Metro PCS 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the lowest priced service plans supporting the BlackBerry in the U.S. wireless

market today.

We operate in a highly competitive industry that is growing and evolving quickly.

Awareness of unlimited wireless plans continues to grow and, early in 2008, the

national carriers introduced unlimited wireless plans, most of which were priced

at $99. We believe the introduction of the new national carrier unlimited plans as

a validation of our business model which results in increased customer

awareness of unlimited offerings and additional growth opportunity.

Voice traffic continues to go wireless. During the year, we saw residential wireline

access line losses by the largest national telephone companies in the 10%-12%

range. In early 2009, we conducted a study and found more than 90% of

MetroPCS customers use their MetroPCS phone as their primary phone, up from

approximately 85% in 2008. According to some studies, roughly 20% of wireline

access lines have been replaced/displaced with wireless services at the end of

2008. We believe that this trend will continue and that our unlimited, flat-rate

service provides a compelling value proposition, especially as families

increasingly “cut the cord.”

Maintaining cost discipline while expanding coverage and adding services to our

plans is critical to our continued success. Since the launch of our first markets in

2002, we have maintained a focus on efficient spending and cost control. I am

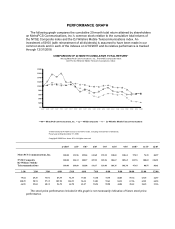

proud to report that for the third consecutive year our Core Markets Cost Per

user (CPU) decreased and was approximately $14 for the full year 2008, which is

more than 40% lower than the average CPU of the national wireless carriers.

Importantly we believe there is still opportunity to drive costs down further as we

gain additional economies of scale, which we believe, will continue to increase

our profitability. Since 2002, we have reported subscriber growth of at least 35%

for six years in a row. Importantly, we have achieved this overall growth while

maintaining high Adjusted EBITDA margins in our Core Markets.

Profitable growth is the cornerstone of our business. As we continue to grow, we

actively monitor and manage our Cost Per Gross Addition (CPGA). For the full

year 2008, we reported a consolidated CPGA of approximately $127 which was

less than half the average CPGA of the national wireless carriers. During the

fourth quarter of 2008, we took steps to improve our ARPU and we saw positive

results. Based upon our current pricing scenarios, we expect ARPU will stabilize

throughout 2009 in the low $40 range, which is consistent with our long-term

outlook guidance. We believe our plans still offer the most value to the customer.

With our unlimited service model and concentrated effort on managing costs to

maintain a low CPU and CPGA, we are proud to say that we have profitability

characteristics similar to the most profitable national wireless carrier in the

industry. Throughout 2008, we continued our aggressive customer acquisition

and, with our pay-in-advance model, we were able to avoid bad debt exposure