Metro PCS 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2008

NYSE: PCS

www.metropcs.com

Table of contents

-

Page 1

ANNUAL REPORT 2008 NYSE: PCS www.metropcs.com -

Page 2

-

Page 3

... service does not require a signed contract. With our unlimited service plans, our subscribers can talk and text all they want. Alleviating subscribers from the concern of metered usage limits, has resulted in our subscribers using their phones over an hour a day or over 2,000 minutes per month... -

Page 4

... available to approximately 100 million in population. In addition to expanding service areas, we have continued to innovate. We continually add value to our pricing plans in order to stay competitive. During 2008 we introduced ChatLink™, a push to talk service, MetroFlash™, Loopt®, a wireless... -

Page 5

... plans as a validation of our business model which results in increased customer awareness of unlimited offerings and additional growth opportunity. Voice traffic continues to go wireless. During the year, we saw residential wireline access line losses by the largest national telephone companies... -

Page 6

... change over the next couple of years will be the migration to 4G technology. We have chosen LTE as our 4G path. We currently anticipate having a data-based LTE solution available by the second half of 2010. LTE will enable customers to use web-enabled phones at speeds not yet experienced by cell... -

Page 7

... in increasing penetration clearly demonstrates we are changing the marketplace. Our strategy of offering unlimited wireless communications is clear and we are focused on execution. The key to building long-term value for our shareholders is reporting consistent results and providing our customers... -

Page 8

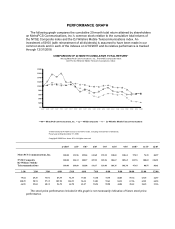

...Communications, Inc. NYSE Composite DJ Wilshire Mobile Telecommunications *$100 invested on 4/18/07 in stock or 3/31/07 in index, including reinvestment of dividends. Fiscal year ending December 31, 2008...26 The stock price performance included in this graph is not necessarily indicative of future... -

Page 9

... June 30, 2008, the aggregate market value of the registrant's voting and non-voting common stock held by nonaffiliates of the registrant was approximately $3,994,225,877, based on the closing price of MetroPCS Communications, Inc. common stock on the New York Stock Exchange on June 30, 2008, of $17... -

Page 10

... 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ...52 Item 7A. Quantitative and Qualitative Disclosures About Market Risk ...85 Item 8. Financial Statements and Supplementary Data ...85 Item 9. Changes in and Disagreements with Accountants on Accounting and... -

Page 11

... INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM...F-1 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM...F-2 Consolidated Balance Sheets ...F-3 Consolidated Statements of Income and Comprehensive Income...F-4 Consolidated Statements of Stockholders' Equity...F-5 Consolidated Statements of Cash... -

Page 12

... throughout this annual report, including the "Business," "Regulation," "Risk Factors," and "Management's Discussion and Analysis of Financial Condition and Results of Operations." We base the forward-looking statements or projections made in this report on our current expectations, plans and... -

Page 13

... wholly-owned subsidiaries. PART I Item 1. Business General We are a wireless communications provider that offers wireless broadband mobile services under the MetroPCS® brand in selected major metropolitan areas in the United States over our own licensed networks or networks of entities in which we... -

Page 14

...areas we serve or plan to serve results in increased efficiencies in network deployment, operations and product distribution. Our Cost Leadership Position. We believe we have the lowest costs of any of the providers of wireless broadband mobile services in the United States, which allows us to offer... -

Page 15

... rate service plans starting at $30 per month. For an additional $5 to $20 per month, our customers may select alternative service plans that offer additional features on an unlimited basis, such as unlimited long distance calls from within our local service calling area to any telephone number... -

Page 16

...; text messaging services (domestic and international); multimedia messaging services; mobile Internet browsing; mobile instant messaging; location based services; social networking services; and push e-mail. Custom Calling Features. We offer custom calling features, including caller ID, call... -

Page 17

Metropolitan Area Licensed Area Core Markets: Georgia: Atlanta, GA ...BTA024 Gainesville, GA...BTA160 Athens,...California: Los Angeles, CA...BTA262(2)(5) Bakersfield, CA ...BTA028(5) Las Vegas: EA 153(5) Las Vegas, NV-AZ-UT ...Philadelphia: EA12(6) Philadelphia, PA ...New York: New York-No. New Jer.-... -

Page 18

... an agreement to acquire this spectrum from Cincinnati Bell Wireless, LLC. See Note 7 to the consolidated financial statement included elsewhere in this report. The map below illustrates the geographic coverage of our licensed spectrum as of December 31, 2008: Detroit Boston New York Sacramento... -

Page 19

... agreement at a rate equal to 11% per annum. As of December 31, 2008, Royal Street has commenced repayment of that portion of the loan related to the Orlando, Lakeland-Winter Haven, Melbourne-Titusville and Los Angeles metropolitan areas. License Term The broadband personal communications services... -

