Metro PCS 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-21

The interest rate on the outstanding debt under the Senior Secured Credit Facility is variable. The rate as of

December 31, 2008 was 6.443%. On November 21, 2006, Wireless entered into a three-year interest rate protection

agreement to manage the Company’s interest rate risk exposure and fulfill a requirement of the Senior Secured

Credit Facility. The agreement covers a notional amount of $1.0 billion and effectively converts this portion of

Wireless’ variable rate debt to fixed-rate debt at an annual rate of 7.169% (See Note 6). On February 20, 2007,

Wireless entered into an amendment to the Senior Secured Credit Facility. Under the amendment, the margin on the

base rate used to determine the Senior Secured Credit Facility interest rate was reduced to 2.25% from 2.50%. On

April 30, 2008, Wireless entered into an additional two-year interest rate protection agreement to manage the

Company’s interest rate risk exposure. This agreement was effective on June 30, 2008, covers a notional amount of

$500.0 million and effectively converts this portion of Wireless’ variable rate debt to fixed rate debt at an annual

rate of 5.464%.

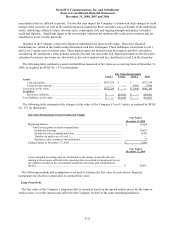

Capital Lease Obligations

The Company entered into various non-cancelable distributed antenna systems (“DAS”) capital lease agreements,

with varying expiration terms through 2024, covering dedicated optical fiber. Assets and future obligations related to

capital leases are included in the accompanying consolidated balance sheet in property and equipment and long-term

debt, respectively. Depreciation of assets held under capital leases is included in depreciation and amortization

expense. See Note 12.

10. Fair Value Measurements:

In the first quarter of 2008, the Company adopted the provisions of SFAS No. 157, “Fair Value Measurements,”

(“SFAS No. 157”) for financial assets and liabilities. SFAS No. 157 became effective for financial assets and

liabilities on January 1, 2008. SFAS No. 157 defines fair value, thereby eliminating inconsistencies in guidance

found in various prior accounting pronouncements, and increases disclosures surrounding fair value calculations.

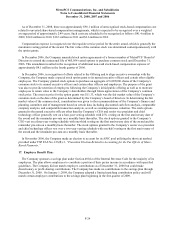

SFAS No. 157 establishes a three-tiered fair value hierarchy that prioritizes inputs to valuation techniques used

in fair value calculations. The three levels of inputs are defined as follows:

x Level 1 - Unadjusted quoted market prices for identical assets or liabilities in active markets that the

Company has the ability to access.

x Level 2 - Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or

similar assets or liabilities in inactive markets; or valuations based on models where the significant

inputs are observable (e.g., interest rates, yield curves, prepayment speeds, default rates, loss severities,

etc.) or can be corroborated by observable market data.

x Level 3 - Valuations based on models where significant inputs are not observable. The unobservable

inputs reflect the Company’s own assumptions about the assumptions that market participants would

use.

SFAS No. 157 requires the Company to maximize the use of observable inputs and minimize the use of

unobservable inputs. If a financial instrument uses inputs that fall in different levels of the hierarchy, the instrument

will be categorized based upon the lowest level of input that is significant to the fair value calculation. The

Company’s financial assets and liabilities measured at fair value on a recurring basis include long-term investments

securities and derivative financial instruments.

Included in the Company’s long-term investments securities are certain auction rate securities some of which are

secured by collateralized debt obligations with a portion of the underlying collateral being mortgage securities or

related to mortgage securities. Due to the lack of availability of observable market quotes on the Company’s

investment portfolio of auction rate securities, the fair value was estimated based on valuation models that rely

exclusively on unobservable Level 3 inputs including those that are based on expected cash flow streams and

collateral values, including assessments of counterparty credit quality, default risk underlying the security, discount

rates and overall capital market liquidity. The valuation of the Company’s investment portfolio is subject to