Metro PCS 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

We participated as a bidder in Auction 73 and on June 26, 2008, we were granted one 12 MHz 700 MHz license

for an aggregate purchase price of approximately $313.3 million. The 700 MHz License supplements the 10 MHz of

advanced wireless spectrum previously granted to us in the Boston-Worcester, Massachusetts/New

Hampshire/Rhode Island/Vermont Economic Area as a result of Auction 66.

On various dates in 2008, we consummated agreements for spectrum acquisitions from third-parties in the

aggregate amount of approximately $15.3 million.

On September 26, 2008, we entered into a spectrum exchange agreement covering licenses in certain markets

with Leap Wireless International, Inc. (“Leap Wireless”) with Leap Wireless acquiring an additional 10 MHz of

spectrum in San Diego and Fresno, California; Seattle, Washington and certain other Washington and Oregon

markets, and we will acquire an additional 10 MHz of spectrum in Shreveport-Bossier City, Louisiana; Lakeland-

Winter Haven, Florida; and Dallas-Ft. Worth, Texas and certain other North Texas markets, with consummation

subject to customary closing conditions.

On various dates in 2008, we entered into agreements for the acquisition of spectrum from third parties in the

aggregate amount of approximately $8.3 million. Consummation of these acquisitions is conditioned upon

customary closing conditions, including approval by the FCC.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

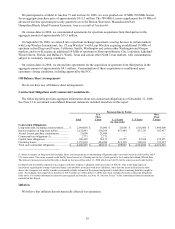

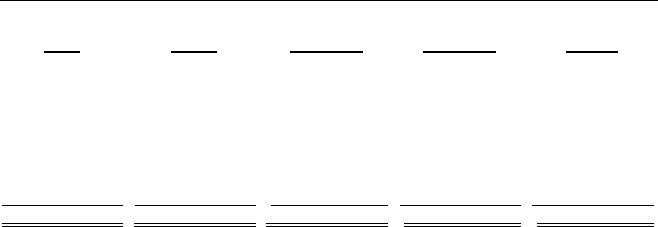

Contractual Obligations and Commercial Commitments

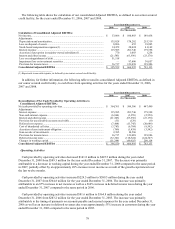

The following table provides aggregate information about our contractual obligations as of December 31, 2008.

See Note 12 to our annual consolidated financial statements included elsewhere in this report.

Payments Due by Period

Total

Less

Than

1 Year 1 - 3 Years 3 - 5 Years

More

Than

5 Years

(In thousands)

Contractual Obligations:

Long-term debt, including current portion........ $ 2,964,000 $ 16,000 $ 32,000 $ 1,516,000 $ 1,400,000

Interest expense on long-term debt(1) ............... 1,232,843 230,269 457,444 437,213 107,917

Alcatel Lucent purchase commitment............... 21,600 21,600 — — —

Contractual tax obligations (2) .......................... 2,773 2,773 — — —

Capital lease obligations ................................... 186,499 10,213 21,357 22,658 132,271

Operating leases................................................ 1,753,010 204,296 419,156 398,231 731,327

Total cash contractual obligations..................... $ 6,160,725 $ 485,151 $ 929,957 $ 2,374,102 $ 2,371,515

____________________________

(1) Interest expense on long-term debt includes future interest payments on outstanding obligations under our senior secured credit facility and 9

¼% senior notes. The senior secured credit facility bears interest at a floating rate tied to a fixed spread to the London Inter Bank Offered Rate.

The interest expense presented in this table is based on the rates at December 31, 2008 which was 6.443% for the senior secured credit facility.

(2) Represents the liability reported in accordance with the Company’s adoption of the provisions of FIN 48. Due to the high degree of

uncertainty regarding the timing of potential future cash outflows associated with these liabilities, other than the items included in the table

above, the Company was unable to make a reasonably reliable estimate of the amount and period in which these remaining liabilities might be

paid. Accordingly, unrecognized tax benefits of $16.6 million as of December 31, 2008, have been excluded from the contractual obligations

table above. For further information related to unrecognized tax benefits, see Note 18, “Income Taxes,” to the consolidated financial statements

included in this Report.

Inflation

We believe that inflation has not materially affected our operations.