Page 20

...- We currently are migrating our billing services to a new vendor." Our outsourced call centers are staffed with professional and bilingual customer service personnel, who are available to assist our customers 24 hours a day, 365 days a year. Some of these outsourced call centers are located outside... -

Page 21

..., but require long-term service contracts and credit checks or deposits. The national carriers also have introduced, either directly or through their affiliates, unlimited fixed-rate services plans in areas in which we offer or plan to offer service. These unlimited fixed-rate service plans may... -

Page 22

... of supporting high-speed, long-range wireless services suitable for mobility applications, using exclusively licensed or unlicensed spectrum. Additionally, we may compete in the future with companies that offer new technologies and market other services we do not offer or may not be available with... -

Page 23

... and assignment of wireless licenses; the ongoing technical, operational and service requirements under which we must operate; the timing, nature and scope of network construction; the rates, terms and conditions of service; the protection and use of customer information; roaming policies; the... -

Page 24

... platform that is generally open to third-party wireless devices and applications, or an Open Network Platform, by allowing consumers to use the handset of their choice and to download and use the applications of their choice, subject to certain network management conditions that are intended to... -

Page 25

... of the CMA and EA license blocks are required to build systems that provide wireless coverage to 35% of the licensed geographic area in four years and 70% of the licensed geographic area by the end of the license term. Licensees of the REAG license blocks are required to cover at least 40% of... -

Page 26

...a party or affiliated group, or if there was a material change in the post-transaction market share concentrations as measured by the Herfindahl-Hirschman Index. In 2008, the FCC revised this screen to include situations where AWS-1 or certain BRS spectrum is available, on a geographic area basis as... -

Page 27

... $94 million relating to open licenses it acquired as result of that auction. If Royal Street were found to no longer qualify as a DE during the initial five-year term of its licenses, it would be required to repay a portion of the bidding credit using the five-year straight-line repayment schedule... -

Page 28

... any new rules retroactive effect. General Regulatory Obligations The Communications Act and the FCC's rules impose a number of requirements on wireless broadband mobile services licensees, which affect our cost of doing business and that could have a material effect on our business, operations, and... -

Page 29

...of mandatory reporting requirements, license conditions, and compliance programs. The FCC also has rules under which wireless broadband mobile carriers may be required to offer priority E-911 services to the public safety agencies under certain circumstances. States in which we do business may limit... -

Page 30

...service to customers using wireless service in high cost areas. Certain competing wireless broadband mobile carriers operating in states where we operate have obtained or applied for ETC status. Their receipt of universal service support funds may affect our competitive status in a particular market... -

Page 31

... aid-compatible digital wireless handsets, demand for our services may decrease, the number of wireless phones we can offer to our customers may decline, or our selling costs may increase if we choose to subsidize the cost of the hearing aid-compatible handsets. Backup power requirements. In October... -

Page 32

... WARN Act, which additional requirements or changes would cause us to incur additional costs and expenses. Roaming. The FCC long has required CMRS providers to permit customers of other carriers to roam "manually" on their networks, for example, by supplying a credit card number, provided that the... -

Page 33

... Alltel Wireless agreement only applies to the rate and not to other terms and conditions. We and others have asked the Commission to clarify these requirements, to extend the four-year commitment to seven years and to require post-merger Verizon Wireless to offer automatic roaming for data services... -

Page 34

... to fund grants to provide access to broadband service to consumers residing in rural, unserved or underserved areas of the United States. The grants are available to, among others, wireless broadband mobile carriers. Grants of up to 80% of the total cost of the project may be used to fund broadband... -

Page 35

... of market entry or rates charged by any CMRS provider. As a result, we are free to establish rates and offer new products and services with minimum state regulation. However, states and local agencies may regulate "other terms and conditions" of wireless service, and certain states where we operate... -

Page 36

... flat monthly rates without requiring a long-term service contract or a credit check. This approach to marketing wireless broadband mobile services may not prove to be successful in the long term. Some companies that offered this type of service in the past were not successful. From time to time, we... -

Page 37

...cost-effectively roam onto other wireless networks; affordability and general economic conditions; supplier or vendor failures; customer care concerns; handset issues, including lack of early access to the newest handsets, handset prices and handset problems; wireless number portability requirements... -

Page 38

... base of current and potential customers. These advantages may allow our competitors to offer service for lower prices, market to broader customer segments, and offer service over larger geographic areas which may have a material adverse effect on our business, financial condition and operating... -

Page 39

... bundles of minutes of use at increasingly lower prices or fixed monthly prices. All of our national wireless broadband mobile competitors and certain of our regional competitors currently are offering unlimited fixed-rate service plans in the markets where we operate and plan to operate and this... -

