Metro PCS 2008 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

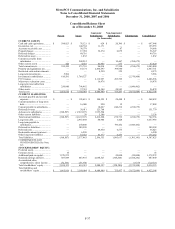

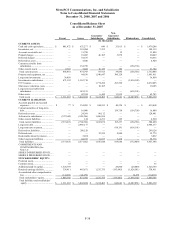

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2008, 2007 and 2006

F-44

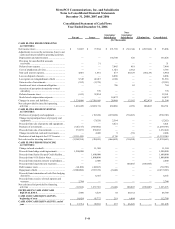

Consolidated Statement of Cash Flows

Year Ended December 31, 2006

Parent Issuer

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Elimination Consolidated

(In Thousands)

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income (loss) .................................................. $ 53,807 $ 77,504 $ 271,709 $ (56,914) $ (292,300) $ 53,806

Adjustments to reconcile net income (loss) to net

cash (used in) provided by operating activities:

Depreciation and amortization............................. — — 134,708 320 — 135,028

Provision for uncollectible accounts

receivable ........................................................... — 31 — — — 31

Deferred rent expense .......................................... — — 7,045 419 — 7,464

Cost of abandoned cell sites................................. — — 1,421 2,362 — 3,783

Non-cash interest expense.................................... 4,810 1,681 473 40,129 (40,129) 6,964

Loss on disposal of assets .................................... — — 8,806 — — 8,806

Loss (gain) on extinguishment of debt ................ 9,345 42,415 (242) — — 51,518

Gain on sale of investments ................................. (815) (1,570) — — — (2,385)

Accretion of asset retirement obligation.............. — — 706 63 — 769

Accretion of put option in majority-owned

subsidiary ........................................................... — 770 — — — 770

Deferred income taxes ......................................... (613) 32,954 — — — 32,341

Stock-based compensation expense..................... — — 14,472 — — 14,472

Changes in assets and liabilities............................ 1,334,686 (1,758,916) 29,988 13,162 432,474 51,394

Net cash provided by (used in) operating

activities .............................................................. 1,401,220 (1,605,131) 469,086 (459) 100,045 364,761

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of property and equipment.................. — (19,326) (472,020) (59,403) — (550,749)

Change in prepaid purchases of property and

equipment........................................................... — (7,826) 2,564 — — (5,262)

Proceeds from sale of property and equipment ... — — 3,021 — — 3,021

Purchase of investments....................................... (326,517) (943,402) — — — (1,269,919)

Proceeds from sale of investments....................... 333,159 939,265 — — — 1,272,424

Change in restricted cash and investments .......... — 2,448 9 (51) — 2,406

Purchases of and deposits for FCC licenses ........ (1,391,410) — (176) — — (1,391,586)

Net cash used in investing activities ..................... (1,384,768) (28,841) (466,602) (59,454) — (1,939,665)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Change in book overdraft..................................... — 11,368 — — — 11,368

Proceeds from bridge credit agreements.............. 1,500,000 — — — — 1,500,000

Proceeds from Senior Secured Credit Facility..... — 1,600,000 — — — 1,600,000

Proceeds from 9¼% Senior Notes ....................... — 1,000,000 — — — 1,000,000

Proceeds from minority interest in subsidiary ..... — 2,000 — — — 2,000

Proceeds from long-term note to parent .............. — — — 100,045 (100,045) —

Debt issuance costs .............................................. (14,106) (44,683) — — — (58,789)

Repayment of debt ............................................... (1,500,000) (935,539) (2,446) — — (2,437,985)

Proceeds from termination of cash flow hedging

derivative............................................................ — 4,355 — — — 4,355

Proceeds from exercise of stock options and

warrants .............................................................. 2,744 — — — — 2,744

Net cash (used in) provided by financing

activities .............................................................. (11,362) 1,637,501 (2,446) 100,045 (100,045) 1,623,693

INCREASE IN CASH AND CASH

EQUIVALENTS................................................ 5,090 3,529 38 40,132 — 48,789

CASH AND CASH EQUIVALENTS,

beginning of year............................................... 10,624 95,772 219 6,094 — 112,709

CASH AND CASH EQUIVALENTS, end of

year ..................................................................... $ 15,714 $ 99,301 $ 257 $ 46,226 $ — $ 161,498