LensCrafters 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

With regards to the policies and actions that are used to mitigate liquidity risks, the Group takes adequate

actions in order to meet its obligations. In particular, the Group:

– utilizes debt instruments or other credit lines in order to meet liquidity requirements;

– utilizes different sources of financing and, as of December 31, 2013, had unused lines of credit of

approximately Euro 1,242.6 million (of which Euro 500.0 million are committed lines);

– is not subject to significant concentrations of liquidity risk, both from the perspective of financial assets as

well as in terms of financing sources;

– utilizes different sources of bank financing but also a liquidity reserve in order to promptly meet any cash

requirements;

– implements systems to concentrate and manage the cash liquidity (Cash Pooling) in order to more

efficiently manage the Group financial flows, thereby avoiding the dispersal of liquid funds and

minimizing financial charges; and

– monitors, through the Treasury Department, forecasts on the utilization of liquidity reserves of the Group

based on expected cash flows.

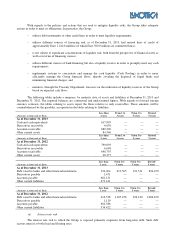

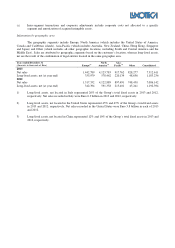

The following tables include a summary, by maturity date, of assets and liabilities at December 31, 2013 and

December 31, 2012. The reported balances are contractual and undiscounted figures. With regards to forward foreign

currency contracts, the tables relating to assets report the flows relative to only receivables. These amounts will be

counterbalanced by the payables, as reported in the tables relating to liabilities.

(Amounts in thousands of Euro)

Less than

1 year

From 1 to

3 years

From 3 to

5 years

Beyond

5 years

As of December 31, 2013

Cash and cash equivalents 617,995

—

—

—

Derivatives receivable 6,039

—

—

—

Accounts receivable 680,296

—

—

—

Other current assets

84,546

—

—

—

(Amounts in thousands of Euro)

Less than

1 year

From 1 to

3 years

From 3 to

5 years

Beyond

5 years

As of December 31, 2012

Cash and cash equivalents 790,093

—

—

—

Derivatives receivable 6,048

—

—

—

Accounts receivable 698,755

—

—

—

Other current assets

48,377

—

—

—

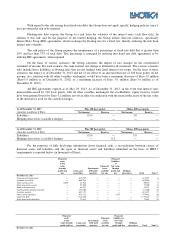

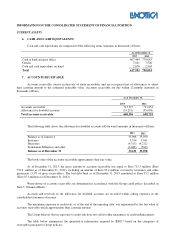

(Amounts in thousands of Euro)

Less than

1 year

From 1 to

3 years

From 3 to

5 years

Beyond

5 years

As of December 31, 2013

Debt owed to banks and other financial institutions 334,964

613,565

191,511

894,470

Derivatives payable 1,471

—

—

—

Accounts payable 681,151

—

—

—

Other current liabilities 473,411

—

—

—

(Amounts in thousands of Euro)

Less than

1 year

From 1 to

3 years

From 3 to

5 years

Beyond

5 years

As of December 31, 2012

Debt owed to banks and other financial institutions 416,538

1,107,256

229,120

1,086,670

Derivatives payable 1,119

—

—

—

Accounts payable 682,588

—

—

—

Other current liabilities 534,422

—

—

—

(e) Interest rate risk

The interest rate risk to which the Group is exposed primarily originates from long-term debt. Such debt

accrues interest at both fixed and floating rates.