Page 40

... we make regarding technology and new service offerings will prove to be successful in the market place or will achieve their intended results. All of these factors could have a material adverse effect on our business, financial condition and operating results. We are dependent on certain network... -

Page 41

... to acquire additional spectrum in the future at a reasonable cost. Because we offer unlimited calling services for a fixed rate, our customers tend, on average, to use our services more than the customers of other wireless broadband mobile carriers. We believe that the average minutes of use of... -

Page 42

..., increased taxes or any other changes in federal law may have an adverse effect on our business, financial condition and operating results. Recent disruptions in the financial markets could adversely affect our ability to obtain debt or equity on reasonable terms or at all. The wireless industry... -

Page 43

...the investment in the long-term which may have a material adverse effect on our business, financial condition, operating results and liquidity. We currently are migrating our billing services to a new vendor. We recently entered into an agreement with a new billing services provider, Amdocs Software... -

Page 44

...continue purchasing our PCS and AWS CDMA products exclusively from Alcatel Lucent, we may have to pay certain liquidated damages based on the difference in prices between exclusive and non-exclusive prices, which would have a material adverse effect on our business, financial condition and operating... -

Page 45

...to our business, such as customer care, financial reporting, network management, billing and payment processing. We purchase a substantial portion of the products, software and services from only a few major suppliers and we generally rely on one key vendor in each area. Some of these agreements may... -

Page 46

... networks, increase the costs of or difficulty in negotiating new agreements with carriers, and decrease the amount of revenue we receive for terminating calls from other carriers on our network. Any such changes may have a materially adverse effect on our business, financial condition and operating... -

Page 47

... also may change in the future the basis on which federal USF fees are charged. The Federal government and many states also apply transaction-based taxes to sales of our products and services and to our purchases of telecommunications services from various carriers. In addition, state regulators and... -

Page 48

... or all of those taxes from our customers and the amount of taxes may deter demand for our services or increase our cost to provide service which could have a material adverse effect on our business, financial condition or operating results. Concerns about whether wireless telephones pose health and... -

Page 49

... who are given access to the consumer data. This could damage our reputation which could have a material adverse effect on our business, financial condition and operating results. Risks Related to Legal and Regulatory Matters Our ability to provide service to our customers and generate revenues... -

Page 50

... our business will not impose new or revised regulatory requirements, new or increased costs or require changes in our current or planned operations. State regulatory agencies also are increasingly focused on the quality of service and support that wireless carriers provide to their customers and... -

Page 51

... adverse effect on our business, financial condition, or operating results, including but not limited to, increasing our operating expenses or costs, requiring us to obtain new or additional authorizations or permits, requiring us to change our business and customer service processes, limiting... -

Page 52

... higher distribution costs resulting from wireless handsets not being activated or maintained on our network, which costs may be material, and which could have a material adverse effect on our business, financial condition and operating results. General Matters Our stock price has historically... -

Page 53

... companies; the general state of the U.S. and world economies; the announcement, commencement, bidding and closing of auctions for new spectrum or acquisitions of other businesses; and recruitment or departure of key personnel. • • • • In addition, in recent months, the stock market... -

Page 54

...a material adverse effect on our business, increase our costs and adversely affect our level of service and inadequate internal controls could also cause investors to lose confidence in our reported financial information which could have a negative effect on the trading price of our stock. The value... -

Page 55

... to, changes in our business or the telecommunications industry; limiting our ability to increase our capital expenditures to roll out new services; limiting our ability to purchase additional spectrum or develop new metropolitan areas in the future; reducing the amount of cash available for working... -

Page 56

... unsolicited offers. The Rights Plan may prevent or make takeovers or unsolicited corporate transactions more difficult. The Rights Plan will cause substantial dilution to a person or group that attempts to acquire us on terms that our board of directors does not believe are in our best interests... -

Page 57

..., Massachusetts; Hawthorne, New York; and Ft. Washington, Pennsylvania. As of December 31, 2008, we also operated 127 retail stores throughout our metropolitan areas. Our executive offices, all of our regional offices, switch sites, retail stores and virtually all of our cell sites are leased from... -

Page 58

... the symbol "PCS." Prior to April 19, 2007, there was no established public trading market for our common stock. The following table sets forth for the periods indicated the high and low composite per share prices as reported by the New York Stock Exchange. High Low Fiscal year ended December 31... -

Page 59

... to be paid pursuant to the 2008 Remuneration Plan to non-employee directors of our Company included annual retainers, stock options, board meeting fees, and committee paid event fees. Recent Sales of Unregistered Securities None. Issuer Purchases of Equity Securities We did not repurchase... -

Page 60

... with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" in this report. 2004 Statement of Operations Data: Revenues: Service revenues...Equipment revenues ...Total revenues ...Operating expenses: Cost of service (excluding depreciation... -

