets.

During the year ended December 31, 2007, we and Royal Street incurred $767.7 million in capital expenditures.

These capital expenditures were primarily for the expansion and improvement of our existing network infrastructure

and costs associated with the construction of new markets.

During the year ended December 31, 2006, we had $550.7 million in capital expenditures. These capital

expenditures were primarily for the expansion and improvement of our existing network infrastructure and costs

associated with the construction of new markets.

Other Acquisitions and Dispositions. On November 29, 2006, we were granted AWS licenses as a result of FCC

Auction 66, for a total aggregate purchase price of approximately $1.4 billion.

On December 21, 2007, we executed an agreement with PTA Communications, Inc., or PTA, to purchase 10

MHz of PCS spectrum from PTA for the basic trading area of Jacksonville, Florida. We also entered into

agreements with NTCH, Inc. (dba Cleartalk PCS) and PTA-FLA, Inc. for the purchase of certain of their assets used

in providing PCS wireless telecommunications services in the Jacksonville market. On January 17, 2008, we closed

on the acquisition of the assets and paid a total of $18.6 million in cash for these assets, exclusive of transaction

costs. On May 13, 2008, we closed on the purchase of the 10 MHz of spectrum from PTA for the basic trading area

of Jacksonville, Florida for consideration of $6.5 million in cash.