Metro PCS 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-16

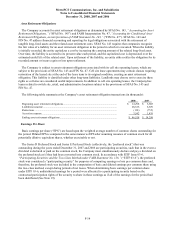

3. Acquisitions:

On December 21, 2007, the Company executed an agreement with PTA Communications, Inc. (“PTA”) to

purchase 10 MHz of PCS spectrum from PTA for the basic trading area of Jacksonville, Florida. The Company also

entered into agreements with NTCH, Inc. (dba Cleartalk PCS) and PTA-FLA, Inc. for the purchase of certain of

their assets used in providing PCS wireless telecommunications services in the Jacksonville market. On January 17,

2008, the Company closed on the acquisition of the assets and paid a total of $18.6 million in cash for these assets,

exclusive of transaction costs. On May 13, 2008, the Company closed on the purchase of the 10 MHz of spectrum

from PTA for the basic trading area of Jacksonville, Florida for consideration of $6.5 million in cash.

4. Majority-Owned Subsidiary:

On November 24, 2004, MetroPCS, through its wholly-owned subsidiaries, together with C9 Wireless, LLC, an

independent, unaffiliated third-party, formed a limited liability company, Royal Street Communications, that

qualified to bid for closed licenses and to receive bidding credits as a very small business DE on open licenses in

FCC Auction 58. MetroPCS indirectly owns 85% of the limited liability company member interest of Royal Street

Communications, but may elect only two of five members of the Royal Street Communications’ management

committee, which has the full power to direct the management of Royal Street. Royal Street Communications has

formed limited liability company subsidiaries which hold all licenses won in Auction 58. At Royal Street’s request

and subject to Royal Street’s control and direction, MetroPCS assisted or is assisting in the construction of Royal

Street’s networks and has agreed to purchase, via a resale arrangement, as much as 85% of the engineered service

capacity of Royal Street’s networks. The Company’s consolidated financial statements include the balances and

results of operations of MetroPCS and its wholly-owned subsidiaries as well as the balances and results of

operations of Royal Street. The Company consolidates its interest in Royal Street in accordance with FIN 46(R).

Royal Street qualifies as a variable interest entity under FIN 46(R) because the Company is the primary beneficiary

of Royal Street and will absorb all of Royal Street’s expected losses. Royal Street does not guarantee MetroPCS

Wireless, Inc.’s (“Wireless”) obligations under its senior secured credit facility, pursuant to which Wireless may

borrow up to $1.7 billion, as amended, (the “Senior Secured Credit Facility”) and its $1.4 billion of 9¼% Senior

Notes due 2014 (the “9¼% Senior Notes”). See the “non-guarantor subsidiaries” information in Note 21 for the

financial position and results of operations of Royal Street. C9 Wireless, LLC, a beneficial interest holder in Royal

Street, has no recourse to the general credit of MetroPCS. All intercompany accounts and transactions between the

Company and Royal Street have been eliminated in the consolidated financial statements.

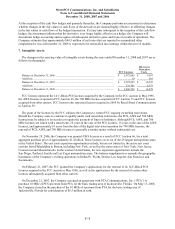

C9 Wireless, LLC has a right to sell, or put, its limited liability company interests in Royal Street

Communications to the Company at specific future dates based on a contractually determined amount (the “Put

Right”). The Put Right represents an unconditional obligation of MetroPCS and its wholly-owned subsidiaries to

purchase from C9 Wireless, LLC its limited liability company interests in Royal Street Communications. In

accordance with SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both

Liabilities and Equity,” this obligation is recorded as a liability and is measured at each reporting date at the amount

of cash that would be required to settle the obligation under the contract terms if settlement occurred at the reporting

date.

5. Investments:

The Company has historically invested its substantial cash balances in, among other things, securities issued and

fully guaranteed by the United States or any state, highly rated commercial paper and auction rate securities, money

market funds meeting certain criteria, and demand deposits. These investments are subject to credit, liquidity,

market and interest rate risk. At December 31, 2008, the Company had invested substantially all of its cash and cash

equivalents in money market funds consisting of treasury securities.

During the year ended December 31, 2007, the Company made an original investment of $133.9 million in

principal in certain auction rate securities, substantially all of which are secured by collateralized debt obligations

with a portion of the underlying collateral being mortgage securities or related to mortgage securities. Consistent

with the Company’s investment policy guidelines, the auction rate securities investments held by the Company all

had AAA/Aaa credit ratings at the time of purchase. With the continuing liquidity issues experienced in the global