Page 61

... flat monthly rate service plans starting at $30 per month. For an additional $5 to $20 per month, our customers may select a service plan that offers additional services, such as unlimited voicemail, caller ID, call waiting, enhanced directory assistance, unlimited text messaging, mobile Internet... -

Page 62

... long-term contract requirements of traditional wireless carriers. In addition, the above products and services are offered by us in the Royal Street markets under the MetroPCS brand. Critical Accounting Policies and Estimates On January 1, 2008, we adopted the provisions of Statement of Financial... -

Page 63

... modified. We adjust the reserves in light of changing facts and circumstances. Our effective tax rate includes the impact of income tax related reserve positions and changes to income tax reserves that we consider appropriate. A number of years may elapse before a particular matter for which we... -

Page 64

... rate securities. FCC Licenses and Microwave Relocation Costs We operate wireless broadband mobile networks under licenses granted by the FCC for a particular geographic area on spectrum allocated by the FCC for terrestrial wireless broadband mobile services. In November 2006, we acquired a number... -

Page 65

... to our initial public offering, factors that our Board of Directors considered in determining the fair market value of our common stock, included the recommendation of our finance and planning committee and of management based on certain data, including discounted cash flow analysis, comparable... -

Page 66

... new customers as gross customer additions upon activation of service. We offer our customers the Metro Promise, which allows a customer to return a newly purchased handset for a full refund prior to the earlier of 30 days or 60 minutes of use. Customers who return their phones under the Metro... -

Page 67

... selling to new customers and fixed charges such as retail store rent and retail associates' salaries. General and administrative expenses include support functions including, technical operations, finance, accounting, human resources, information technology and legal services. We record stock-based... -

Page 68

... amount of state income tax during the years ended December 31, 2008, 2007 and 2006, respectively. Seasonality Our customer activity is influenced by seasonal effects related to traditional retail selling periods and other factors that arise from our target customer base. Based on historical... -

Page 69

... based on the average number of customers in each operating segment. There are no transactions between reportable segments. Interest and certain other expenses, interest income and income taxes are not allocated to the segments in the computation of segment operating profit for internal evaluation... -

Page 70

... Year Ended December 31, 2008 Compared to Year Ended December 31, 2007 Set forth below is a summary of certain financial information by reportable operating segment for the periods indicated: Reportable Operating Segment Data 2008 2007 (in thousands) Change REVENUES: Service revenues: Core Markets... -

Page 71

... increase in upgrade handset sales to existing customers accounting for a $26.0 million increase. These increases in equipment revenues were partially offset by a lower average price of handsets activated which accounted for a $28.2 million decrease. • Cost of Service. Cost of service increased... -

Page 72

... Markets customer base, coupled with expenses associated with the launch of service in new markets well as the build-out expenses related to the New York and Boston metropolitan areas. In addition, pass through charges increased approximately $52.1 million during the year ended December 31, 2008... -

Page 73

... year ended December 31, 2008 compared to the same period in 2007 primarily due to the approximately 83% growth in our Expansion Markets customer base, including the launch of service in new markets, as well as the build-out expenses related to the New York and Boston metropolitan areas. In addition... -

Page 74

... of new markets. In addition, our weighted average interest rate decreased to 7.78% for the twelve months ended December 31, 2008 compared to 8.15% for the twelve months ended December 31, 2007 as a result of a decrease in the borrowing rates under the senior secured credit facility. Average... -

Page 75

Year Ended December 31, 2007 Compared to Year Ended December 31, 2006 Set forth below is a summary of certain financial information by reportable operating segment for the periods indicated: Reportable Operating Segment Data 2007 2006 (in thousands) Change REVENUES: Service revenues: Core Markets ... -

Page 76

... increase in service revenues is primarily attributable to net additions of approximately 358,000 customers for the year ended December 31, 2007, which accounted for $213.2 million of the Core Markets increase, coupled with the migration of existing customers to higher priced rate plans accounting... -

Page 77

...in the Expansion Markets, including the launch of service in the Los Angeles metropolitan area and build-out expenses related to the New York, Philadelphia, Boston and Las Vegas metropolitan areas. In addition, stock-based compensation expense increased $10.1 million. See "- Stock-Based Compensation... -

Page 78

... agreement during the year ended December 31, 2007. During the year ended December 31, 2006, certain network technology related to our cell sites in certain markets was retired and replaced with new technology, resulting in a loss on disposal of assets. Interest Expense. Interest expense increased... -

Page 79

...cost of acquiring a new customer; cost per user per month, or CPU, which measures the non-selling cash cost of operating our business on a per customer basis; and churn, which measures turnover in our customer base. Effective December 31, 2008, we revised our definition of ARPU to include activation... -

Page 80

... purchase of an upgraded or replacement phone and does not identify themselves as an existing customer, we count the phone leaving service as a churn and the new phone entering service as a gross customer addition. Churn remained flat for the year ended December 31, 2008 at 4.7%. Churn for the year... -

