LensCrafters 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

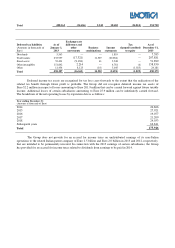

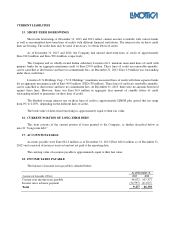

Nonqualified Pension Plans and Agreements—U.S. Holdings also maintains a nonqualified, unfunded

supplemental executive retirement plan (“Lux SERP”) for participants of its qualified pension plan to provide benefits

in excess of amounts permitted under the provisions of prevailing tax law. The pension liability and expense associated

with this plan are accrued using the same actuarial methods and assumptions as those used for the qualified pension

plan. This plan’s benefit provisions mirror those of the Lux Pension Plan.

U.S. Holdings also sponsors the Cole National Group, Inc. Supplemental Pension Plan. This plan is a

nonqualified unfunded SERP for certain participants of the former Cole pension plan who were designated by the Board

of Directors of Cole on the recommendation of Cole’s chief executive officer at such time. This plan provides benefits

in excess of amounts permitted under the provisions of the prevailing tax law. The pension liability and expense

associated with this plan are accrued using the same actuarial methods and assumptions as those used for the qualified

pension plan.

All plans operate under the U.S. regulatory framework. The plans are subject to the provisions of the

Employee Retirement Income Security Act of 1974 (“ERISA), as amended. The Luxottica Group ERISA Plans

Compliance and Investment Committee controls and manages the operation and administration of the plans. The plans

expose the Company to actuarial risks, such as longevity risk, currency risk, and interest rate risk. The Lux Pension

Plan exposes the Company to market (investment) risk.

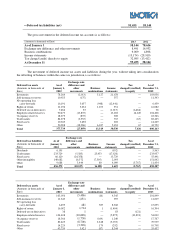

The following tables provide key information pertaining to the Lux Pension Plan and SERPs (amounts in

thousands of Euro).

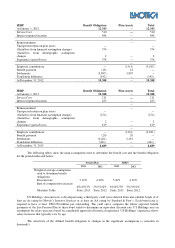

Lux Pension Plan Benefit Obligation Plan Assets Total

At January 1, 2012 483,738

(355,563)

128,175

Service Cost 22,366 2,958 25,323

Interest expense/(income) 24,189 (19,033) 5,156

Remeasurement:

Unexpected return on plan assets

—

(33,504) (33,504)

(Gain)/loss from financial assumption changes 59,781

—

59,781

(Gain)/loss from demographic assumption

changes 310

—

310

Experience (gains)/losses (6,020)

—

(6,020)

Employer contributions

—

(48,898) (48,898)

Benefit payment (15,210) 15,210

—

Translation difference 11,590 9,056 2,534

At December 31, 2012 557,564 (429,775) 127,789

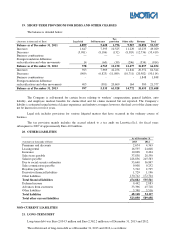

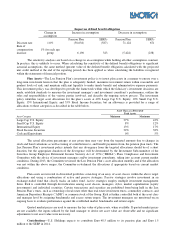

Lux Pension Plan Benefit Obligation Plan Assets Total

At January 1, 2013 557,564 (429,775) 127,789

Service Cost 24,896 2,034 26,930

Interest expense/(income) 23,476 (18,822) 4,654

Remeasurement:

Unexpected return on plan assets

—

(56,886)- (56,886)

(Gain)/loss from financial assumption changes (51,367)

—

(51,367)

(Gain)/loss from demographic assumption

changes 240

—

240

Experience (gains)/losses 5,086

—

5,086

Employer contributions

—

(38,566) (38,566)

Benefit payment (41,479) 41,479

—

Translation difference (22,679) 21,239 (1,439)

At December 31, 2013 495,737 (479,297) 16,440