LensCrafters 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

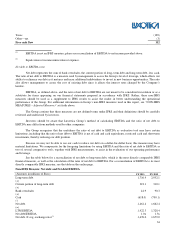

November 15, 2015. The offering prospectus contains a clause concerning the change of

control which provides for the possibility of the holders of the bonds to exercise a redemption

option of 100% of the value of the notes in the event that a third party not linked to the Del

Vecchio family gains control of the Company. This clause is not applied in the event that the

Company obtains an investment grade credit rating. In this regard, on January 20, 2014 the

rating agency Standard & Poor’s awarded a Long Term Credit Rating of “A-” to the

Company.

On December 15, 2011 the subsidiary Luxottica U.S. Holdings Corp. made a private

placement of notes in the U.S. market for a total amount of USD 350 million, expiring on

December 15, 2021. The Note Purchase Agreement provides for the advance repayment of

the loan in the event that a third party not linked to the Del Vecchio family gains control of at

least 50% of the Company shares.

On April 17, 2012 Luxottica Group S.p.A. and the subsidiary Luxottica U.S. Holdings Corp.

entered into a revolving loan agreement for Euro 500 million expiring on April 10, 2017 with

Unicredit AG - Milan Branch as agent, and with Bank of America Securities Limited,

Citigroup Global Markets Limited, Crédit Agricole Corporate and Investment Bank – Milan

Branch, Banco Santander S.A., The Royal Bank of Scotland PLC and Unicredit S.p.A. as

backers, guaranteed by its subsidiary Luxottica S.r.l. As at December 31, 2013, this facility

was undrawn. The agreement provides for the advance repayment of the loan in the event that

a third party not linked to the Del Vecchio family gains control of the Company and at the

same time the majority of lenders believe, reasonably and in good faith, that this party cannot

repay the debt.

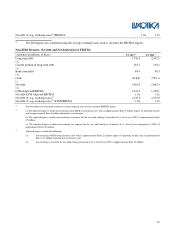

On March 19, 2012 the Company issued a bond listed on the Luxembourg Stock Exchange

(code ISIN XS0758640279) for a total amount of Euro 500 million, expiring on March 19,

2019. The offering prospectus contains a clause concerning a change of control, which

provides for the possibility of the holders of the bonds to exercise a redemption option for

100% of the value of the notes in the event that a third party not linked to the Del Vecchio

family gains control of the Company. This clause is not applied in the event that the

Company obtains an investment grade credit rating. As previously stated, on January 20,

2014 the rating agency Standard & Poor’s awarded a Long Term Credit Rating of “A-” to the

Company.

On February 10, 2014 the Company issued a bond listed on the Luxembourg Stock Exchange

(code ISIN XS1030851791) for a total amount of Euro 500 million, expiring on February 10,

2024. The bond was issued pursuant to the Company’s Euro Medium Term Note Programme

which was established on May 10, 2013. The EMTN Programme contains a clause

concerning a change of control, which provides for the possibility of the holders of the bonds

to exercise a redemption option for 100% of the value of the notes in the event that a third

party not linked to the Del Vecchio family gains control of the Company. This clause is not

applied in the event that the Company obtains an investment grade credit rating. The rating