Page 81

... for the year ended December 31, 2007. For the year ended December 31, 2006, Core Markets Adjusted EBITDA was $492.8 million. We continue to experience increases in Core Markets Adjusted EBITDA as a result of continued customer growth and cost benefits due to the increasing scale of our business in... -

Page 82

... of our service coverage area existing Expansion Markets and our recent launches of service in new markets. Net customer additions increased to 663,853 for the year ended December 31, 2007 from 587,072 for the year ended December 31, 2006 due to the continued demand for our service offerings and the... -

Page 83

... day of the month and the last day of the month divided by two. The following table shows the calculation of ARPU for the periods indicated. Year Ended December 31, 2006 2007 2008 (In thousands, except average number of customers and ARPU) Calculation of Average Revenue Per User (ARPU): Service... -

Page 84

... in these non-selling cash costs over time, and to help evaluate how changes in our business operations affect non-selling cash costs per customer. In addition, CPU provides management with a useful measure to compare our non-selling cash costs per customer with those of other wireless providers. We... -

Page 85

... and cash equivalents. Over the last year, the capital and credit markets have become increasingly volatile as a result of adverse economic and financial conditions that have triggered the failure and near failure of a number of large financial services companies and a global recession. We believe... -

Page 86

... provide for the related construction and operating costs associated with such license area. We currently plan to focus on building out networks to cover approximately 40 million of total population during 2009-2010 including the launch of the Boston and New York metropolitan areas in February 2009... -

Page 87

...existing Core Markets network through the addition of cell sites and switches. We believe the increased service area and capacity in existing markets will improve our service offering, helping us to attract additional customers and increase revenues. In addition, we believe our new Expansion Markets... -

Page 88

... credit facility. In addition, for further information, the following table reconciles consolidated Adjusted EBITDA, as defined in our senior secured credit facility, to cash flows from operating activities for the years ended December 31, 2006, 2007 and 2008. 2006 Year Ended December 31, 2007 2008... -

Page 89

..., $25.2 million in cash used for business acquisitions, a $186.9 million increase in purchases of property and equipment which was primarily related to construction in the Expansion Markets, and $267.2 million in net proceeds from the sale of investments during the year ended December 31, 2007 that... -

Page 90

... margin used to determine the senior secured credit facility interest rate was reduced to 2.25% from 2.50%. On April 30, 2008, Wireless entered into an additional two-year interest rate protection agreement to manage its interest rate risk exposure. The agreement was effective on June 30, 2008 and... -

Page 91

... the basic trading area of Jacksonville, Florida. We also entered into agreements with NTCH, Inc. (dba Cleartalk PCS) and PTA-FLA, Inc. for the purchase of certain of their assets used in providing PCS wireless telecommunications services in the Jacksonville market. On January 17, 2008, we closed on... -

Page 92

... December 31, 2008. See Note 12 to our annual consolidated financial statements included elsewhere in this report. Payments Due by Period Total Less Than 1 Year 1 - 3 Years (In thousands) 3 - 5 Years More Than 5 Years Contractual Obligations: Long-term debt, including current portion...$ Interest... -

Page 93

... are accounted for under FASB Statement No. 133 and its related interpretations and (c) how derivative instruments and related hedged items affect a company's financial position, results of operations and cash flows. SFAS No. 161 is effective for fiscal years beginning on or after November 15, 2008... -

Page 94

... in market prices and rates, including interest rates. We do not routinely enter into derivatives or other financial instruments for trading, speculative or hedging purposes, unless it is hedging interest rate risk exposure or is required by our senior secured credit facility. We do not currently... -

Page 95

...Director Independence The information required by this item is incorporated by reference to the definitive Proxy Statement for the 2009 Annual Meeting of our Stockholders, which will be filed with the SEC no later than 120 days after December 31, 2008. Item 14. Principal Accounting Fees and Services... -

Page 96

... Consolidated Financial Statements: Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of December 31, 2008 and 2007...Consolidated Statements of Income and Comprehensive Income for the years ended December 31, 2008, 2007 and 2006...Consolidated Statements of... -

Page 97

... 3 to the General Purchase Agreement, effective as of December 3, 2007, by and between MetroPCS Wireless, Inc. and Lucent Technologies Inc. (Filed as Exhibit 10.4(d) to MetroPCS Communications, Inc's Annual Report on Form 10-K (SEC File No. 001-33409), filed on February 29, 2008, and incorporated by... -

Page 98

...Bank of New York Trust Company, N.A., as trustee under the Indenture referred to therein. (Filed as Exhibit 10.14(c) to MetroPCS Communications, Inc's Annual Report on Form 10-K (SEC File No. 001-33409), filed on February 29, 2008, and incorporated by reference herein). Purchase Agreement, dated May... -

