Metro PCS 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-46

Assets acquired under capital lease obligations were $92.9 million for the year-ended December 31, 2008.

On April 24, 2007, concurrent with the closing of the Offering, all outstanding shares of preferred stock,

including accrued but unpaid dividends, were converted into 150,962,644 shares of common stock.

See Note 2 for the non-cash increase in the Company’s asset retirement obligations.

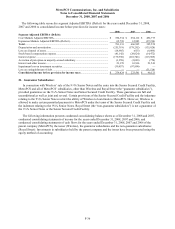

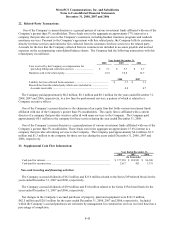

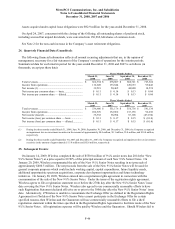

24. Quarterly Financial Data (Unaudited):

The following financial information reflects all normal recurring adjustments that are, in the opinion of

management, necessary for a fair statement of the Company’s results of operations for the interim periods.

Summarized data for each interim period for the years ended December 31, 2008 and 2007 is as follows (in

thousands, except per share data):

Three Months Ended

March 31,

2008

June 30,

2008

September 30,

2008

December 31,

2008

Total revenues .................................................................. $ 662,354 $ 678,807 $ 686,721 $ 723,634

Income from operations.................................................... 112,028 135,644 120,653 99,442

Net income (1).................................................................. 39,519 50,465 44,880 14,574

Net income per common share — basic ........................... $ 0.11 $ 0.14 $ 0.13 $ 0.04

Net income per common share — diluted ........................ $ 0.11 $ 0.14 $ 0.13 $ 0.04

Three Months Ended

March 31,

2007

June 30,

2007

September 30,

2007

December 31,

2007

Total revenues .................................................................. $ 536,686 $ 551,176 $ 556,738 $ 591,134

Income from operations.................................................... 102,676 132,062 133,138 92,238

Net income (loss)(2)......................................................... 36,352 58,094 53,108 (47,150)

Net income (loss) per common share — basic ................. $ 0.11 $ 0.17 $ 0.15 $ (0.14)

Net income (loss) per common share — diluted............... $ 0.11 $ 0.17 $ 0.15 $ (0.14)

_______________________________

(1) During the three months ended March 31, 2008, June 30, 2008, September 30, 2008, and December 31, 2008, the Company recognized

an impairment loss on investment securities in the amount of approximately $8.0 million, $9.1 million, $3.0 million, and $10.8 million,

respectively.

(2) During the three months ended September 30, 2007 and December 31, 2007, the Company recognized an impairment loss on investment

securities in the amount of approximately $ 15.0 million and $82.8 million, respectively.

25. Subsequent Events:

On January 14, 2009, Wireless completed the sale of $550.0 million of 9¼% senior notes due 2014 (the “New

9¼% Senior Notes”) at a price equal to 89.50% of the principal amount of such New 9¼% Senior Notes. On

January 20, 2009, Wireless consummated the sale of the New 9¼% Senior Notes resulting in net proceeds of

approximately $480.5 million. The net proceeds from the sale of the New 9¼% Senior Notes will be used for

general corporate purposes which could include working capital, capital expenditures, future liquidity needs,

additional opportunistic spectrum acquisitions, corporate development opportunities and future technology

initiatives. On January 20, 2009, Wireless entered into a registration rights agreement in connection with the

consummation of the sale of the New 9¼% Senior Notes. Under the terms of the registration rights agreement,

Wireless agrees to file a registration statement on or before the 270th day after the New 9¼% Senior Notes’ issue

date covering the New 9¼% Senior Notes. Wireless also agreed to use commercially reasonable efforts to have

such Registration Statement declared effective on or prior to the 300th day after the New 9¼% Senior Notes’ issue

date. Alternatively, if Wireless is unable to consummate the Exchange Offer (as defined in the Registration Rights

Agreement) or if holders of the New 9¼% Senior Notes cannot participate in the Exchange Offer for certain

specified reasons, then Wireless and the Guarantors will use commercially reasonable efforts to file a shelf

registration statement within the times specified in the Registration Rights Agreement to facilitate resale of the New

9¼% Senior Notes. All registration expenses will be paid by Wireless and the Guarantors. Should Wireless fail to