Metro PCS 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

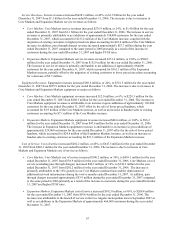

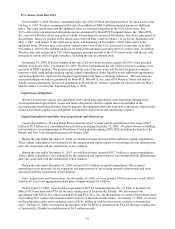

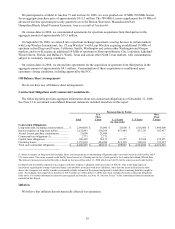

During the year ended December 31, 2007, we made an original investment of $133.9 million in principal in

certain auction rate securities, substantially all of which are secured by collateralized debt obligations with a portion

of the underlying collateral being mortgage securities or related to mortgage securities. Consistent with our

investment policy guidelines, the auction rate securities investments held by us all had AAA/Aaa credit ratings at the

time of purchase. With the continued liquidity issues experienced in global credit and capital markets, the auction

rate securities held by us at December 31, 2008 continue to experience failed auctions as the amount of securities

submitted for sale in the auctions exceeds the amount of purchase orders. In addition, all of the auction rate

securities held by us have been downgraded or placed on credit watch.

The estimated market value of our auction rate security holdings at December 31, 2008 was approximately $6.0

million, which reflects a $127.9 million cumulative adjustment to the original principal value of $133.9 million. The

estimated market value at December 31, 2007 was approximately $36.1 million, which reflected a $97.8 million

adjustment to the aggregate principal value at that date. Although the auction rate securities continue to pay interest

according to their stated terms, based on valuation models that rely exclusively on unobservable inputs, we recorded

an impairment charge of $30.9 million and $97.8 million during the years ended December 31, 2008 and 2007,

respectively, reflecting an additional portion of our auction rate security holdings that we have concluded have an

other-than-temporary decline in value. The offsetting increase in fair value of approximately $0.8 million is

reported in accumulated other comprehensive loss in the consolidated balance sheets.

Historically, given the liquidity created by auctions, our auction rate securities were presented as current assets

under short-term investments on our balance sheet. Given the failed auctions, our auction rate securities are illiquid

until there is a successful auction for them or we sell them. Accordingly, the entire amount of such remaining

auction rate securities has been reclassified from current to non-current assets and is presented in long-term

investments on our balance sheet as of December 31, 2008 and 2007. The $6.0 million estimated market value at

December 31, 2008 does not materially impact our liquidity and is not included in our approximately $697.9 million

in cash and cash equivalents as of December 31, 2008. We may incur additional impairments to our auction rate

securities which may be up to the full remaining value of such auction rate securities. Management believes that

any future additional impairment charges will not have a material effect on our liquidity.

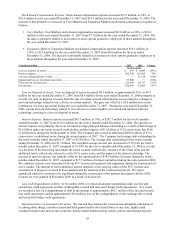

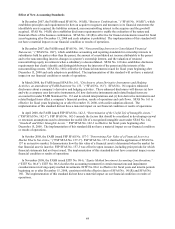

On April 24, 2007, MetroPCS Communications consummated an initial public offering of its common stock.

MetroPCS Communications sold 37,500,000 shares of common stock at a price per share of $23.00 (less

underwriting discounts and commissions), which resulted in net proceeds to MetroPCS Communications of

approximately $818.3 million. In addition, selling stockholders sold an aggregate of 20,000,000 shares of common

stock, including 7,500,000 shares sold pursuant to the exercise by the underwriters of their over-allotment option.

MetroPCS Communications did not receive any proceeds from the sale of shares of common stock by the selling

stockholders; however, MetroPCS Communications did receive proceeds of approximately $3.8 million from the

exercise of options to acquire common stock which was sold in the initial public offering. Concurrent with the initial

public offering by MetroPCS Communications, all outstanding shares of preferred stock of MetroPCS

Communications, including accrued but unpaid dividends as of April 23, 2007, were converted into

150,962,644 shares of common stock. On June 6, 2007, MetroPCS Wireless, Inc., or Wireless, consummated the

sale of the additional notes in the aggregate principal amount of $400.0 million. The proceeds from the sale of the

additional notes were approximately $421.0 million. On January 20, 2009, Wireless consummated the sale of

$550.0 million of 9¼% senior notes due 2014, or new notes. The net proceeds from the sale of the new notes was

approximately $480.5 million. The net proceeds will be used for general corporate purposes which could include

working capital, capital expenditures, future liquidity needs, additional opportunistic spectrum acquisitions,

corporate development opportunities and future technology initiatives.

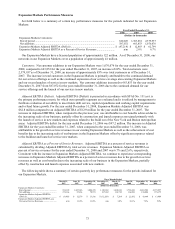

Our strategy has been to offer our services in major metropolitan areas and their surrounding areas, which we

refer to as clusters. We are seeking opportunities to enhance our current market clusters and to provide service in

new geographic areas. From time to time, we may purchase spectrum and related assets from third parties or the

FCC. As a result of the acquisition of spectrum licenses and the opportunities that these licenses provide for us to

expand our operations into major metropolitan markets, we will require significant additional capital in the future to

finance the construction and initial operating costs associated with such licenses. We generally do not intend to

commence the construction of any individual license area until we have sufficient funds available to provide for the

related construction and operating costs associated with such license area. We currently plan to focus on building

out networks to cover approximately 40 million of total population during 2009-2010 including the launch of the

Boston and New York metropolitan areas in February 2009. Our initial launch dates will be accomplished in phases

in the larger metropolitan areas. Our future builds will entail a more extensive use of distributed antenna systems, or

DAS, systems than we have deployed in the past. This, along with other factors, could result in an increase in the