Page 99

...of New York Mellon Trust Company, N.A., as trustee. (Filed as Exhibit 10.1 to MetroPCS Communications, Inc.'s Current Report on Form 8-K, filed on January 21, 2009, and incorporated by reference herein). Registration Rights Agreement, dated as of January 20, 2009, by and among MetroPCS Wireless, Inc... -

Page 100

... of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. METROPCS COMMUNICATIONS, INC. (Registrant) By: /s/ ROGER D. LINQUIST Roger D. Linquist President, Chief Executive Officer and Chairman of the Board Date: March 2, 2009 91 -

Page 101

... to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. /s/ ROGER D. LINQUIST Roger D. Linquist President, Chief Executive Officer and Chairman of the Board... -

Page 102

(This page intentionally left blank) -

Page 103

... of its operations and its cash flows for each of the three years in the period ended December 31, 2008, in conformity with accounting principles generally accepted in the United States of America. As discussed in Note 10 to the consolidated financial statements, the Company changed its method... -

Page 104

... three years in the period ended December 31, 2008, of the Company and our report dated February 27, 2009 expressed an unqualified opinion on those financial statements (which expresses an unqualified opinion and includes an explanatory paragraph relating to a change in the method of accounting for... -

Page 105

...and per share information) 2008 2007 CURRENT ASSETS: Cash and cash equivalents ...Inventories, net ...Accounts receivable (net of allowance for uncollectible accounts of $4,106 and $2,908 at December 31, 2008 and 2007, respectively)...Prepaid charges...Deferred charges...Deferred tax assets...Other... -

Page 106

... Communications, Inc. and Subsidiaries Consolidated Statements of Income and Comprehensive Income For the Years Ended December 31, 2008, 2007 and 2006 (in thousands, except share and per share information) 2008 2007 2006 REVENUES: Service revenues ...Equipment revenues...Total revenues...OPERATING... -

Page 107

MetroPCS Communications, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity For the Years Ended December 31, 2008, 2007 and 2006 (in thousands, except share information) Additional Paid-In Amount Capital Accumulated Other Comprehensive Income (Loss) Number of Shares Deferred ... -

Page 108

MetroPCS Communications, Inc. and Subsidiaries Consolidated Statements of Stockholders' Equity - (Continued) For the Years Ended December 31, 2008, 2007 and 2006 (in thousands, except share information) Accumulated Other Comprehensive Income (Loss) Number of Shares Additional Paid-In Amount ... -

Page 109

... ...Purchases of and deposits for FCC licenses ...Cash used in business acquisitions...Microwave relocation costs...Net cash used in investing activities...CASH FLOWS FROM FINANCING ACTIVITIES: Change in book overdraft...Proceeds from bridge credit agreements ...Proceeds from Senior Secured Credit... -

Page 110

... and Business Operations: MetroPCS Communications, Inc. ("MetroPCS"), a Delaware corporation, together with its consolidated subsidiaries (the "Company"), is a wireless telecommunications carrier that offers wireless broadband mobile services. As of December 31, 2008, the Company offered services... -

Page 111

...business enterprises report information about operating segments in annual financial statements. At December 31, 2008, the Company had thirteen operating segments based on geographic regions within the United States: Atlanta, Boston, Dallas/Ft. Worth, Detroit, Las Vegas, Los Angeles, Miami, New York... -

Page 112

... to pay for equipment purchases and for amounts estimated to be uncollectible from other carriers. The following table summarizes the changes in the Company's allowance for uncollectible accounts (in thousands): 2008 2007 2006 Balance at beginning of period ...Additions: Charged to expense...Direct... -

Page 113

... discount rates, counterparty risk and ongoing strength and quality of market credit and liquidity (See Note 5). Revenues and Cost of Service The Company's wireless services are provided on a month-to-month basis and are paid in advance. Revenues from wireless services are recognized as services are... -

Page 114

... other advanced wireless services. In June 2008, the Company acquired a 700 MHz license that also can be used to provide similar services. The personal communications services ("PCS") licenses previously included, and the AWS licenses currently include, the obligation and resulting costs to relocate... -

Page 115

... during the years ended December 31, 2008, 2007 and 2006, respectively. Income Taxes The Company records income taxes pursuant to SFAS No. 109, "Accounting for Income Taxes," ("SFAS No. 109"). SFAS No. 109 uses an asset and liability approach to account for income taxes, wherein deferred taxes are... -

Page 116

... classified under other long-term liabilities. Landlords may choose not to exercise these rights as cell sites are considered useful improvements. In addition to cell site operating leases, the Company has leases related to switch site, retail, and administrative locations subject to the provisions... -

