Metro PCS 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-34

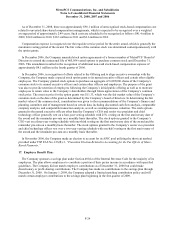

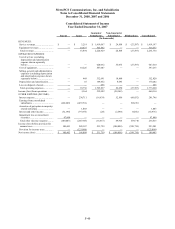

As of December 31, 2008, the Company had thirteen operating segments based on geographic region within the

United States: Atlanta, Boston, Dallas/Ft. Worth, Detroit, Las Vegas, Los Angeles, Miami, New York,

Orlando/Jacksonville, Philadelphia, Sacramento, San Francisco and Tampa/Sarasota. Each of these operating

segments provides wireless voice and data services and products to customers in its service areas or is currently

constructing a network in order to provide these services. These services include unlimited local and long distance

calling, voicemail, caller ID, call waiting, enhanced directory assistance, text messaging, picture and multimedia

messaging, domestic and international long distance, international text messaging, ringtones, games and content

applications, unlimited directory assistance, ring back tones, nationwide roaming, mobile Internet browsing, mobile

instant messaging, push e-mail, location based services, social networking services and other value-added services.

The Company aggregates its operating segments into two reportable segments: Core Markets and Expansion

Markets.

•Core Markets, which include Atlanta, Miami, Sacramento and San Francisco, are aggregated because they

are reviewed on an aggregate basis by the chief operating decision maker, they are similar in respect to their

products and services, production processes, class of customer, method of distribution, and regulatory

environment and currently exhibit similar financial performance and economic characteristics.

•Expansion Markets, which include Boston, Dallas/Ft. Worth, Detroit, Las Vegas, Los Angeles, New York,

Orlando/Jacksonville, Philadelphia and Tampa/Sarasota, are aggregated because they are reviewed on an

aggregate basis by the chief operating decision maker, they are similar in respect to their products and

services, production processes, class of customer, method of distribution, and regulatory environment and

have similar expected long-term financial performance and economic characteristics.

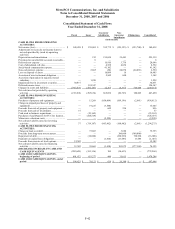

General corporate overhead, which includes expenses such as corporate employee labor costs, rent and utilities,

legal, accounting and auditing expenses, is allocated equally across all operating segments. Corporate marketing

and advertising expenses are allocated equally to the operating segments, beginning in the period during which the

Company launches service in that operating segment. Expenses associated with the Company’s national data center

and national operations center are allocated based on the average number of customers in each operating segment.

There are no transactions between reportable segments.

Interest and certain other expenses, interest income and income taxes are not allocated to the segments in the

computation of segment operating results for internal evaluation purposes.

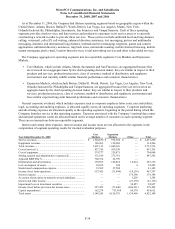

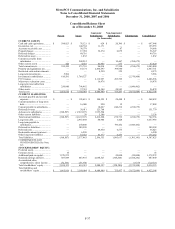

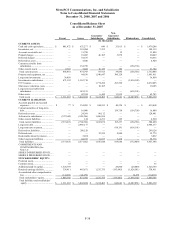

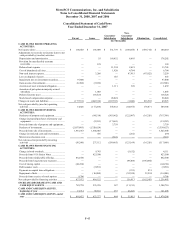

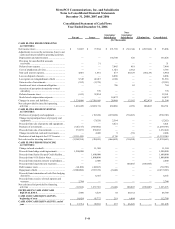

Year Ended December 31, 2008

Core

Markets

Expansion

Markets Other Total

Service revenues ....................................................................... $ 1,504,870 $ 932,380 $ — $ 2,437,250

Equipment revenues.................................................................. 186,263 128,003 — 314,266

Total revenues........................................................................... 1,691,133 1,060,383 — 2,751,516

Cost of service(1)...................................................................... 437,765 419,530 — 857,295

Cost of equipment..................................................................... 374,777 329,871 — 704,648

Selling, general and administrative expenses(2)....................... 171,819 275,763 — 447,582

Adjusted EBITDA(3)................................................................ 720,334 62,799 —

Depreciation and amortization.................................................. 130,695 106,410 18,214 255,319

Loss on disposal of assets ......................................................... 18,652 249 4 18,905

Stock-based compensation expense.......................................... 13,562 27,580 — 41,142

Income (loss) from operations .................................................. 557,425 (71,440) (18,218) 467,767

Interest expense ........................................................................ — — 179,398 179,398

Accretion of put option in majority-owned subsidiary.............. — — 1,258 1,258

Interest and other income.......................................................... — — (23,170) (23,170)

Impairment loss on investment securities ................................. — — 30,857 30,857

Income (loss) before provision for income taxes...................... 557,425 (71,440) (206,561) 279,424

Capital expenditures ................................................................. 162,274 731,968 60,370 954,612

Total assets ............................................................................... 1,140,205 4,126,975 1,154,968 6,422,148