LensCrafters 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

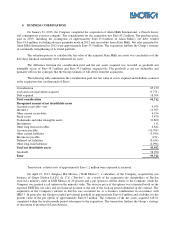

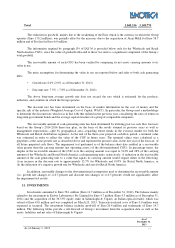

4. BUSINESS COMBINATIONS

On January 23, 2013, the Company completed the acquisition of Alain Mikli International, a French luxury

and contemporary eyewear company. The consideration for the acquisition was Euro 85.2 million. The purchase price

paid in 2013, including the assumption of approximately Euro 15.0 million of Alain Mikli’s net debt, totaled

Euro 91.0 million, excluding advance payments made in 2012 and receivables from Alain Mikli. Net sales generated by

Alain Mikli International in 2012 were approximately Euro 55.5 million. The acquisition furthers the Group’s strategy

of continually strengthening of its brand portfolio.

The valuation process to calculate the fair value of the acquired Alain Mikli net assets was concluded as of the

date these financial statements were authorized for issue.

The difference between the consideration paid and the net assets acquired was recorded as goodwill and

intangible assets of Euro 58.7 million and Euro 33.5 million, respectively. The goodwill is not tax deductible and

primarily reflects the synergies that the Group estimates it will derive from the acquisition.

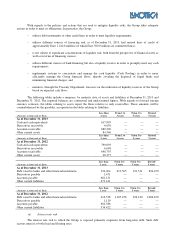

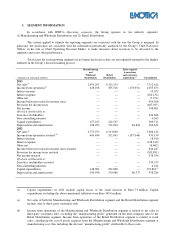

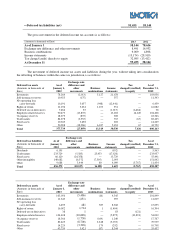

The following table summarizes the consideration paid, the fair value of assets acquired and liabilities assumed

at the acquisition date (in thousands of Euro):

Consideration 85,179

Cash and cash equivalents acquired (3,771)

Debt acquired 18,304

Total consideration 99,712

Recognized amount of net identifiable assets

Accounts receivable—net 9,975

Inventory 11,397

Other current receivables 4,156

Fixed assets 3,470

Trademarks and other intangible assets 33,800

Investments 113

Other long term receivables 6,642

Accounts payable (10,708)

Other current liabilities (5,590)

Income tax payable (231)

Deferred tax liabilities (9,014)

Other long-term liabilities (2,996)

Total net identifiable assets 41,012

Goodwill 58,700

Total 99,712

Transaction - related costs of approximately Euro 1.2 million were expensed as incurred.

On April 25, 2013, Sunglass Hut Mexico (“SGH Mexico”), a subsidiary of the Company, acquired the sun

business of Grupo Devlyn S.A.P.I. de C.V. (“Devlyn”). As a result of the acquisition the shareholders of Devlyn

received a minority stake in SGH Mexico of 20 percent and a put option to sell the shares to the Company, while the

Company was granted a call option on the minority stake. The exercise price of the options was estimated based on the

expected EBITDA, net sales and net financial position at the end of the lock-up period identified in the contract. The

acquisition of the Company’s interest in Devlyn was accounted for as a business combination in accordance with

IFRS 3. In particular, the Group recorded provisional goodwill of approximately Euro 6.0 million and a liability for the

present value of the put option of approximately Euro 9.5 million. The valuation of the net assets acquired will be

completed within the twelve-month period subsequent to the acquisition. The transaction furthers the Group’s strategy

of increasing its presence in Latin America.