LensCrafters 2013 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

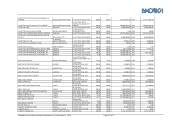

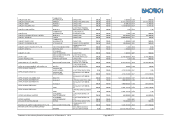

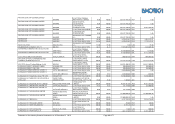

Footnotes to the statutory financial statements as of December 31, 2013 Page 61 of 71

43. OTHER INFORMATIONS

Information on the ownership structure and corporate governance are contained in a separate file which is integrated in

the financial statements.

During the two years 2012 and 2013 there were no atypical and/or unusual transactions, as defined by Consob

communication no. 6064293 dated July 28, 2006.

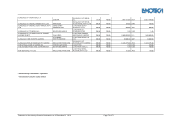

Disclosures about share-based payments can be found in the note on "Share-based payments" in the notes to the

consolidated financial statements.

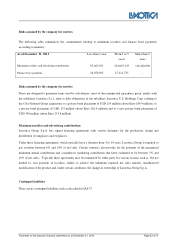

From the year 2010 the development and innovation project, called " Industry 2015 New technologies for Made in Italy

started with project number MI00153.

The objective project is the platform creation in order to operate on the technical and management side and to support

the technological and competitive development of the Italian eyewear companies.

The platform see that the commercial and supply chain events will be accepted quickly by the total productive process

and that every critical situation, related to planning changes, has to be promptly visible.

Moreover the platform has to permit the communicative interactivity of the supply chain subjects.

By means of license decree of the Ministry of the Economic Development n. 00098MI01 dated December, 21, 2012,

have been admitted expenses for Euro 13,747,949 and benefits for Euro 4,247,627.

The Luxottica Group’s part is Euro 5,030,748 and the expense contribution for Euro 1,445,349.

The parent is required to calculate the consolidated taxable income arising from the sum of the income reported by

consolidating companies, taking into account any changes in tax legislation. The parent then presents a single

consolidated tax return for the group. With the exception for subjective tax liability, penalties and interest relating to the

overall income of each participating company; the tax group head is responsible for determining its own taxable income

maintaining compliance relating to the determination of group taxable income and is severally liable for any sums owed

by each subsidiary.