Page 117

... are accounted for under FASB Statement No. 133 and its related interpretations and (c) how derivative instruments and related hedged items affect a company's financial position, results of operations and cash flows. SFAS No. 161 is effective for fiscal years beginning on or after November 15, 2008... -

Page 118

... trading area of Jacksonville, Florida. The Company also entered into agreements with NTCH, Inc. (dba Cleartalk PCS) and PTA-FLA, Inc. for the purchase of certain of their assets used in providing PCS wireless telecommunications services in the Jacksonville market. On January 17, 2008, the Company... -

Page 119

... a three-year interest rate protection agreement to manage the Company's interest rate risk exposure and fulfill a requirement of Wireless' Senior Secured Credit Facility. The agreement covers a notional amount of $1.0 billion and effectively converts this portion of Wireless' variable rate debt to... -

Page 120

... licenses subsequently acquired from other carriers. On December 21, 2007, the Company executed an agreement with PTA Communications, Inc. ("PTA") to purchase 10 MHz of PCS spectrum from PTA for the basic trading area of Jacksonville, Florida. On May 13, 2008, the Company closed on the purchase of... -

Page 121

... Haven, Florida; and Dallas-Ft. Worth, Texas and certain other North Texas markets, with consummation subject to customary closing conditions. During the year ended December 31, 2008, the Company entered into various agreements for the acquisition and exchange of spectrum in the aggregate amount of... -

Page 122

... Senior Secured Credit Facility, were used to repay amounts owed under various credit agreements, credit facilities, and to pay related premiums, fees and expenses, as well as for general corporate purposes. On June 6, 2007, Wireless completed the sale of an additional $400.0 million of 91/4% Senior... -

Page 123

...on the base rate used to determine the Senior Secured Credit Facility interest rate was reduced to 2.25% from 2.50%. On April 30, 2008, Wireless entered into an additional two-year interest rate protection agreement to manage the Company's interest rate risk exposure. This agreement was effective on... -

Page 124

... - 37 5,986 Year Ended December 31, 2008 Losses included in earnings that are attributable to the change in unrealized losses relating to those assets still held at the reporting date as reported in impairment loss on investment securities in the consolidated statements of income and comprehensive... -

Page 125

...required for the operation of its wireless networks. Total rent expense for the years ended December 31, 2008, 2007 and 2006 was $199.1 million, $125.1 million and $85.5 million, respectively. The Company entered into various non-cancelable DAS capital lease agreements, with varying expiration terms... -

Page 126

... Communications, Inc. and Subsidiaries Notes to Consolidated Financial Statements December 31, 2008, 2007 and 2006 The Company has an agreement with Alcatel Lucent, to provide it with PCS and AWS CDMA system products and services, including without limitation, wireless base stations, switches, power... -

Page 127

... immediately prior to such merger or consolidation) on a national securities exchange for a period of 30 consecutive trading days above a price implying a market valuation of the Series D Preferred Stock over twice the Series D Preferred Stock initial purchase price, or (iii) the date specified... -

Page 128

... director's annual retainer and meeting fees will be paid in cash and each director will receive options to purchase common stock. In accordance with the 2008 Remuneration Plan, no shares of common stock were issued to nonemployee members of the Board of Directors during the year ended December... -

Page 129

..., 2) fair market value of the underlying stock on date of grant, 3) expected life, 4) estimated volatility and 5) the risk-free interest rate. The Company utilized the following weighted-average assumptions in estimating the fair value of the option grants in the years ended December 31, 2008, 2007... -

Page 130

... that vested during the year ended December 31, 2008 was $45.0 million. The Company has recognized $41.1 million, $28.0 million and $14.5 million of non-cash stock-based compensation expense in the years ended December 31, 2008, 2007 and 2006, respectively, and an income tax benefit of $17.2 million... -

Page 131

... Election Related to Accounting for the Tax Effects of ShareBased Payments." 17. Employee Benefit Plan: The Company sponsors a savings plan under Section 401(k) of the Internal Revenue Code for the majority of its employees. The plan allows employees to contribute a portion of their pretax income in... -

Page 132

... income and comprehensive income for the years ended December 31, 2008, 2007 and 2006 is as follows (in thousands): 2008 2007 2006 U.S. federal income tax provision at statutory rate...Increase (decrease) in income taxes resulting from: State income taxes, net of federal income tax impact...Change... -

Page 133

...At December 31, 2008 the Company has approximately $1.2 million and $0.2 million of alternative minimum tax credit carry forwards for federal and state income tax purposes, respectively. These alternative minimum tax credits carry forward indefinitely. Financial statement deferred tax assets must be... -

Page 134

... and state net operating losses the Company has available for carry forward to offset future taxable income, or may increase the amount of tax due for the period under audit, resulting in an increase to the effective rate in the year of resolution. In 2008, MetroPCS concluded a state audit which... -

Page 135

... about which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. The Company's chief operating decision maker is the President, Chief Executive Officer and Chairman of... -

Page 136

..., Las Vegas, Los Angeles, Miami, New York, Orlando/Jacksonville, Philadelphia, Sacramento, San Francisco and Tampa/Sarasota. Each of these operating segments provides wireless voice and data services and products to customers in its service areas or is currently constructing a network in order to... -

Page 137

...4,153,122 _____ (1) (2) Cost of service includes stock-based compensation expense disclosed separately. For the years ended December 31, 2008, 2007 and 2006, cost of service includes $2.9 million, $1.8 million and $1.3 million, respectively, of stock-based compensation expense. Selling, general and... -

Page 138

... a guarantor of the 91/4% Senior Notes or the Senior Secured Credit Facility. The following information presents condensed consolidating balance sheets as of December 31, 2008 and 2007, condensed consolidating statements of income for the years ended December 31, 2008, 2007 and 2006, and condensed... -

Page 139

... to Consolidated Financial Statements December 31, 2008, 2007 and 2006 Consolidated Balance Sheet As of December 31, 2008 Parent CURRENT ASSETS: Cash and cash equivalents...Inventories, net ...Accounts receivable, net ...Prepaid charges ...Deferred charges ...Deferred tax asset ...Current receivable... -

Page 140

......Total assets ...$ CURRENT LIABILITIES: Accounts payable and accrued expenses ...$ Current maturities of long-term debt...Deferred revenue ...Advances to subsidiaries ...Other current liabilities ...Total current liabilities ...Long-term debt ...Long-term note to parent...Deferred tax liabilities... -

Page 141

... and 2006 Consolidated Statement of Income Year Ended December 31, 2008 Parent REVENUES: Service revenues...Equipment revenues ...Total revenues ...OPERATING EXPENSES: Cost of service (excluding depreciation and amortization expense shown separately below)...Cost of equipment ...Selling, general and... -

Page 142

..., 2008, 2007 and 2006 Consolidated Statement of Income Year Ended December 31, 2007 Parent REVENUES: Service revenues...Equipment revenues...Total revenues ...OPERATING EXPENSES: Cost of service (excluding depreciation and amortization expense shown separately below) ...Cost of equipment ...Selling... -

Page 143

..., 2008, 2007 and 2006 Consolidated Statement of Income Year Ended December 31, 2006 Parent REVENUES: Service revenues...Equipment revenues...Total revenues ...OPERATING EXPENSES: Cost of service (excluding depreciation and amortization expense shown separately below) ...Cost of equipment ...Selling... -

Page 144

...FROM OPERATING ACTIVITIES: Net income (loss) ...$ Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization ...Provision for uncollectible accounts receivable ...Deferred rent expense ...Cost of abandoned cell sites...Stock-based... -

Page 145

... income taxes ...Stock-based compensation expense...Changes in assets and liabilities...Net cash provided by (used in) operating activities ...CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property and equipment...Change in prepaid purchases of property and equipment...Proceeds from sale... -

Page 146

... income taxes ...Stock-based compensation expense...Changes in assets and liabilities...Net cash provided by (used in) operating activities ...CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property and equipment...Change in prepaid purchases of property and equipment...Proceeds from sale... -

Page 147

MetroPCS Communications, Inc. and Subsidiaries Notes to Consolidated Financial Statements December 31, 2008, 2007 and 2006 22. Related-Party Transactions: One of the Company's current directors is a general partner of various investment funds affiliated with one of the Company's greater than 5% ... -

Page 148

...to Consolidated Financial Statements December 31, 2008, 2007 and 2006 Assets acquired under capital lease obligations were $92.9 million for the year-ended December 31, 2008. On April 24, 2007, concurrent with the closing of the Offering, all outstanding shares of preferred stock, including accrued... -

Page 149

... Financial Statements December 31, 2008, 2007 and 2006 file the registration statement, have such registration statement declared effective, consummate the Exchange Offer or, in the alternative, have the shelf registration statement declared effective, Wireless will be required to pay certain... -

Page 150

... and Other Investor Information A copy of the Company's 2008 Annual Report on Form 10-K filed with the SEC is included in this annual report. A copy of any exhibit listed in the exhibit index to the Company's Annual Report on Form 10-K or any other SEC filing is available free of charge by visiting... -

Page 151

....com Telephone: 1-800-937-5449 Independent Public Accounting Firm Deloitte & Touche LLP Legal Counsel Baker Botts L.L.P., Dallas Stock Symbol New York Stock Exchange: PCS MetroPCS Management Roger D. Linquist Chairman, President & Chief Executive Officer Thomas C. Keys Chief Operating Officer... -

Page 152

MetroPCS Communications, Inc. NYSE: PCS www.metropcs.com Corporate Headquarters 2250 Lakeside Blvd. Richardson, TX 75082